Filters

Question type

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 92

Multiple Choice

All of the following below are needed for the calculation of straight-line depreciation except

A) cost

B) residual value

C) estimated life

D) units produced

E) None of the above

F) A) and C)

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Question 93

True/False

The amount of depreciation expense for the first full year of use of a fixed asset costing $95,000, with an estimated residual value of $5,000 and a useful life of 5 years, is $19,000 by the straight-line method.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 94

Essay

On April 15, Compton Co. paid $2,800 to upgrade a delivery truck and $125 for an oil change. Journalize the entries for the upgrade to delivery truck and oil change expenditures.

Correct Answer

verified

Correct Answer

verified

Question 95

Essay

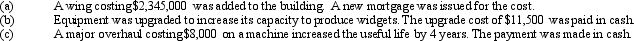

Journalize each of the following transactions:

Correct Answer

verified

Correct Answer

verified

Question 96

Multiple Choice

On December 31, Strike Company has decided to sell one of its batting cages. The initial cost of the equipment was $310,000 with an accumulated depreciation of $260,000. Depreciation has been taken up to the end of the year. The company found a company that is willing to buy the equipment for $50,000. What is the amount of the gain or loss on this transaction?

A) Gain of $50,000

B) Loss of $50,000

C) No gain or loss

D) Cannot be determined

E) None of the above

F) A) and D)

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Question 97

Multiple Choice

The method of determining depreciation that yields successive reductions in the periodic depreciation charge over the estimated life of the asset is

A) units-of-production

B) declining-balance

C) straight-line

D) time-valuation

E) B) and D)

F) None of the above

F) None of the above

Correct Answer

verified

Correct Answer

verified

Question 98

True/False

The acquisition costs of property, plant, and equipment should include all normal, reasonable and necessary costs to get the asset in place and ready for use.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 99

True/False

When old equipment is traded in for a new equipment, the difference between the list price and the trade in allowance is called boot.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 100

Multiple Choice

Factors contributing to a decline in the usefulness of a fixed asset may be divided into the following two categories

A) salvage and functional

B) physical and functional

C) residual and salvage

D) functional and residual

E) None of the above

F) C) and D)

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 161 - 170 of 170

Related Exams