B) False

Correct Answer

verified

Correct Answer

verified

True/False

If, prior to the last weekly payroll period of the calendar year, the cumulative earnings for an employee are $98,800, earnings subject to social security tax are $100,000, and the tax rate is 6.0%, the employer's social security tax on the $2,000 gross earnings paid on the last day of the year is $120.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 5, 2012, Garrett Company, a calendar-year company, issued $500,000 of notes payable, of which $100,000 is due on January 1 for each of the next five years. The proper balance sheet presentation on December 31, 2012, is

A) Current Liabilities, $500,000.

B) Current Liabilities, $100,000; Long-term Debt, $400,000.

C) Long-term Debt, $500,000

D) Current Liabilities, $400,000; Long-term Debt, $100,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

The payroll register of Seaside Architecture Company indicates $970 of Social Security and $257 of Medicare tax withheld on total salaries of $16,500 for the period. Federal withholding for the period totaled $3,245. Provide the journal entry for the period's payroll.

Correct Answer

verified

Correct Answer

verified

True/False

All long-term liabilities eventually become current liabilities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The borrower is the one who issues a note payable to a creditor.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

FICA tax is a payroll tax that is paid only by employers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Grayson Bank agrees to lend the Trust Company $100,000 on January 1. Trust Company signs a $100,000, 8%, 9-month note. The entry made by Trust Company on January 1 to record the proceeds and issuance of the note is:

A) Interest Expense 8,000 Cash 92,000

Notes Payable 100,000

B) Cash 100,000 Notes Payable 100,000

C) Cash 108,000 Interest Expense 8,000

Notes Payable 108,000

D) Notes Payable 100,000 Interest Payable 6,000

Cash 100,000

Interest Expense 6,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On June 8, Alton Co. issued an $90,000, 6%, 120-day note payable to Seller Co. Assuming a 360-day year for your calculations, what is the maturity value of the note?

A) $90,450

B) $90,000

C) $91,800

D) $95,400

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Employers are required to compute and report payroll taxes on a calendar-year basis, even if a different fiscal year is used for financial reporting and income tax purposes.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Notes payable may be issued to creditors to satisfy accounts payable created earlier.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

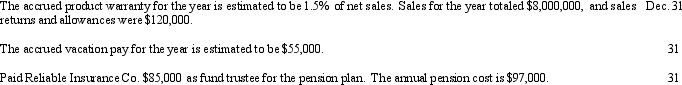

Journalize the following transactions:

Correct Answer

verified

Correct Answer

verified

Showing 161 - 172 of 172

Related Exams