A) debit Bonds Payable, credit Cash

B) debit Cash and Discount on Bonds Payable, credit Bonds Payable

C) debit Cash, credit Premium on Bonds Payable and Bonds Payable

D) debit Cash, credit Bonds Payable

F) None of the above

Correct Answer

verified

Correct Answer

verified

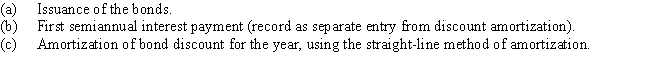

Essay

On the first day of the current fiscal year,$1,500,000 of 10-year,8% bonds,with interest payable semiannually,were sold for $1,225,000.Present entries to record the following transactions for the current fiscal year:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1,Zero Company obtained a $52,000,four-year,6.5% installment note from Regional Bank.The note requires annual payments of $15,179,beginning on December 31,Year 1.The December 31,Year 2 carrying amount in the amortization table for this installment note will be equal to

A) $26,000

B) $27,635

C) $21,642

D) $28,402

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If the straight-line method of amortization of discount on bonds payable is used,the amount of yearly interest expense will increase as the bonds approach maturity.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the amount of a bond premium on an issued 11%,four-year,$100,000 bond is $12,928,the annual interest expense is $5,500.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Levi Company issued $200,000 of 12% bonds on January 1 at face value.The bonds pay interest semiannually on January 1 and July 1.The bonds are dated January 1 and mature in five years on January 1.The total interest expense related to these bonds for the current year ending on December 31 is

A) $2,000

B) $6,000

C) $18,000

D) $24,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry a company records for the payment of interest,interest expense,and amortization of bond discount is

A) debit Interest Expense, credit Cash and Discount on Bonds Payable

B) debit Interest Expense, credit Cash

C) debit Interest Expense and Discount on Bonds Payable, credit Cash

D) debit Interest Expense, credit Interest Payable and Discount on Bonds Payable

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

On the first day of the fiscal year,a company issues a $500,000,8%,10-year bond that pays semiannual interest of $20,000 ($500,000 × 8% × 1/2),receiving cash of $520,000.Journalize the entry to record the first interest payment and amortization of premium using the straight-line method.

Correct Answer

verified

Correct Answer

verified

True/False

The price of a bond is equal to the sum of the interest payments and the face amount of the bonds.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the market rate of interest is 7%,the price of 6% bonds paying interest semiannually with a face value of $500,000 will be

A) equal to $500,000

B) greater than $500,000

C) less than $500,000

D) greater than or less than $500,000, depending on the maturity date of the bonds

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If the market rate of interest is 8% and a corporation's bonds bear interest at 7%,the bonds will sell at a premium.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each description below to the appropriate term (a-g) . -The contract between bond issuer and bond purchaser

A) Contract rate

B) Effective rate

C) Bond discount

D) Bond premium

E) Bond

F) Bond indenture

G) Principal

I) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

One reason a dollar today is worth more than a dollar one year from today is the time value of money.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Gemstone Company obtained a $165,000,10-year,7% installment note from Guarantee Bank.The note requires annual payments of $23,492,with the first payment occurring on the last day of the fiscal year.The first payment consists of interest of $11,550 and principal repayment of $11,942.The journal entry to record the payment of the first annual amount due on the note would include a

A) debit to Cash for $11,942

B) credit to Interest Payable for $11,550

C) debit to Notes Payable for $11,942

D) debit to Interest Expense for $23,492

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The market interest rate related to a bond is also called the

A) stated interest rate

B) effective interest rate

C) contract interest rate

D) straight-line rate

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

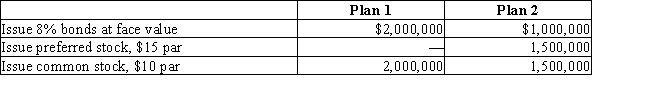

Ulmer Company is considering the following alternative financing plans:  Income tax is estimated at 35% of income.Dividends of $1 per share were declared and paid on the preferred stock.Determine the earnings per share of common stock,assuming income before bond interest and income tax is $600,000.

Income tax is estimated at 35% of income.Dividends of $1 per share were declared and paid on the preferred stock.Determine the earnings per share of common stock,assuming income before bond interest and income tax is $600,000.

Correct Answer

verified

Correct Answer

verified

True/False

The face value of a term bond is payable at a single specific date in the future.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 161 - 177 of 177

Related Exams