A) Option A

B) Option B

C) Option C

D) Option D

F) A) and C)

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

A company using the perpetual inventory system paid cash for freight costs to purchase merchandise.Which of the following reflects the effects of this event on the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

For a company that uses the perpetual inventory system,a physical count of the inventory can reveal the amount of inventory shrinkage the company has experienced.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A perpetual inventory system updates the Merchandise Inventory account for all purchases of inventory,as well as returns of inventory to suppliers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] Assume the perpetual inventory system is used. 1) Green Company purchased merchandise inventory that cost $64,000 under terms of 2/10, n/30 and FOB shipping point. 2) Green Company paid freight cost of $2,400 to have the merchandise delivered. 3) Payment was made to the supplier on the inventory within 10 days. 4) All of the merchandise was sold to customers for $94,000 cash and delivered under terms FOB destination with freight cost amounting to $1,600. -What is the amount of gross margin that results from these transactions?

A) $31,280

B) $27,280

C) $28,880

D) $29,680

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

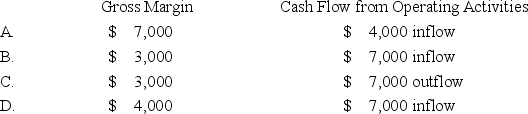

Flagler Company purchased $4,000 of merchandise on account.Flagler sold the merchandise to a customer for $7,000 cash.What is the increase in gross margin and the net change in cash flow from operating activities as a result of these transactions? (Consider the effects of both parts of this event. )

A) Option A

B) Option B

C) Option C

D) Option D

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding a multistep income statement is true?

A) When a company sells inventory for more than its cost,the difference between the sales revenue and the cost of goods sold is called the operating income.

B) A single-step income statement shows sales,gross margin,and net income.

C) Gross margin is calculated as sales revenue minus cost of goods sold.

D) Gross margin equals net income.

F) A) and D)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Which of the following is considered a period cost?

A) Transportation cost on goods received from suppliers

B) Advertising expense for the current month

C) Cost of merchandise purchased

D) None of these answer choices are considered a period cost

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the chief advantage of the periodic system?

A) Efficiency and ease of recording

B) Immediate feedback on the inventory on hand at any time during the period

C) Timely discovery of losses due to theft

D) Better control over inventory

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The entry to record the amount of inventory shrinkage affects both the balance sheet and the income statement.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When using a perpetual inventory system,which of the following events is an asset use transaction?

A) Paid cash to purchase inventory

B) Paid cash for transportation-out costs

C) Purchased inventory on account

D) Paid cash for transportation-in costs

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A company using a perpetual inventory system treats transportation-out as an operating expense.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Net sales is calculated by subtracting cost of goods sold from sales revenue.

B) False

Correct Answer

verified

Correct Answer

verified

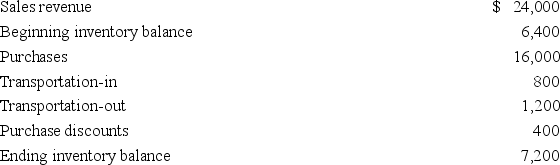

Multiple Choice

Sullivan Company uses the periodic inventory system.The following balances were drawn from the accounts of Sullivan Company prior to the closing process:

What is the gross margin that will be shown on the income statement?

What is the gross margin that will be shown on the income statement?

A) $8,400

B) $7,200

C) $15,600

D) $18,400

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Wilson Company purchased $44,000 of merchandise from the Poole Wholesale Company.Wilson also paid $3,000 for freight costs to have the goods shipped to its location.The company uses the perpetual inventory system.Which of the following summarizes the effects of the journal entries required to record these transactions for The Wilson Company? (Consider the effects of both business events. )

A) Total debits to the inventory account would be $47,000.

B) Total debits to the inventory account would be $44,000.

C) Transportation-in would be debited for $3,000.

D) Total debits to the inventory account would be $41,000.

F) B) and C)

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

Which of the following would be considered as primarily a merchandising business?

A) West Consulting

B) Martin's Supermarket

C) Sandridge and Associates Law Offices

D) KPM Accounting and Tax Service

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Wholesale companies sell goods primarily to other businesses.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company using the perpetual inventory system paid $250 cash to have goods delivered from one of its suppliers.How would the payment of $250 for transportation-in be classified?

A) An asset source transaction

B) An asset use transaction

C) An asset exchange transaction

D) A claims exchange transaction

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Galaxy Company sold merchandise costing $1,700 for $2,600 cash.The merchandise was later returned by the customer for a refund.The company uses the perpetual inventory system.What effect will the sales return have on the financial statements? (Consider the effects of both parts of this event. )

A) Total assets and total stockholders' equity decrease by $900.

B) Total assets decrease by $2,600 and total stockholders' equity decreases by $1,700.

C) Total assets and total stockholders' equity decrease by $2,600.

D) Total assets and total stockholders' equity increase by $900.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The return on sales ratio indicates the amount of each sales dollar that is left over after covering the cost of goods sold.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 114

Related Exams