Correct Answer

verified

Correct Answer

verified

True/False

If $500,000 of 10-year bonds with interest payable semiannually are sold for $494,040 based on (1)the present value of $500,000 due in 20 periods at 5% plus (2)the present value of twenty $25,000 payments at 5%,the nominal or contract rate and the market rate of interest for the bonds are both 10%.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

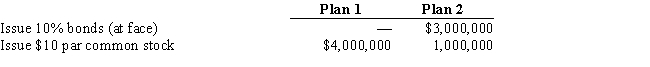

Sorenson Co.is considering the following alternative plans for financing the company:  Income tax is estimated at 40% of income.Determine the earnings per share of common stock under the two alternative financing plans,assuming income before bond interest and income tax is $1,000,000.

Income tax is estimated at 40% of income.Determine the earnings per share of common stock under the two alternative financing plans,assuming income before bond interest and income tax is $1,000,000.

Correct Answer

verified

Correct Answer

verified

True/False

If the amount of a bond premium on an issued 11%,four-year,$100,000 bond is $12,928,the semiannual straight-line amortization of the premium is $1,416.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Eddie Industries issues $1,500,000 of 8% bonds at 105,the amount of cash received from the sale is

A) $1,425,000

B) $1,080,000

C) $1,000,000

D) $1,575,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the maturities of a bond issue are spread over several dates,the bonds are called

A) serial bonds

B) bearer bonds

C) debenture bonds

D) term bonds

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Bondholders' claims on the assets of the corporation rank ahead of stockholders' claims.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

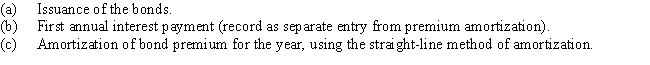

On the first day of the current fiscal year,$2,000,000 of 10-year,7% bonds,with interest payable annually,were sold for $2,125,000.Present entries to record the following transactions for the current fiscal year:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The interest rate specified in the bond indenture is called the

A) discount rate

B) contract rate

C) market rate

D) effective rate

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each description below to the appropriate term (a-g) . -Allows the issuer to redeem bonds before maturity date

A) EPS

B) Face value

C) Callable bond

D) Indenture

E) Term bond

F) Convertible bond

G) Serial bond

I) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The interest portion of an installment note payment is computed by multiplying the interest rate by the carrying amount of the note at the end of the period.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

(a) Prepare the journal entry to issue $500,000 bonds that sold for $490,000. (b) Prepare the journal entry to issue $500,000 bonds that sold for $515,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1,Zero Company obtained a $52,000,four-year,6.5% installment note from Regional Bank.The note requires annual payments of $15,179,beginning on December 31,Year 1.The December 31,Year 3 carrying amount in the amortization table for this installment note will be equal to

A) $0

B) $13,000

C) $14,252

D) $16,603

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When a corporation issues bonds,it executes a contract with the bondholders,known as a bond debenture.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Premium on bonds payable may be amortized by the straight-line method if the results obtained by its use do not materially differ from the results obtained by use of the interest method.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the market rate of interest was 12%,Halprin Corporation issued $1,000,000,11%,10-year bonds that pay interest annually.The selling price of this bond issue was

A) $321,970

B) $1,000,000

C) $943,494

D) $621,524

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Balance sheet and income statement data indicate the following:  Based on the data presented above,what is the times interest earned ratio (round to two decimal places) ?

Based on the data presented above,what is the times interest earned ratio (round to two decimal places) ?

A) 5.00

B) 5.44

C) 4.00

D) 4.33

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The balance in Discount on Bonds Payable that is applicable to bonds due in three years would be reported on the balance sheet in the section entitled

A) Investments

B) Long-term liabilities

C) Current assets

D) Intangible assets

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each description below to the appropriate term (a-g) . -The rate printed on the bond certificate

A) Contract rate

B) Effective rate

C) Bond discount

D) Bond premium

E) Bond

F) Bond indenture

G) Principal

I) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The times interest earned ratio is computed as

A) (Income Before Income Taxes + Interest Expense) ÷ Interest Expense

B) (Income Before Income Taxes - Interest Expense) ÷ Interest Expense

C) Income Before Income Taxes ÷ Interest Expense

D) (Income Before Income Taxes + Interest Expense) ÷ Interest Revenue

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 177

Related Exams