A) currency and reserves

B) currency but not reserves

C) reserves but not currency

D) neither currency nor reserves

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Federal Reserve increases the interest rate on bank deposits at the Fed, banks will want to hold

A) fewer reserves, so the reserve ratio will fall.

B) fewer reserves, so the reserve ratio will rise.

C) more reserves, so the reserve ratio will fall.

D) more reserves, so the reserve ratio will rise.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The regional Federal Reserve Banks

A) are not allowed to make loans to banks in their region.

B) regulate banks in their regions.

C) have more voting members on the FOMC than does the Board of Governors.

D) are each headed by a member of the Board of Governors.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To increase the money supply, the Fed could

A) sell government bonds.

B) auction more loans to banks.

C) increase the reserve requirement.

D) None of the above is correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The Federal Reserve primarily uses open-market operations to change the money supply.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

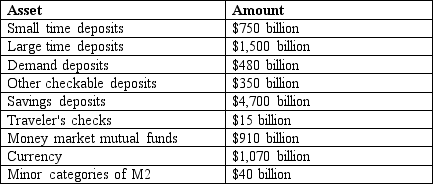

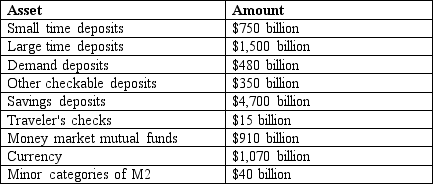

Table 29-1.

The information in the table pertains to an imaginary economy.

-Refer to Table 29-1. What is the value of M1 in billions of dollars?

-Refer to Table 29-1. What is the value of M1 in billions of dollars?

A) $1,915 billion

B) $1,900 billion

C) $2,665 billion

D) $2,825 billion

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

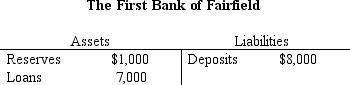

Table 29-4.

-Refer to Table 29-4. The reserve ratio for this bank is

-Refer to Table 29-4. The reserve ratio for this bank is

A) 8 percent.

B) 12.5 percent.

C) 87.5 percent.

D) 25 percent.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Treasury Bonds are

A) both a store of value and a medium of exchange.

B) a store of value, but not a medium of exchange

C) a medium of exchange, but not a store of value.

D) neither a store of value nor a medium of exchange.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bank has a 20 percent reserve requirement, $8,000 in loans, and has loaned out all it can given the reserve requirement.

A) It has $6,400 in deposits.

B) It has $10,000 in deposits.

C) It has $9,600 in deposits.

D) It has $1,600 in deposits.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

The money multiplier is when the reserve ratio is 12.5 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 29-2. The Monetary Policy of Tazi is controlled by the country's central bank known as the Bank of Tazi. The local unit of currency is the taz. Aggregate banking statistics show that collectively the banks of Tazi hold 300 million tazes of required reserves, 75 million tazes of excess reserves, have issued 7,500 million tazes of deposits, and hold 225 million tazes of Tazian Treasury bonds. Tazians prefer to use only demand deposits and so all money is on deposit at the bank. -Refer to Scenario 29-2. Assume that banks desire to continue holding the same ratio of excess reserves to deposits. What is the reserve requirement and the reserve ratio for Tazian Banks?

A) 5 percent, 8 percent

B) 4 percent, 8 percent

C) 4 percent, 5 percent

D) None of the above is correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following can banks use to borrow from the Federal Reserve?

A) the discount window or the term auction facility

B) the discount window but not the term auction facility

C) the term auction facility but not the discount window

D) Banks cannot borrow from the Federal Reserve, only the government can.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not correct?

A) The regional Federal Reserve Banks play a role in regulating banks and ensuring the health of the banking system.

B) The President of the New York Federal Reserve Regional Bank always gets to vote on the decisions made by the Federal Open Market Committee.

C) U.S. monetary policy is made by the Federal Open Market Committee.

D) The Federal Open Market Committee meets every 12 weeks.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You pay for cheese and bread from the deli with currency. Which function of money does this best illustrate?

A) medium of exchange

B) unit of account

C) store of value

D) liquidity

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 29-1.

The information in the table pertains to an imaginary economy.

-Refer to Table 29-1. What is the value of M2 in billions of dollars?

-Refer to Table 29-1. What is the value of M2 in billions of dollars?

A) $9,815 billion

B) $8,315 billion

C) $7,565 billion

D) $7,405 billion

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The reserve requirement is 4 percent, banks hold no excess reserves and people hold no currency. If the Fed sells $10,000 worth of bonds, what happens to the money supply?

A) it increases by $250,000

B) it increases by $200,000

C) it decreases by $200,000

D) it decreases by $250,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a 100-percent-reserve banking system, if people decided to decrease the amount of currency they held by increasing the amount they held in checkable deposits, then

A) M1 would increase.

B) M1 would decrease.

C) M1 would not change.

D) M1 might rise or fall.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In recent years the Federal Open Market Committee has focused on a target for

A) M1 growth.

B) the federal funds rate.

C) the number of Treasury Securities issued by the federal government.

D) total reserves of banks.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All U.S. paper dollars read "This note is legal tender for all debts, public and private." This statement represents which characteristic of US currency?

A) The U.S. operates under the gold standard.

B) U.S. paper money is commodity money.

C) U.S. paper money is fiat money.

D) U.S. paper money is a convenient store of wealth.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

How does the Fed Open Market Committee increase the money supply?

Correct Answer

verified

Correct Answer

verified

Showing 321 - 340 of 517

Related Exams