B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a firm utilizes debt financing, an X% decline in earnings before interest and taxes (EBIT)will result in a decline in earnings per share that is larger than X.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The graphical probability distribution of ROE for a firm that uses financial leverage would tend to be more peaked than the distribution if the firm used no leverage, other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Two firms, although they operate in different industries, have the same expected earnings per share and the same standard deviation of expected EPS.Thus, the two firms must have the same business risk.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT? As a firm increases the operating leverage used to produce a given quantity of output, this will

A) normally lead to a decrease in its business risk.

B) normally lead to a decrease in the standard deviation of its expected EBIT.

C) normally lead to a decrease in the variability of its expected EPS.

D) normally lead to a reduction in its fixed assets turnover ratio.

E) normally lead to an increase in its fixed assets turnover ratio.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would increase the likelihood that a company would increase its debt ratio, other things held constant?

A) An increase in the corporate tax rate.

B) An increase in the personal tax rate.

C) The Federal Reserve tightens interest rates in an effort to fight inflation.

D) The company's stock price hits a new low.

E) An increase in costs incurred when filing for bankruptcy.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to Exhibit 15.2.If this plan were carried out, what would be VF's new WACC and its new value of operations? WACC Value

A) 9.64% $497, 925

B) 9.83% $507, 884

C) 10.03% $518, 041

D) 10.23% $528, 402

E) 10.74% $538, 970

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Two operationally similar companies, HD and LD, have the same total assets, operating income (EBIT) , tax rate, and business risk.Company HD, however, has a much higher debt ratio than LD.Also HD's basic earning power (BEP) exceeds its cost of debt (rd) .Which of the following statements is CORRECT?

A) HD should have a higher times interest earned (TIE) ratio than LD.

B) HD should have a higher return on equity (ROE) than LD, but its risk, as measured by the standard deviation of ROE, should also be higher than LD's.

C) Given that BEP > rd, HD's stock price must exceed that of LD.

D) Given that BEP > rd, LD's stock price must exceed that of HD.

E) HD should have a higher return on assets (ROA) than LD.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Merriwether Building has operating income of $20 million, a tax rate of 40%, and no debt.It pays out all of its net income as dividends and has a zero growth rate.The current stock price is $40 per share, and it has 2.5 million shares of stock outstanding.If it moves to a capital structure that has 40% debt and 60% equity (based on market values) , its investment bankers believe its weighted average cost of capital would be 10%.What would its stock price be if it changes to the new capital structure?

A) $40

B) $48

C) $52

D) $54

E) $60

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) There is no reason to think that changes in the personal tax rate would affect firms' capital structure decisions.

B) A firm with high business risk is more likely to increase its use of financial leverage than a firm with low business risk, assuming all else equal.

C) If a firm's after-tax cost of equity exceeds its after-tax cost of debt, it can always reduce its WACC by increasing its use of debt.

D) Suppose a firm has less than its optimal amount of debt.Increasing its use of debt to the point where it is at its optimal capital structure will decrease the costs of both debt and equity financing.

E) In general, a firm with low operating leverage also has a small proportion of its total costs in the form of fixed costs.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following events is likely to encourage a company to raise its target debt ratio, other things held constant?

A) An increase in the personal tax rate.

B) An increase in the company's operating leverage.

C) The Federal Reserve tightens interest rates in an effort to fight inflation.

D) The company's stock price hits a new high.

E) An increase in the corporate tax rate.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

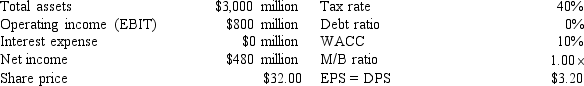

The following information has been presented to you about the Gibson Corporation.

The company has no growth opportunities (g = 0) , so the company pays out all of its earnings as dividends (EPS = DPS) .The consultant believes that if the company moves to a capital structure financed with 20% debt and 80% equity (based on market values) that the cost of equity will increase to 11% and that the pre-tax cost of debt will be 10%.If the company makes this change, what would be the total market value (in millions) of the firm?

The company has no growth opportunities (g = 0) , so the company pays out all of its earnings as dividends (EPS = DPS) .The consultant believes that if the company moves to a capital structure financed with 20% debt and 80% equity (based on market values) that the cost of equity will increase to 11% and that the pre-tax cost of debt will be 10%.If the company makes this change, what would be the total market value (in millions) of the firm?

A) $3, 200

B) $3, 600

C) $4, 000

D) $4, 200

E) $4, 800

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 72 of 72

Related Exams