Correct Answer

verified

Correct Answer

verified

Essay

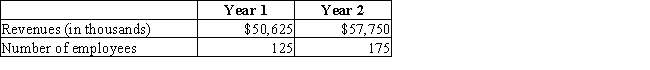

Easy Sailing,LLC provides repair services for commercially owned boats and yachts.The firm has five members in the LLC,which did not change between the first year and the second year.During Year 2,the business expanded into three new regions of the country.The following revenue and employee information is provided:  Required

(a)For Year 1 and Year 2,determine the revenue per employee

(excluding members).

(b)Interpret the trend between the two years.

Required

(a)For Year 1 and Year 2,determine the revenue per employee

(excluding members).

(b)Interpret the trend between the two years.

Correct Answer

verified

11ea8d32_28ba_71c3_b445_ef6cadae1465_TB6239_00

Correct Answer

verified

Multiple Choice

The characteristic of a partnership that gives the authority to any partner to legally bind the partnership and all other partners to business contracts is called

A) unlimited liability

B) ease of formation

C) mutual agency

D) dissolution

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

Prior to liquidating their partnership,Samuel and Brian had capital accounts of $60,000 and $240,000,respectively.The partnership assets were sold for $120,000.The partnership had no liabilities.Samuel and Brian share income and losses equally.Required (a)Determine the amount of Samuel's deficiency. (b)Determine the amount distributed to Brian,assuming Samuel is unable to satisfy the deficiency.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A gain or loss on realization is divided among partners according to their

A) income sharing ratio

B) capital balances

C) drawing balances

D) contribution of assets

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

Gentry,sole proprietor of a hardware business,decides to form a partnership with Noel.Gentry's accounts are as follows:  Noel agrees to contribute $80,000 for a 20% interest.Journalize the entries to record

(a)Gentry's investment and

(b)Noel's investment.

Noel agrees to contribute $80,000 for a 20% interest.Journalize the entries to record

(a)Gentry's investment and

(b)Noel's investment.

Correct Answer

verified

11ea8d32_28b7_d983_b445_cf8dd01a3879_TB6239_00

Correct Answer

verified

True/False

An advantage of the partnership form of business is that each partner's potential loss is limited to that partner's investment in the partnership.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Malcolm has a capital balance of $90,000 after adjusting to fair market value.Celeste contributes $45,000 to receive a 25% interest in a new partnership with Malcolm.Determine the amount and recipient of the partner bonus.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If there is no written agreement as to the way income will be divided among partners,

A) they will share income and losses equally

B) they will share income and losses according to their capital balances

C) they will share income and losses according to the time devoted to the business

D) there really is no partnership agreement

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

When a new partner is admitted to a partnership,all partnership assets should be revised to reflect current values.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In the distribution of income,the net income is less than the salary and interest allowances granted; the remaining balance will be a negative amount that must be divided among the partners as though it were a loss.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Xavier and Yolanda have original investments of $50,000 and $100,000,respectively,in a partnership.The articles of partnership include the following provisions regarding the division of net income: interest on original investment at 10%; salary allowances of $27,000 and $18,000,respectively; and the remaining income equally.How much of the net loss of $6,000 is allocated to Yolanda?

A) $1,000

B) $3,000

C) $5,000

D) $0

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Xavier and Yolanda have original investments of $50,000 and $100,000,respectively,in a partnership.The articles of partnership include the following provisions regarding the division of net income: interest on original investment at 10%; salary allowances of $38,000 and $28,000,respectively; and the remainder to be divided equally.How much of the net income of $77,000 is allocated to Xavier?

A) $66,000

B) $41,000

C) $36,000

D) $43,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

Jesse and Tim form a partnership by combining the assets of their separate businesses.Jesse contributes accounts receivable with a face amount of $50,000 and equipment with a cost of $180,000 and accumulated depreciation of $100,000.The partners agree that the equipment is to be valued at $58,000,that $3,500 of the accounts receivable are completely worthless and are not to be accepted by the partnership,and that $2,000 is a reasonable allowance for the uncollectibility of the remaining accounts receivable.Tim contributes cash of $21,000 and merchandise inventory of $44,500.The partners agree that the merchandise inventory is to be valued at $48,000.Journalize the entries to record in the partnership accounts (a)Jesse's investment and (b)Tim's investment.

Correct Answer

verified

Correct Answer

verified

Essay

Prior to liquidating their partnership,Porter and Robert had capital account balances of $160,000 and $100,000,respectively.Prior to liquidation,the partnership had no cash assets other than what was realized from the sale of the partnership assets.These partnership assets were sold for $250,000.The partnership had $10,000 of liabilities.Porter and Robert share income and losses equally.RequiredDetermine the amount received by Porter as a final distribution from liquidation of the partnership.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each statement to the appropriate term (a-h) : -Where changes in partner capital accounts for a period of time are reported

A) Deficiency

B) Realization

C) Proprietorship

D) Partnership

E) Mutual agency

F) Liquidation

G) Income-sharing ratio

H) Statement of partnership equity

J) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Singer and McMann are partners in a business.Singer's original capital was $40,000 and McMann's was $60,000.They agree to salaries of $12,000 and $18,000 for Singer and McMann,respectively,and 10% interest on original capital.If they agree to share the remaining profits and losses in a 3:2 ratio,what will Singer's share of the income (loss) be if the net loss for the year is $10,000?

A) ($12,600)

B) ($14,000)

C) ($6,000)

D) ($10,000)

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each statement to the appropriate term (a-h) . -Agreement that is the contract between partners

A) Partnership

B) Partnership agreement

C) Distribution of remaining cash to partners

D) Mutual agency

E) Equally

F) Death of a partner

G) Liquidation

H) Unlimited liability

J) E) and F)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a disadvantage of a partnership when compared to a corporation?

A) The partnership is more likely to have a net loss.

B) The partnership is easier to organize.

C) The partnership is less expensive to organize.

D) The partnership has limited life.

F) B) and C)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

When a partnership is formed,assets contributed by the partners should be recorded on the partnership books at their

A) book values on the partners' books prior to their being contributed to the partnership

B) fair market value at the time of the contribution

C) original costs to the partner contributing them

D) assessed values for property tax purposes

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 199

Related Exams