B) False

Correct Answer

verified

Correct Answer

verified

Essay

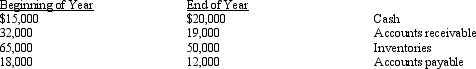

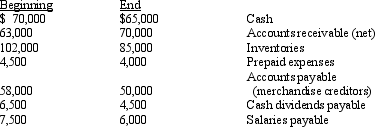

The Dickinson Company reported net income of $155,000 for the current year. Depreciation recorded on buildings and equipment amounted to $65,000 for the year. Balances of the current asset and current liability accounts at the beginning and end of the year are as follows:

Instructions

Prepare the cash flows from the operating activities section of the statement of cash flows using the indirect method.

Instructions

Prepare the cash flows from the operating activities section of the statement of cash flows using the indirect method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Accounts receivable from sales transactions were $44,000 at the beginning of the year and $53,000 at the end of the year. Net income reported on the income statement for the year was $105,000. Exclusive of the effect of other adjustments, the cash flows from operating activities to be reported on the statement of cash flows prepared by the indirect method is

A) $105,000

B) $114,000

C) $96,000

D) $158,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

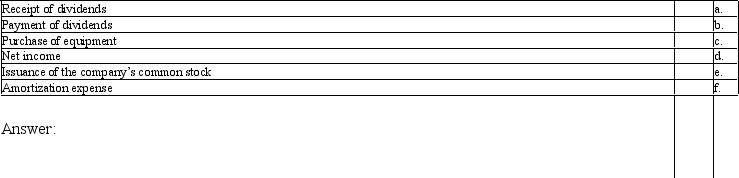

For each of the following, identify whether it would be disclosed as an operating (O), financing (F), or investing (I) activity on the statement of cash flows under the indirect method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The order of presentation of activities on the statement of cash flows is

A) operating, investing, and financing.

B) operating, financing, and investing.

C) financing, operating, and investing.

D) financing, investing, and operating.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

In determining the cash flows from operating activities for the statement of cash flows by the indirect method, the depreciation expense for the period is added to the net income for the period.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The direct method of preparing the operating activities section of the statement of cash flows reports major classes of gross cash receipts and gross cash payments.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Free cash flow is the measure of operating cash flow available for corporate purposes after providing sufficient fixed asset additions to maintain current productive capacity and dividends.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Free cash flow is

A) all cash in the bank

B) cash from operations

C) cash from financing, less cash used to purchase fixed assets to maintain productive capacity and cash used for dividends

D) cash flow from operations, less cash used to purchase fixed assets to maintain productive capacity and cash used for dividends

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following should be deducted from net income in calculating net cash flow from operating activities using the indirect method?

A) depreciation expense

B) gain on sale of land

C) a loss on the sale of equipment

D) dividends declared and paid

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following concepts of cash is not appropriate to use in preparing the statement of cash flows?

A) cash

B) cash and money market funds

C) cash and cash equivalents

D) cash and U.S. treasury bonds

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Cash flows from financing activities, as part of the statement of cash flows, include payments for dividends.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Cash flows from investing activities, as part of the statement of cash flows, include receipts from the sale of land.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

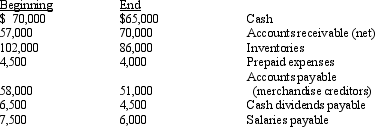

The net income reported on an income statement for the current year was $63,000. Depreciation recorded on fixed assets for the year was $24,000. Balances of the current asset and current liability accounts at the end and beginning of the year are listed below. Prepare the cash flows from operating activities section of a statement of cash flows using the indirect method.

Correct Answer

verified

Correct Answer

verified

Essay

Cost of merchandise sold reported on the income statement was $155,000. The accounts payable balance increased $5,000, and the inventory balance increased by $11,000 over the year. Determine the amount of cash paid for merchandise?

Correct Answer

verified

Correct Answer

verified

Essay

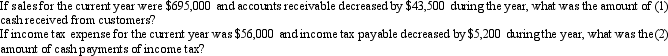

The cash flows from operating activities are reported by the direct method on the statement of cash flows. Determine the following:

Correct Answer

verified

Correct Answer

verified

Essay

The net income reported on an income statement for the current year was $58,000. Depreciation recorded on fixed assets for the year was $24,000. Balances of the current asset and current liability accounts at the end and beginning of the year are listed below. Prepare the cash flows from operating activities section of a statement of cash flows using the indirect method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Accounts receivable from sales to customers amounted to $40,000 and $32,000 at the beginning and end of the year, respectively. Income reported on the income statement for the year was $110,000. Exclusive of the effect of other adjustments, the cash flows from operating activities to be reported on the statement of cash flows is

A) $118,000.

B) $110,000.

C) $102,000.

D) $150,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a noncash investing and financing activity?

A) payment of a cash dividend

B) payment of a six-month note payable

C) purchase of merchandise inventory on account

D) issuance of common stock to acquire land

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

To determine cash payments for income tax for the cash flow statement using the direct method, an increase in income taxes payable is added to the income tax expense.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 162

Related Exams