Filters

Question type

A) comparative statements

B) common-sized financial statements

C) price-level accounting

D) audit report

E) A) and B)

F) B) and C)

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Question 102

True/False

A financial statement showing each item on the statement as a percentage of one key item on the statement is called common-sized financial statements.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 103

Multiple Choice

Short-term creditors are typically most interested in assessing

A) marketability.

B) profitability.

C) operating results.

D) solvency.

E) A) and B)

F) All of the above

F) All of the above

Correct Answer

verified

Correct Answer

verified

Question 104

True/False

In computing the rate earned on total assets, interest expense is subtracted from net income before dividing by average total assets.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 105

True/False

In horizontal analysis, the current year is the base year.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 106

True/False

The excess of current assets over current liabilities is referred to as working capital.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 107

True/False

Reporting unusual items separately on the income statement allows investors to isolate the effects of these items on income and cash flows.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 108

Multiple Choice

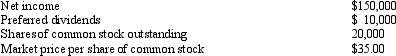

A company reports the following:  Determine the company's earnings per share on common stock.

Determine the company's earnings per share on common stock.

A) $7.50

B) $7.00

C) $8.00

D) $35.00

E) A) and D)

F) A) and B)

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Question 109

Essay

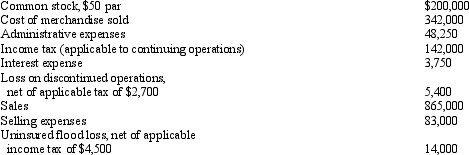

From the following data for Norton Company for the year ended December 31, 2012 prepare a multiple-step income statement. Show parenthetically earnings per share for the following: income from continuing operations, loss on discontinued operations (less applicable income tax), income before extraordinary item, extraordinary item (less applicable income tax), and net income.

Correct Answer

verified

Correct Answer

verified

Question 110

Essay

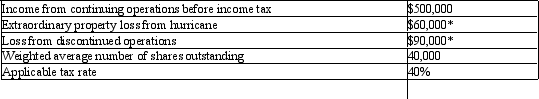

Bradenton Company reports the following for 2012:

Correct Answer

verified

* Net of a...View Answer

Show Answer

Correct Answer

verified

* Net of a...

View Answer

Question 111

True/False

Interpreting financial analysis should be considered in light of conditions peculiar to the industry and the general economic conditions.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 112

Multiple Choice

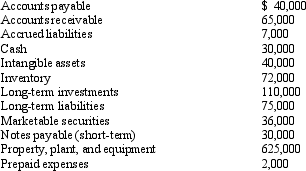

Based on the above data, what is the quick ratio, rounded to one decimal point?

Based on the above data, what is the quick ratio, rounded to one decimal point?

A) 2.7

B) 2.6

C) 1.7

D) 0.9

E) C) and D)

F) A) and B)

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Question 113

True/False

If the accounts receivable turnover for the current year has decreased when compared with the ratio for the preceding year, there has been an acceleration in the collection of receivables.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Showing 181 - 193 of 193

Related Exams