A) $17,500

B) $12,500

C) $14,250

D) $15,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The times-interest-earned ratio is usually calculated as the ratio of net income to interest expense.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.]

On January 1, Year 1, Pierce Corporation issued $25,000 in 8%, 5-year bonds payable at 102. Interest payments are due each December 31. Pierce uses the straight-line method to amortize bond discounts and premiums.

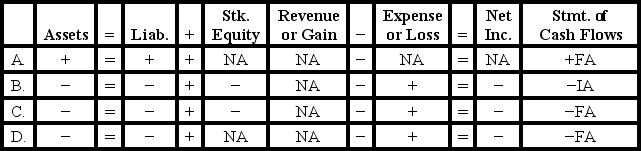

-Which of the following shows the effect of the bond issuance on January 1,Year 1?

![[The following information applies to the questions displayed below.] On January 1, Year 1, Pierce Corporation issued $25,000 in 8%, 5-year bonds payable at 102. Interest payments are due each December 31. Pierce uses the straight-line method to amortize bond discounts and premiums. -Which of the following shows the effect of the bond issuance on January 1,Year 1? A) Option A B) Option B C) Option C D) Option D](https://d2lvgg3v3hfg70.cloudfront.net/TB6522/11ea8a6f_8d54_3446_a2a1_e763bb56d9ad_TB6522_00.jpg)

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.]

On January 1, Year 1, Echols Company borrowed $100,000 cash from Sun Bank by issuing a 5-year, 8% term note. The principal and interest are repaid by making annual payments beginning on December 31, Year 1. The annual payment on the loan equals $25,045.65.

-Which of the following shows how the borrowing of cash from Sun Bank on January 1,Year 1,affects the elements of the financial statements?

![[The following information applies to the questions displayed below.] On January 1, Year 1, Echols Company borrowed $100,000 cash from Sun Bank by issuing a 5-year, 8% term note. The principal and interest are repaid by making annual payments beginning on December 31, Year 1. The annual payment on the loan equals $25,045.65. -Which of the following shows how the borrowing of cash from Sun Bank on January 1,Year 1,affects the elements of the financial statements? A) Option A B) Option B C) Option C D) Option D](https://d2lvgg3v3hfg70.cloudfront.net/TB6522/11ea8a6f_8d5c_2299_a2a1_11d5dc04fac6_TB6522_00.jpg)

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following describes the characteristics of a convertible bond?

A) Bonds mature at specified intervals throughout the life of the total issuance.

B) Bonds may be exchanged for stock at the discretion of the bondholder.

C) Bonds mature on a specified date in the future.

D) Bonds may be exchanged for stock at the discretion of the issuer.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Thrasher Company reported income before taxes of $180,000.The company is in a 30% income tax bracket.Also,Thrasher's income statement contained a charge for interest expense amounting to $60,000.Based on this information alone,what is the company's times-interest-earned ratio?

A) 2.1

B) 3.0

C) 3.1

D) 4.0

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1,Strang Incorporated issued bonds with a face value of $500,000,a stated rate of interest of 8%,and a 5-year term to maturity.The effective rate of interest was 10%.Interest is payable in cash on June 30 and December 31 of each year.Which of the following statements is true?

A) This bond was issued at a premium,and each semiannual cash payment is $25,000.

B) This bond was issued at a discount,and each semiannual cash payment is $20,000.

C) This bond was issued at a discount,and the annual interest expense is $40,000.

D) This bond was issued at a premium,and the annual interest expense is $40,000.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

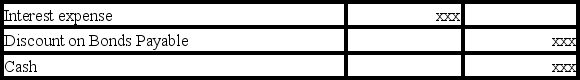

Spokane Company called in bonds at a price that was above the carrying value of the bond liability.Which of the following shows how this event will affect the elements of the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] On January 1, Year 1, Wayne Company issued bonds with a face value of $600,000, a 6% stated rate of interest, and a 10-year term. Interest is payable in cash on December 31 of each year. Wayne uses the straight-line method to amortize bond discounts and premiums. -Assuming Wayne issued the bond for 102.5,what is the amount of interest expense that will be reported on the income statement for the year ending December 31,Year 1?

A) $34,500

B) $36,000

C) $37,500

D) $15,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The times-interest-earned ratio is calculated by which of the following?

A) Total assets divided by interest expense.

B) Net income divided by interest expense.

C) Earnings before interest and taxes divided by interest expense.

D) None of these answer choices are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

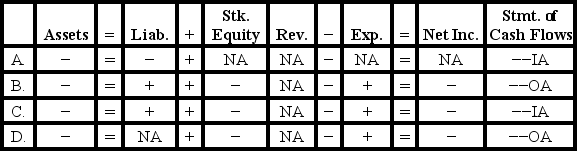

Bruce Company experienced an accounting event that was recorded in the company's general journal as indicated below:

Which of the following shows how this event affects the elements of the financial statements?

Which of the following shows how this event affects the elements of the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Companies that issue bonds are required to pay the face value of the bonds at maturity and to make fluctuating periodic interest payments based on the market interest rate.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

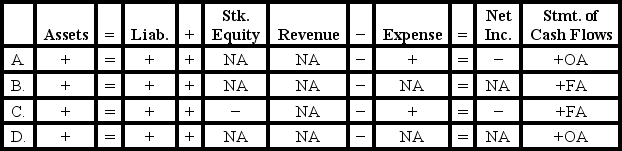

Johansen Company issued a bond at a discount.Which of the following shows how the issuance of the bonds affects the elements of the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true regarding the straight-line method of amortizing discounts and premiums on bonds?

A) It assigns variable amounts of interest over the term of the liability.

B) It uses compound interest principles.

C) It assigns the same amount of interest to each interest period over the life of the bond.

D) It accurately reports the amount of interest expense incurred during each interest period.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

If bonds with a face value of $200,000 are issued at 98,the amount of cash received from issuing the bonds is $204,082.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Amortization of a discount on bonds payable is an asset use transaction.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jacobs Company issued bonds with a $300,000 face value on January 1,Year 1.The bonds were issued at 102 and carried a 5-year term to maturity.They had a 9% stated rate of interest that was payable in cash on December 31st of each year.Jacobs uses the straight-line method to amortize bond discounts and premiums.Based on this information alone,how does the recognition of interest expense during Year 1 affect the company's accounting equation?

A) Decrease equity by $25,800,decrease liabilities by $1,200,and decrease assets by $27,000

B) Decrease both assets and stockholders' equity by $2,700

C) Decrease both assets and stockholders' equity by $25,800

D) Increase liabilities by $1,200,decrease assets by $25,800,and decrease equity by $27,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is one of the main advantages of using long-term debt financing instead of equity financing?

A) Not having to pay back the principal

B) Ability to raise large amounts of capital

C) Tax-deductibility of interest

D) Tax-deductibility of dividends

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Loans that require payment of interest at regular intervals and payment of principal at maturity are installment notes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following conditions indicate a company has a relatively high level of financial risk?

A) A low times-interest-earned ratio

B) A low debt to assets ratio

C) A high return on equity

D) A high current ratio

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 105

Related Exams