A) Latvia

B) Italy

C) France

D) Sweden

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The only qualification to receive government assistance under a negative income tax is

A) pre-school children.

B) to be enrolled in job training.

C) a working head-of-household.

D) a low income.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the Temporary Assistance for Needy Families program, most families

A) must have both parents in the home to qualify.

B) are female head-of-household families in which the father is absent.

C) have adult children with disabilities living at home.

D) are ineligible to receive assistance from other support programs.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The economic life cycle describes how young people usually have higher savings rates than middle-aged people.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A disadvantage of the Earned Income Tax Credit (EITC) program is that it does not help alleviate poverty due to unemployment, sickness, or other inability to work.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The maximin criterion for government policies is associated with

A) the school of thought called utilitarianism.

B) the school of thought called liberalism.

C) the school of thought called libertarianism.

D) the school of thought called stoicism.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The regular pattern of income variation over a person's life is called the

A) earned income cycle.

B) substitution effect.

C) life cycle.

D) pattern of change.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 20-5 Suppose the government implemented a negative income tax and used the following formula to compute a family's tax liability: Taxes owed = (1/4 of income) - $10,000 -Refer to Scenario 20-5. A family earning $110,000 before taxes would have how much after-tax income?

A) $82,500

B) $92,500

C) $100,000

D) $127,500

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

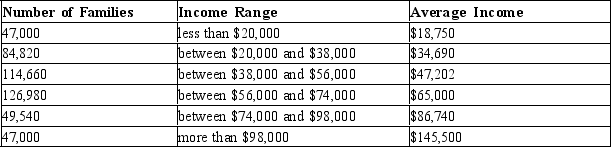

Table 20-5

Distribution of Income in Umakastan  -Refer to Table 20-5. Where would the government of Umakastan have to set the poverty line to have a poverty rate of about 28%?

-Refer to Table 20-5. Where would the government of Umakastan have to set the poverty line to have a poverty rate of about 28%?

A) $20,000

B) $34,690

C) $38,000

D) $56,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Whether or not policymakers should try to make our society more egalitarian is largely a matter of

A) economic efficiency.

B) political philosophy.

C) egalitarian principles.

D) enhanced opportunity.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

People have their highest saving rates when they are

A) retired.

B) middle-aged.

C) married with young children.

D) young and single.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When considering a person's standard of living, data on the income distribution and the poverty rate may provide an incomplete picture because the poor may

A) receive in-kind transfers.

B) be lending to smooth their income over their life cycle.

C) be saving to smooth their income due to a drop in transitory income.

D) under-report their income.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In 2011 the top 5 percent of income earners accounted for over 50% of all income received by United States' families.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Saving and borrowing is indicative of a family that

A) is most likely to be poor.

B) has a difficult time balancing its standard of living.

C) does not adjust its standard of living to reflect transitory changes in income.

D) is most likely millionaires.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Economic mobility in the United States is

A) great, so many of those below the poverty line are there only temporarily.

B) rare, so most of those below the poverty line are there for decades.

C) rare, yet many of those below the poverty line are there only temporarily.

D) unrelated to poverty.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following does not explain why data on income distribution and the poverty rate give an incomplete picture of inequality?

A) in-kind transfers

B) economic life cycle

C) transitory income

D) All of the above contribute to an incomplete picture of inequality.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The typical economic life cycle illustrates how people tend to

A) borrow more when they are younger and save more when they are middle-aged.

B) earn their peak incomes immediately prior to the typical retirement age of 65.

C) adjust their consumption based on changes in their transitory income.

D) All of the above are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following will not occur when government policies are enacted to make the distribution of income more equitable?

A) People will alter their behaviors.

B) Incentives will be distorted.

C) Total utility will likely remain constant.

D) The allocation of resources will be less efficient .

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Utilitarianism is

A) a liberal religion that focuses on individual rights.

B) a political philosophy that believes the government should choose policies deemed to be just by an impartial observer.

C) a political philosophy that believes the government should not redistribute income.

D) a political philosophy that believes the government should choose policies to maximize the total utility of society.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A common criticism of government programs that are designed to assist the poor is that

A) those who receive assistance rarely meet the criterion for eligibility.

B) the majority of those below the poverty line refuse to accept government assistance.

C) they create incentives for people to become "needy."

D) they typically account for a majority of annual government expenditures.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 455

Related Exams