Correct Answer

verified

Correct Answer

verified

Essay

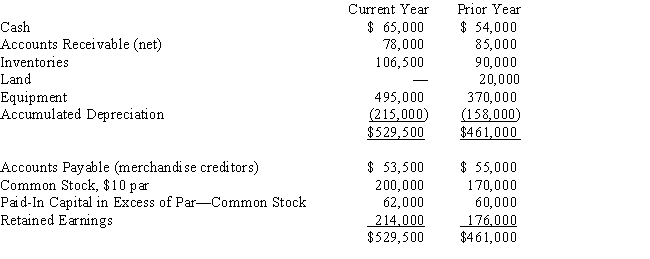

On the basis of the following data for Branch Co.for the current and preceding years ended December 31,prepare a statement of cash flows using the indirect method.Assume that equipment costing $125,000 was purchased for cash and the land was sold for $15,000.The stock was issued for cash and the only entries in the retained earnings account were for net income of $56,000 and cash dividends declared and paid of $18,000.

Correct Answer

verified

Correct Answer

verified

True/False

Cash flows from operating activities,as part of the statement of cash flows,include cash transactions that enter into the determination of net income.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Using the indirect method,if land costing $85,000 was sold for $145,000,the amount reported in the financing activities section of the statement of cash flows would be $85,000.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Cash flows from financing activities,as part of the statement of cash flows,would include any payments for dividends.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

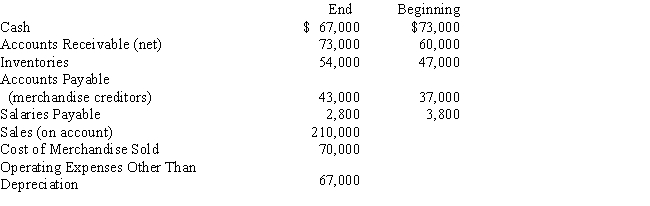

Balances of the current asset and current liability accounts at the end and beginning of the year are as follows:  Use the direct method to prepare the Cash flows from operating activities section of a statement of cash flows.

Use the direct method to prepare the Cash flows from operating activities section of a statement of cash flows.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash dividends of $45,000 were declared during the year.Cash dividends payable were $10,000 at the beginning of the year and $15,000 at the end of the year.The amount of cash for the payment of dividends during the year is

A) $50,000

B) $40,000

C) $55,000

D) $35,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

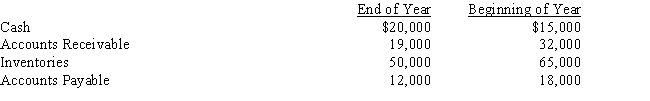

Dickinson Company reported net income of $155,000 for the current year.Depreciation recorded on buildings and equipment amounted to $65,000 for the year.In addition,a building with an original cost of $250,000 and accumulated depreciation of $190,000 on the date of the sale was sold for $75,000.Balances of the current asset and current liability accounts at the beginning and end of the year are as follows:Prepare the Cash flows from operating activities section of the statement of cash flows using the indirect method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Income tax was $175,000 for the year.Income tax payable was $30,000 and $40,000 at the beginning and end of the year,respectively.Cash payments for income tax reported on the statement of cash flows using the direct method is

A) $175,000

B) $165,000

C) $205,000

D) $215,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Preferred stock issued in exchange for land would be reported on the statement of cash flows in

A) the Cash flows from financing activities section

B) the Cash flows from investing activities section

C) a separate schedule

D) the Cash flows from operating activities section

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

To determine cash payments for income taxes for the statement of cash flows using the direct method,an increase in income taxes payable is added to the income tax expense.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Net income for the year was $45,500.Accounts receivable increased by $5,500,and accounts payable increased by $11,200.Under the indirect method,the cash flow from operations is

A) $51,200

B) $45,500

C) $62,200

D) $28,800

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The declaration and issuance of a stock dividend would be reported on the statement of cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Identify the section of the statement of cash flows (a-d) where each of the following items would be reported. -Payment of dividends to stockholders

A) Operating activities

B) Financing activities

C) Investing activities

D) Schedule of noncash financing and investing

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following represents an inflow of cash and therefore would be reported on the statement of cash flows?

A) retirement of bond payable

B) acquisition of treasury stock

C) declaration of stock dividends

D) issuance of long-term debt

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash paid for equipment would be reported on the statement of cash flows in

A) the Cash flows from operating activities section

B) the Cash flows from financing activities section

C) the Cash flows from investing activities section

D) a separate schedule

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

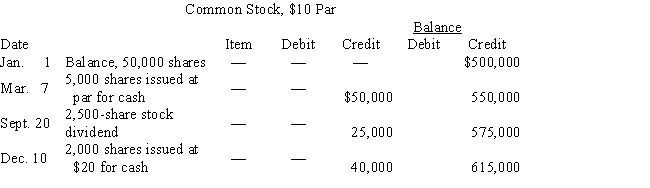

On the basis of the details of the common stock account presented below,calculate the total amount to be recorded in the financing section of the statement of cash flows.Assume any stock issues were at par.Indicate whether the amount results in an increase or decrease in cash.

Correct Answer

verified

Correct Answer

verified

Essay

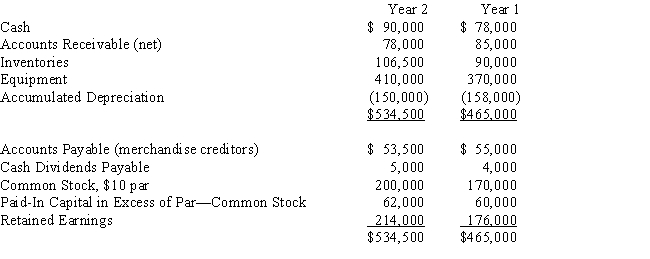

On the basis of the following data for Garrett Co.for Years 1 and 2 ended December 31,prepare a statement of cash flows using the indirect method of reporting cash flows from operating activities.Assume that equipment costing $125,000 was purchased for cash and equipment costing $85,000 with accumulated depreciation of $65,000 was sold for $15,000; that the stock was issued for cash; and that the only entries in the retained earnings account were for net income of $56,000 and cash dividends declared of $18,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation uses the indirect method for preparing the statement of cash flows.A fixed asset has been sold for $25,000 representing a gain of $4,500.The value in the operating activities section regarding this event would be

A) $25,000

B) $(4,500)

C) $29,500

D) $4,500

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following should be added to net income in calculating net cash flow from operating activities using the indirect method?

A) a gain on the sale of land

B) a decrease in accounts payable

C) an increase in accrued liabilities

D) dividends paid on common stock

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 187

Related Exams