B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

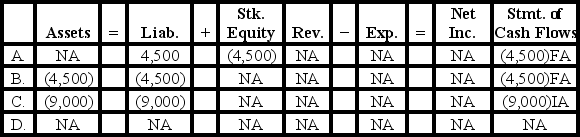

On March 1, Year 1, Gilmore Incorporated declared a cash dividend on its 1,500 outstanding shares of $50 par value, 6% preferred stock. The dividend will be paid on May 1, Year 1 to the stockholders of record as of April 1, Year 1.

-How will the May 1 payment of the dividend affect the elements of the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A corporation must record a liability for cash dividends on the date of record.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following best describes how each share of par value stock issued is reported in the Common Stock account?

A) Current market value

B) Average issue price

C) Par or stated value

D) Lower of cost or market

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How is the price-earnings ratio calculated?

A) Market price per share of stock divided by earnings per share

B) The interest rate on borrowed money divided by the current prime rate

C) The price of a company's products as compared to its net income

D) The market value of a company's stock divided by average earnings over the past three years

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is a reason why a company would buy treasury stock?

A) Because management believes the market price of the stock is undervalued.

B) To have stock available to issue to employees in stock option plans.

C) To avoid a hostile takeover.

D) All of these are reasons a company would buy treasury stock.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The balance sheet of a sole proprietorship will report two equity accounts: one for amounts contributed by the owner,and one for the earnings of the business.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following entities would have a "Paid-in Capital in Excess" account in the equity section of the balance sheet?

A) A corporation

B) A municipality

C) A sole proprietorship

D) A partnership

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A corporation is a legal entity created by the authority of a state government,separate and distinct from its owners.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The Securities and Exchange Commission (SEC)has the authority to set and enforce auditing,attestation,quality control,and ethics standards for auditors of public companies.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How does the issuance of a common stock dividend normally impact the calculation of a company's price-earnings (P/E) ratio?

A) It decreases the P/E ratio.

B) It would not be expected to impact the P/E ratio.

C) It increase the P/E ratio.

D) The impact on the P/E ratio cannot be determined.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

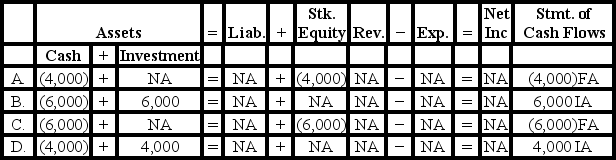

Kellogg,Inc.purchased 200 shares of its own $20 par value stock for $30 cash per share.Which of the following answers reflects how this purchase of treasury stock would affect the elements of Kellogg's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 92 of 92

Related Exams