Correct Answer

verified

Correct Answer

verified

Essay

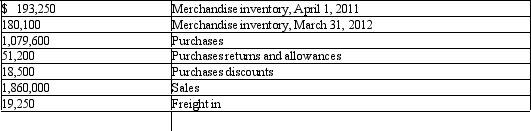

Using the following data taken from Hsu's Imports Inc., determine the gross profit to be reported on the income statement for the year ended March 31, 2011.

Correct Answer

verified

Gross Profit = Sales...View Answer

Show Answer

Correct Answer

verified

View Answer

True/False

If payment is due by the end of the month in which the sale is made, the invoice terms are expressed as n/30.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Office salaries, depreciation of office equipment, and office supplies are examples of what type of expense?

A) selling expense

B) miscellaneous expense

C) administrative expense

D) other expense

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

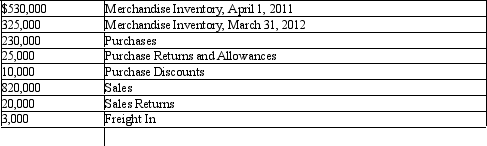

The following data were extracted from the accounting records of Meridian Designs for the year ended March 31, 2012.

Prepare the cost of merchandise sold section of the income statement for the year ended March 31, 2011, using the periodic method. Also determine gross profit.

Prepare the cost of merchandise sold section of the income statement for the year ended March 31, 2011, using the periodic method. Also determine gross profit.

Correct Answer

verified

Correct Answer

verified

True/False

A business using the perpetual inventory system, with its detailed subsidiary records, does need to take a physical inventory.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Sales to customers who use nonbank credit cards, such as American Express, are generally treated as credit sales.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In a perpetual inventory system, when merchandise is returned to the seller, Cost of Merchandise Sold is debited as part of the transaction.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using a perpetual inventory system, the entry to record the sale of merchandise on account includes a

A) debit to Sales

B) debit to Merchandise Inventory

C) credit to Merchandise Inventory

D) credit to Accounts Receivable

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

In a multiple-step income statement the dollar amount for income from operations is always the same as net income.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The form of the balance sheet in which assets, liabilities, and stockholders' equity are presented in a downward sequence is called the report form.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Most companies will take a purchases discount, because 1% or 2% discounts are insignificant.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Merchandise Inventory normally has a debit balance.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

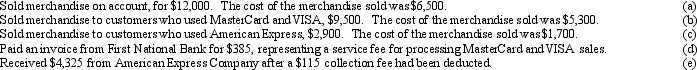

Using the perpetual inventory system, journalize the entries for the following selected transactions:

Correct Answer

verified

Correct Answer

verified

True/False

A deduction allowed to wholesalers and retailers from the price of merchandise listed in catalogs is called cash discounts.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Gross profit minus selling expenses equals net income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ramone Company had $600,000 in Net Sales for the year 2011. The total assets at the beginning of the year were $240,000 and total assets at the end of the year were $280,000. The ratio of net sales to total assets is (round answer to 2 decimal places) :

A) 2.31

B) 1.15

C) .43

D) .87

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The buyer will include the sales tax as part of the cost of items purchased for use.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

On March 5th, Blowout Sales makes $22,500.00 in sales on the company's own credit cards. The cost of merchandise sold are $16,825.00. Journalize the sales and recognition of the cost of merchandise sold.

Correct Answer

verified

Mar 5 Accounts Receivable 22,5...View Answer

Show Answer

Correct Answer

verified

View Answer

Multiple Choice

The inventory system employing accounting records that continuously disclose the amount of inventory is called

A) retail

B) periodic

C) physical

D) perpetual

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 221

Related Exams