A) causes firms to change prices less frequently and makes relative prices less variable.

B) causes firms to change prices less frequently and makes relative prices more variable.

C) causes firms to change prices more frequently and makes relative prices less variable.

D) causes firms to change prices more frequently and makes relative prices more variable.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The source of all four classic hyperinflations was high rates of money growth.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

The consumer price index increases from 200 to 208. What is the inflation rate?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the principle of monetary neutrality, a decrease in the money supply will not change

A) nominal GDP.

B) the price level.

C) unemployment.

D) All of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the money market is drawn with the value of money on the vertical axis, as the price level decreases, the value of money

A) increases, so the quantity of money demanded increases.

B) increases, so the quantity of money demanded decreases.

C) decreases, so the quantity of money demanded decreases.

D) decreases, so the quantity of money demanded increases.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Fisher effect

A) says the government can generate revenue by printing money.

B) says there is a one for one adjustment of the nominal interest rate to the inflation rate.

C) explains how higher money supply growth leads to higher inflation.

D) explains how prices adjust to obtain equilibrium in the money market.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the classical dichotomy, which of the following is not influenced by monetary factors?

A) real GDP.

B) real wages.

C) real interest rates.

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The payments you make on your automobile loan are given in terms of dollars. As prices rise you notice you give up fewer goods to make your payments.

A) The dollar amount you pay is a nominal value. The number of goods you give up is a real value.

B) The dollar amount you pay is a real value. The number of goods you give up is a nominal value.

C) Both the dollar amount you pay and the goods you give up are nominal values.

D) Both the dollar amount you pay and the goods you give up are real values.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the money market is drawn with the value of money on the vertical axis, if money supply and money demand both shift to the right

A) the price level must have risen

B) the price level must have fallen.

C) the price level rises if money supply shifts farther than money demand.

D) the price level falls if money supply shifts farther than money demand.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The country of Lessidinia has a tax system identical to that of the United States. Suppose someone in Lessidinia bought a parcel of land for 20,000 foci (the local currency) in 1960 when the price index equaled 100. In 2002, the person sold the land for 100,000 foci, and the price index equaled 600. The tax rate on nominal gains was 20 percent. Compute the taxes on the nominal gain and the change in the real value of the land in terms of 2002 prices to find the after-tax real rate of capital gain.

A) -60 percent

B) -30 percent

C) 30 percent

D) 60 percent

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Fisher effect is crucial for understanding changes over time in

A) the nominal interest rate.

B) the real interest rate.

C) the inflation rate.

D) the unemployment rate.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things the same, a decrease in velocity means that

A) the rate at which money changes hands falls, so the price level rises.

B) the rate at which money changes hands falls, so the price level falls.

C) the rate at which money changes hands rises, so the price level rises.

D) the rate at which money changes hands rises, so the price level falls.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the money market is drawn with the value of money on the vertical axis, as the price level increases, the value of money

A) increases, so the quantity of money demanded increases.

B) increases, so the quantity of money demanded decreases.

C) decreases, so the quantity of money demanded decreases.

D) decreases, so the quantity of money demanded increases.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

The theory that most economists rely on to explain inflation is called the .

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following combinations of nominal interest rates and inflation implies a real interest rate of 7 percent?

A) a nominal interest rate of 5 percent and an inflation rate of 4 percent.

B) a nominal interest rate of 4 percent and an inflation rate of 3 percent.

C) a nominal interest rate of 8 percent and an inflation rate of 1 percent.

D) a nominal interest rate of 14 percent and an inflation rate of 2 percent.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

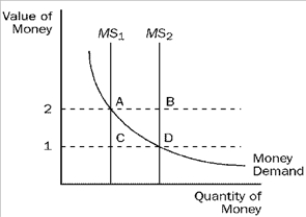

Figure 30-1  -Refer to Figure 30-1. If the current money supply is MS1, then

-Refer to Figure 30-1. If the current money supply is MS1, then

A) equilibrium exists when the value of money is 2.

B) equilibrium exists when the equilibrium is at point D.

C) equilibrium exists when the value of money is 1.

D) there is excess demand if the value of money is 2.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If P denotes the price of goods and services measured in terms of money, then

A) 1/P represents the value of money measured in terms of goods and services.

B) P can be interpreted as the inflation rate.

C) the supply of money influences the value of P, but the demand for money does not.

D) All of the above are correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Inflation is costly only if it is unanticipated.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Hyperinflation is generally defined as inflation that exceeds 50 percent per month.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

An increase in the price level means that a dollar buys __________ goods and services so the value of a dollar __________.

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 481

Related Exams