B) False

Correct Answer

verified

Correct Answer

verified

True/False

A liability account normally has a credit balance.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When a company receives cash in advance from a customer,it should debit Cash and credit Accounts Receivable.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kincaid Company provided consulting services of $2,500 to a customer who paid $1,300 and promised to pay the remainder next month.Which of the following journal entries correctly records this transaction?

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following accounts is increased with a debit?

A) Insurance Expense

B) Service Revenue

C) Accounts Payable

D) Common Stock

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

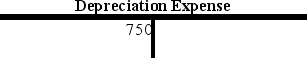

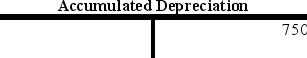

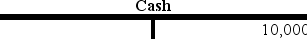

Peterson Corporation recorded an adjusting entry using T-accounts as follows:

Which of the following reflects how this adjustment affects the company's financial statements?

Which of the following reflects how this adjustment affects the company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which account is increased by a credit?

A) Accounts Receivable

B) Service Revenue

C) Interest Expense

D) Supplies

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Generally accepted accounting principles require that a business's fiscal year must end on December 31.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Journals are sometimes called books of original entry because transactions are recorded in journals before amounts are entered into the ledger.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Closing entries move all current year data for revenues,expenses,and dividends into the retained earnings account.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

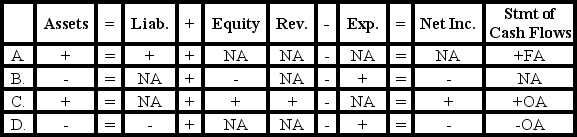

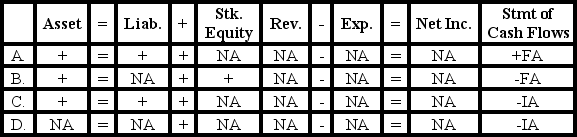

A transaction has been recorded in the T-accounts of Vernon Company as follows:

Which of the following reflects how this event affects the company's financial statements?

Which of the following reflects how this event affects the company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On August 1,Year 1,Benjamin and Associates collected $18,000 in advance for legal services to be rendered for one year.Which of the following entries reflect the end-of-the-year adjustment to reflect revenue earned?

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On October 1,Year 1,Senegal Company paid $1,200 in advance for rent of office space for one year and recorded a journal entry debiting Prepaid Rent and crediting Cash for $1,200.On December 31,Year 1,the required adjusting entry was recorded.What are the adjusted account balances at December 31,Year 1?

A) Prepaid Rent,$300;Rent Expense,$900

B) Prepaid Rent,$1,200;Rent Expense,$0

C) Prepaid Rent,$0;Rent Expense,$1,200

D) Prepaid Rent,$900;Rent Expense,$300

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following accounts normally has a debit balance?

A) Prepaid Insurance

B) Unearned Service Revenue

C) Accounts Payable

D) Common Stock

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Wagner Company acquired $500,000 cash from the issue of common stock.How would this transaction be recorded in the company's T-accounts?

A) ![]()

![]()

B) ![]()

![]()

C) ![]()

![]()

D) ![]()

![]()

F) A) and B)

Correct Answer

verified

Correct Answer

verified

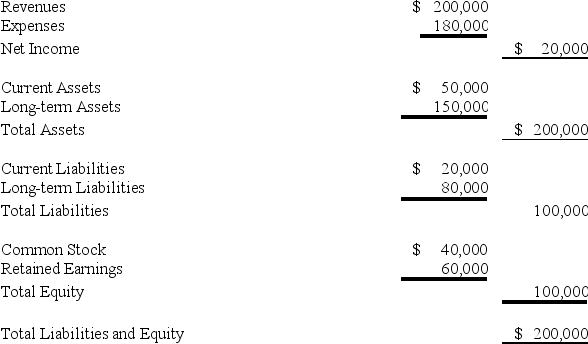

Multiple Choice

Wichita,Inc.reported the following amounts on its financial statements prepared as of the end of the current accounting period:

-What is the company's return-on-equity ratio?

-What is the company's return-on-equity ratio?

A) 5%

B) 10%

C) 20%

D) 50%

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Many companies choose to end their fiscal years during a part of the year when they expect low activity.

B) False

Correct Answer

verified

Correct Answer

verified

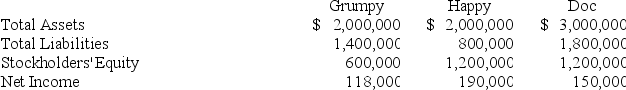

Multiple Choice

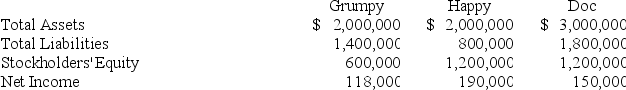

At the end of Year 1,the following information is available for Grumpy,Happy,and Doc Companies.

-Which company is the most profitable from the stockholders' perspective?

-Which company is the most profitable from the stockholders' perspective?

A) Grumpy

B) Happy

C) Doc

D) Cannot be determined

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the end of Year 1,the following information is available for Grumpy,Happy,and Doc Companies.

-Which of the following ratios would be most useful in evaluating a company's performance from the owners' perspective?

-Which of the following ratios would be most useful in evaluating a company's performance from the owners' perspective?

A) Return-on-assets ratio

B) Debt-to-assets ratio

C) Return-on-equity ratio

D) Either the debt-to-assets ratio or the return-on-equity ratio

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Why are adjusting entries recorded at the end of the accounting period?

A) The Cash account must be adjusted for the effects of the daily transactions with customers and creditors.

B) The company's accounts must be adjusted to ensure that debits are equal to credits prior to preparing the trial balance.

C) Unrecorded accruals and deferrals must be recognized before the financial statements can be prepared.

D) The data from the temporary accounts (revenues,expenses,and dividends) must be moved into the retained earnings account.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 106

Related Exams