A) Cash flow method.

B) Allowance method.

C) Direct write-off method.

D) Accrual method.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Elliston Company accepted credit card payments for $10,000 of services provided to customers.The credit card company charges a 3% fee for handling the transaction.Which of the following describes the effect of this transaction?

A) Increase revenue by $9,700

B) Increase assets by $10,000

C) Increase stockholders' equity (retained earnings) by $9,700

D) Increase net income by $10,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If a company estimates uncollectible accounts based on a percentage of receivables,the resulting estimate will be presented on the balance sheet as the ending balance in Allowance for Doubtful Accounts.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an advantage of accepting credit cards from retail customers?

A) The acceptance of credit cards tends to increase sales.

B) The credit card company performs credit worthiness assessments.

C) There are fees charged for the privilege of accepting credit cards.

D) The credit card company assumes the cost of slow collections and write-offs.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a significant difference between the allowance method and the direct write-off method?

A) One method requires writing off of uncollectible accounts and the other does not.

B) One method conforms to GAAP and the other typically does not.

C) One method reports net realizable value on the balance sheet and the other does not.

D) One method requires the estimation of uncollectible accounts and the other does not.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] On January 1, Year 2, Kincaid Company's Accounts Receivable and the Allowance for Doubtful Accounts carried balances of $31,000 and $500, respectively. During Year 2, Kincaid reported $72,500 of credit sales, wrote off $550 of receivables as uncollectible, and collected cash from receivables amounting to $74,550. Kincaid estimates that it will be unable to collect one percent (1%) of credit sales. -Which of the following describes the effects of Kincaid's entry to recognize the write-off of the uncollectible accounts?

A) Increase assets and stockholders' equity.

B) Increase assets and decrease stockholders' equity.

C) Decrease assets and stockholders' equity.

D) Does not affect assets or stockholders' equity.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] On January 1, Year 2, Kincaid Company's Accounts Receivable and the Allowance for Doubtful Accounts carried balances of $31,000 and $500, respectively. During Year 2, Kincaid reported $72,500 of credit sales, wrote off $550 of receivables as uncollectible, and collected cash from receivables amounting to $74,550. Kincaid estimates that it will be unable to collect one percent (1%) of credit sales. -What is the amount of uncollectible accounts expense that will be reported on the Year 2 income statement?

A) $310

B) $725

C) $745.50

D) $550

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

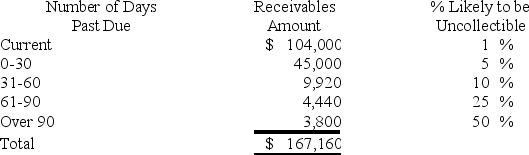

Domino Company ages its accounts receivable to estimate uncollectible accounts expense.Domino began Year 2 with balances in Accounts Receivable and Allowance for Doubtful Accounts of $76,500 and $5,800,respectively.During Year 2,the company wrote off $4,640 in uncollectible accounts.In preparation for the company's estimate of uncollectible accounts expense for Year 2,Domino prepared the following aging schedule:

What amount will be reported as uncollectible accounts expense on the Year 2 income statement?

What amount will be reported as uncollectible accounts expense on the Year 2 income statement?

A) $6,132

B) $1,512

C) $7,292

D) $4,640

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The net realizable value of accounts receivable decreases when an account receivable is written off.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is (are) the term(s) used to describe the person responsible for making payment on the due date of a promissory note?

A) Lender or maker

B) Maker or debtor

C) Borrower

D) Borrower or maker or debtor

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

On June 1,Year 2,Carolina Company collected a $24,000 note receivable that had been issued on June 1,Year 1.The note carried a 6% interest rate.On June 1,Year 2,the company will recognize interest revenue in the amount of $1,440.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] On January 1, Year 2, Kincaid Company's Accounts Receivable and the Allowance for Doubtful Accounts carried balances of $31,000 and $500, respectively. During Year 2, Kincaid reported $72,500 of credit sales, wrote off $550 of receivables as uncollectible, and collected cash from receivables amounting to $74,550. Kincaid estimates that it will be unable to collect one percent (1%) of credit sales. -What is the net realizable value of receivables that will be reported on Kincaid's Year 2 balance sheet?

A) $29,075

B) $27,725

C) $28,950

D) $28,400

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When an uncollectible account receivable is written off,the amount of total assets is unchanged.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The collection of an account receivable is an asset source transaction.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When is it acceptable to use the direct write-off method?

A) If the dollar amount of uncollectible accounts is not material.

B) If most uncollectible accounts do not occur in the period of sale.

C) If most sales are made to other businesses.

D) All of these answer choices are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

With the direct write-off method,writing off an account receivable is an asset use transaction.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] On January 1, Year 2 Grande Company had a $16,000 balance in the Accounts Receivable account and a zero balance in the Allowance for Doubtful Accounts account. During Year 2, Grande provided $104,000 of service on account. The company collected $97,000 cash from accounts receivable. Uncollectible accounts are estimated to be 2% of sales on account. -What is the amount of cash flow from operating activities that would appear on the Year 2 statement of cash flows?

A) $97,000

B) $104,000

C) $89,520

D) $95,060

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a cost of extending credit to customers?

A) Uncollectible accounts expense

B) Lost sales

C) Fees paid to credit card companies

D) Explicit interest

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When a company accepts a credit card payment for a sale,the amount of sales revenue to be recorded is reduced by the amount of the credit card company's fee.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The longer an account receivable has been outstanding,the less likely it is to be collected.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 83

Related Exams