A) If evaluated using the correct post-merger WACC, Project X would have a negative NPV.

B) After the merger, Careco/Audaco would have a corporate WACC of 11%.Therefore, it should reject Project X but accept Project Y.

C) Careco/Audaco's WACC, as a result of the merger, would be 10%.

D) After the merger, Careco/Audaco should select Project Y but reject Project X.If the firm does this, its corporate WACC will fall to 10.5%.

E) If the firm evaluates these projects and all other projects at the new overall corporate WACC, it will probably become riskier over time.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT? Assume a company's target capital structure is 50% debt and 50% common equity.

A) The WACC is calculated on a before-tax basis.

B) The WACC exceeds the cost of equity.

C) The cost of equity is always equal to or greater than the cost of debt.

D) The cost of reinvested earnings typically exceeds the cost of new common stock.

E) The interest rate used to calculate the WACC is the average after-tax cost of all the company's outstanding debt as shown on its balance sheet.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

If the expected dividend growth rate is zero, then the cost of external equity capital raised by issuing new common stock (r?)is equal to the cost of equity capital from retaining earnings (rs)divided by one minus the percentage flotation cost required to sell the new stock, (1 - F).If the expected growth rate is not zero, then the cost of external equity must be found using a different formula.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

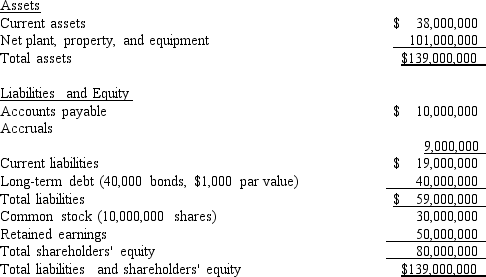

Exhibit 9.1

The Collins Group, a leading producer of custom automobile accessories, has hired you to estimate the firm's weighted average cost of capital.The balance sheet and some other information are provided below.

The stock is currently selling for $15.25 per share, and its noncallable $1, 000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00.The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%.The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years.The firm's tax rate is 40%.

-Refer to Exhibit 9.1.What is the best estimate of the firm's WACC?

The stock is currently selling for $15.25 per share, and its noncallable $1, 000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00.The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%.The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years.The firm's tax rate is 40%.

-Refer to Exhibit 9.1.What is the best estimate of the firm's WACC?

A) 10.85%

B) 11.19%

C) 11.53%

D) 11.88%

E) 12.24%

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) We should use historical measures of the component costs from prior financings that are still outstanding when estimating a company's WACC for capital budgeting purposes.

B) The cost of new equity (re) could possibly be lower than the cost of reinvested earnings (rs) if the market risk premium, risk-free rate, and the company's beta all decline by a sufficiently large amount.

C) A firm's cost of reinvesting earnings is the rate of return stockholders require on a firm's common stock.

D) The component cost of preferred stock is expressed as rp(1 - T) , because preferred stock dividends are treated as fixed charges, similar to the treatment of interest on debt.

E) In the WACC calculation, we must adjust the cost of preferred stock (the market yield) to reflect the fact that 70% of the dividends received by corporate investors are excluded from their taxable income.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The after-tax cost of debt that should be used as the component cost when calculating the WACC is the average after-tax cost of all the firm's outstanding debt.

B) Suppose some of a publicly-traded firm's stockholders are not diversified; they hold only the one firm's stock.In this case, the CAPM approach will result in an estimated cost of equity that is too low in the sense that if it is used in capital budgeting, projects will be accepted that will reduce the firm's intrinsic value.

C) The cost of equity is generally harder to measure than the cost of debt because there is no stated, contractual cost number on which to base the cost of equity.

D) The bond-yield-plus-risk-premium approach is the most sophisticated and objective method for estimating a firm's cost of equity capital.

E) The cost of capital used to evaluate a project should be the cost of the specific type of financing used to fund that project, i.e., it is the after-tax cost of debt if debt is to be used to finance the project or the cost of equity if the project will be financed with equity.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Lincoln Company sold a $1, 000 par value, noncallable bond several years ago that now has 20 years to maturity and a 7.00% annual coupon that is paid semiannually.The bond currently sells for $925 and the company's tax rate is 40%.What is the component cost of debt for use in the WACC calculation?

A) 4.28%

B) 4.46%

C) 4.65%

D) 4.83%

E) 5.03%

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The after-tax cost of debt usually exceeds the after-tax cost of equity.

B) For a given firm, the after-tax cost of debt is always more expensive than the after-tax cost of non-convertible preferred stock.

C) Retained earnings that were generated in the past and are reported on the firm's balance sheet are available to finance the firm's capital budget during the coming year.

D) The WACC that should be used in capital budgeting is the firm's marginal, after-tax cost of capital.

E) The WACC is calculated using before-tax costs for all components.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Adams Inc.has the following data: rRF = 5.00%; RPM = 6.00%; and b = 1.05.What is the firm's cost of common from reinvested earnings based on the CAPM?

A) 11.30%

B) 11.64%

C) 11.99%

D) 12.35%

E) 12.72%

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The cost of preferred stock to a firm must be adjusted to an after-tax figure because 70% of dividends received by a corporation may be excluded from the receiving corporation's taxable income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To help estimate its cost of common equity, Maxwell and Associates recently hired you.You have obtained the following data: D? = $0.90; P? = $27.50; and g = 7.00% (constant) .Based on the DCF approach, what is the cost of common from reinvested earnings?

A) 9.29%

B) 9.68%

C) 10.08%

D) 10.50%

E) 10.92%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The WACC is calculated using a before-tax cost for debt that is equal to the interest rate that must be paid on new debt, along with the after-tax costs for common stock and for preferred stock if it is used.

B) An increase in the risk-free rate is likely to reduce the marginal costs of both debt and equity.

C) The relevant WACC can change depending on the amount of funds a firm raises during a given year.Moreover, the WACC at each level of funds raised is a weighted average of the marginal costs of each capital component, with the weights based on the firm's target capital structure.

D) Beta measures market risk, which is generally the most relevant risk measure for a publicly-owned firm that seeks to maximize its intrinsic value.However, this is not true unless all of the firm's stockholders are well diversified.

E) The bond-yield-plus-risk-premium approach to estimating the cost of common equity involves adding a risk premium to the interest rate on the company's own long-term bonds.The size of the risk premium for bonds with different ratings is published daily in The Wall Street Journal.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) All else equal, an increase in a company's stock price will increase its marginal cost of reinvested earnings (not newly issued stock) , rs.

B) All else equal, an increase in a company's stock price will increase its marginal cost of new common equity, re.

C) Since the money is readily available, the after-tax cost of reinvested earnings (not newly issued stock) is usually much lower than the after-tax cost of debt.

D) If a company's tax rate increases but the YTM on its noncallable bonds remains the same, the after-tax cost of its debt will fall.

E) When calculating the cost of preferred stock, a company needs to adjust for taxes, because preferred stock dividends are deductible by the paying corporation.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Since its stockholders are not directly responsible for paying a corporation's income taxes, corporations should focus on before-tax cash flows when calculating the WACC.

B) An increase in a firm's tax rate will increase the component cost of debt, provided the YTM on the firm's bonds is not affected by the change in the tax rate.

C) When the WACC is calculated, it should reflect the costs of new common stock, reinvested earnings, preferred stock, long-term debt, short-term bank loans if the firm normally finances with bank debt, and accounts payable if the firm normally has accounts payable on its balance sheet.

D) If a firm has been suffering accounting losses that are expected to continue into the foreseeable future, and therefore its tax rate is zero, then it is possible for the after-tax cost of preferred stock to be less than the after-tax cost of debt.

E) Since the costs of internal and external equity are related, an increase in the flotation cost required to sell a new issue of stock will increase the cost of reinvested earnings.

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The component costs of capital are market-determined variables in the sense that they are based on investors' required returns.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The higher the firm's flotation cost for new common equity, the more likely the firm is to use preferred stock, which has no flotation cost, and reinvested earnings, whose cost is the average return on the assets that are acquired.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) WACC calculations should be based on the before-tax costs of all the individual capital components.

B) Flotation costs associated with issuing new common stock normally reduce the WACC.

C) If a company's tax rate increases, then, all else equal, its weighted average cost of capital will decline.

D) An increase in the risk-free rate will normally lower the marginal costs of both debt and equity financing.

E) A change in a company's target capital structure cannot affect its WACC.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

When estimating the cost of equity by use of the bond-yield-plus-risk-premium method, we can generally get a good idea of the interest rate on new long-term debt, but we cannot be sure that the risk premium we add is appropriate.This problem leaves us unsure of the true value of rs.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The firm's cost of external equity raised by issuing new stock is the same as the required rate of return on the firm's outstanding common stock.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bartlett Company's target capital structure is 40% debt, 15% preferred, and 45% common equity.The after-tax cost of debt is 6.00%, the cost of preferred is 7.50%, and the cost of common using reinvested earnings is 12.75%.The firm will not be issuing any new stock.You were hired as a consultant to help determine their cost of capital.What is its WACC?

A) 8.98%

B) 9.26%

C) 9.54%

D) 9.83%

E) 10.12%

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 92

Related Exams