B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

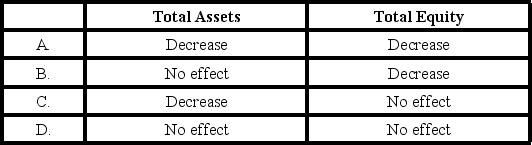

Jasper Company accepted a check from Harp Company as payment for services rendered.Jasper's bank statement revealed that the Harp check was an NSF check.What effect will the entry to record the NSF check have on the accounting equation of Jasper Company?

A) option A

B) option B

C) option C

D) option D

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements concerning internal controls is true?

A) Internal administrative controls are designed to limit the amount of funds spent on investments.

B) Strong internal controls provide reasonable assurance that the objectives of a company will be accomplished.

C) Internal accounting controls are limited to the policies and procedures used to protect the company from embezzlement.

D) The control procedure,segregation of duties,prohibits the employment of a husband and wife or other closely related parties within the same company.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an administrative control?

A) Performance evaluation

B) Accuracy of the recording procedures

C) Keeping cash in a safe

D) Maintenance of accurate inventory records

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A business learns about customers' NSF checks through debit memos that are included with the bank statement.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding the Securities and Exchange Commission (SEC) is not true?

A) SEC rules frequently require disclosures in addition to those required by GAAP.

B) The SEC has the authority to establish and enforce accounting rules for public companies.

C) The SEC is a private professional organization.

D) Public companies must register with the SEC.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Establishment of a petty cash fund is an asset exchange transaction.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a primary role of an independent auditor?

A) Assume legal and professional responsibilities to the public.

B) Advise client on tax strategies.

C) Determine whether a company's financial statements are materially correct.

D) All of these answer choices are correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

For a petty cash fund to be most useful to a business,one of the employees of the business should be designated as responsible for the fund.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] The bank statement for Tetra Company contained the following items: a bank service charge of $10; a credit memo for interest earned, $15; and a $50 NSF check from a customer. The company had outstanding checks of $100 and a deposit in transit of $300. -Assuming that the unadjusted bank balance was $500,what is the unadjusted book balance?

A) $745

B) $455

C) $700

D) $800

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not one of the nine features of an internal control system?

A) Establishment of clear lines of authority

B) Having employees covered by a fidelity bond

C) Requiring regular vacations for certain employees

D) Customer service comment cards

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true with regards to financial statement audits?

A) The auditors guarantee that the financial statements are accurate and correct.

B) Financial audits are directed toward the discovery of fraud.

C) Auditors provide reasonable assurance that statements are free from material misstatements,whether caused by errors or fraud.

D) Auditors will not disclose information that they have acquired as a result of their accountant-client relationship.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At March 31,Cummins Co.had an unadjusted balance in its cash account of $10,400.At the end of March,the company determined that it had outstanding checks of $900,deposits in transit of $600,a bank service charge of $20,and an NSF check from a customer for $200.What is the true cash balance at March 31?

A) $10,100

B) $10,180

C) $10,380

D) $9,880

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

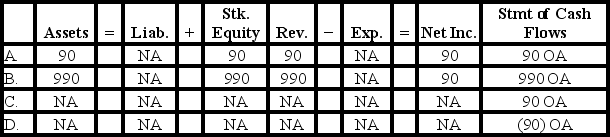

While performing its monthly bank reconciliation,the bookkeeper for Grace Corporation noted that a deposit of $990 (received from a customer on account) was recorded in the company books as $900.Which of the following shows the effect of the correcting entry on the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gross Company established a $250 petty cash fund on January 1.On March 1,the fund contained $160 in receipts for miscellaneous expenses and $85 in cash.If the entries to record the disbursements and to replenish the fund are combined,what effect will the resulting entry have on the elements of the financial statements?

A) No effect on total assets

B) Decrease stockholder's equity by $160

C) Increase stockholder's equity by $165

D) Decrease total assets by $165

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Typical adjustments to the unadjusted book balance on a bank reconciliation include bank service charges,customer NSF checks,and certified checks.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Chester Company has established internal control policies and procedures in order to achieve the following objectives: 1) Effective evaluation of management performance. 2) Assure that the accounting records contain reliable information. 3) Safeguard the company's assets. Which of these objectives are achieved by accounting controls?

A) Objectives 1 and 2

B) Objectives 2 and 3

C) Objectives 3 and 4

D) All four objectives

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

A credit balance in the Cash Short and Over account represents a shortage of cash and would be treated as an expense.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following will be caused by the entry to record the customer's NSF check?

A) Accounts receivable increases.

B) Cash decreases.

C) Stockholders' equity decreases.

D) Accounts receivable increases and cash decreases.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Internal controls designed to evaluate performance and the degree of compliance with company policies and public laws are classified as administrative controls.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 82

Related Exams