A) Entrenched management

B) Double taxation

C) Personal liability

D) Excessive regulation

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements best describes the term "par value?"

A) The number of shares currently in the hands of stockholders

B) The amount that must be paid to purchase a share of stock

C) Determined by dividing total stockholder's equity by the number of shares of stock

D) An amount used in determining a corporation's legal capital

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

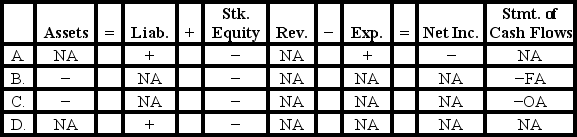

The board of directors of Chandler Company declared a cash dividend.Which of the following choices accurately reflects how this event would affect the elements of the company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Van Buren Corporation issued 5,000 shares of $6 par common stock for $24 per share.For this transaction,Common Stock should be credited (increased)for $120,000.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A high price-earnings ratio generally means that investors are optimistic about a company's future growth.

B) False

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

On January 2,Year 1,Torres Corporation issued 20,000 shares of $10 par-value common stock for $11 per share.Which of the following statements is true?

A) The Common Stock account will increase by $220,000.

B) The Cash account will increase by $200,000.

C) Total stockholders' equity will increase by $200,000.

D) The Paid-in Capital in Excess of Par Value account will increase by $20,000.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

An appropriation of retained earnings restricts the amount of dividends that a corporation can declare in the future.

B) False

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

How is treasury stock reported on a corporation's balance sheet?

A) As an addition to total paid-in capital

B) As a deduction in determining total stockholders' equity

C) As a deduction from total paid-in capital

D) As a deduction from retained earnings

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Treasury Stock is a stockholders' equity account that has a normal credit balance.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which form of business organization is established as a separate legal entity?

A) Sole proprietorship

B) Partnership

C) Corporation

D) None of these

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fred and Barney started a partnership.During Year 1,Fred invested $20,000 in the business and Barney invested $32,000.The partnership agreement called for each partner to receive an annual distribution equal to 15% of his capital contribution.Any further earnings were to be retained in the business and divided equally between the partners.The partnership reported net income of $38,000 during Year 1.How will the $38,000 of net income be split between Fred and Barney respectively? (Hint: Consider both the cash withdrawals and allocation of remaining income. ) Fred Barney

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

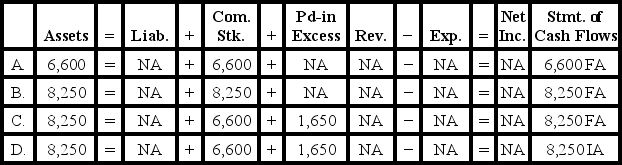

On January 12,Year 1,Gilliam Corporation issued 550 shares of $12 par-value common stock for $15 per share.The number of shares authorized is 5,000,and the number of shares outstanding prior to this transaction was 1,200.Which of the following describes the effect of the January 12 transaction on the elements of the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For Year 2,the Sacramento Corporation had beginning and ending Retained Earnings balances of $208,054 and $231,012,respectively.Also during Year 2,the board of directors declared cash dividends of $29,000,which were paid during Year 2.The board also declared a stock dividend,which was issued and required a transfer in the amount of $16,000 to paid-in capital.Total expenses during Year 2 were $32,916.Based on this information,what was the amount of total revenue for Year 2?

A) $68,158

B) $143,154

C) $100,874

D) $179,132

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Weller Corporation issued 10,000 shares of no-par common stock for $25 per share.For this transaction,Common Stock should be credited (increased)for $250,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not be a reason to expect an increase in the market price of the stock of Carlyle Corporation?

A) Carlyle Corp.has a history of earnings growth.

B) Investors expect that revenue and earnings growth in the future will not be as great as revenue and earnings growth has been in the past.

C) The market price has been influenced by positive financial information that is not provided in the financial statements.

D) Investors believe Carlyle Corp.has potential for earnings growth.

F) B) and D)

Correct Answer

verified

B

Correct Answer

verified

True/False

Preferred stockholders generally have no voting rights in a corporation.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A distribution by a sole proprietorship to the owner is called a withdrawal.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about why companies choose not to pay cash dividends is (are) true?

A) The board and management prefer to reinvest all net income for future growth.

B) The corporation does not have sufficient cash.

C) The corporation does not have sufficient retained earnings.

D) All of these statements are true.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Treasury Stock is reported on the balance sheet between the liabilities and stockholders' equity sections.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the year,Todd Corporation issued 200 shares of $20 par value common stock for $50 a share.A total of 500 shares were authorized.In addition,the company purchased 75 shares of treasury stock at $44 a share.Which of the following best presents the related lines in the stockholders' equity section of the company's balance sheet?

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 92

Related Exams