A) 10.0%

B) 16.7%

C) 12.5%

D) 50.0%

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding net margin is not true?

A) Net margin refers to the percentage of each sales dollar remaining after all expenses are subtracted.

B) Net margin may be calculated in several ways.

C) The amount of net margin is affected by a company's choices of accounting principles.

D) The smaller the net margin the better.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding the quick ratio is not true?

A) The quick ratio is also known as the acid-test ratio.

B) The quick ratio ignores some current assets that are less liquid than others.

C) The quick ratio is a conservative variation of the current ratio.

D) The quick ratio equals quick assets divided by total liabilities.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Darden Company has cash of $40,000,accounts receivable of $60,000,inventory of $32,000,and equipment of $100,000.Assuming current liabilities of $48,000,this company's working capital is:

A) $12,000.

B) $52,000.

C) $144,000.

D) $84,000.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which ratio compares the earnings per share of a company to the market price for a share of the company's stock?

A) Price-earnings ratio

B) Dividend yield

C) Book value per share

D) Return on equity

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The current ratio is one of the most common measures of solvency.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The accounts receivable turnover ratio can be used to asses a firm's solvency.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Benson Company received cash of $1,000,000 from issuing common stock at par value.As a result of this transaction,the company's debt-to-equity ratio will:

A) Decrease.

B) Increase.

C) Remain the same.

D) Cannot be determined.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The accounting profession assumes that financial statement users have an expert knowledge of business.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Starwood Corporation has current assets of $200,000,total current liabilities of $750,000 net credit sales of $1,300,000,beginning accounts receivable of $65,000 and ending accounts receivable of $69,000.What is Starwood's accounts receivable turnover?

A) 21.8 times

B) 19.4 times

C) 22.4 times

D) 5.8 times

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

While horizontal analysis examines one item over many time periods,vertical analysis examines many items in the same interval of time.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding the information disclosed in financial statements is not true?

A) The costs of providing all possible information about a firm would be prohibitively high for the business.

B) Some information disclosed in financial statements may be irrelevant to some users.

C) Financial statements should be detailed enough to answer any financial-related question an investor might have.

D) When too much information is presented users may suffer from information overload.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lilly's Corporation has working capital of $620,000,and Harmon Corporation has working capital of $840,000.Which of the following statements is not true?

A) Since working capital is an absolute amount,other factors such as size of the company and materiality will help to determine liquidity of these two companies.

B) Since Harmon's working capital exceeds Lilly's working capital,it is safe to conclude that Harmon is more liquid than Lilly.

C) If Lilly Corporation is smaller than Harmon or has lower current liabilities;Lilly could be more liquid than Harmon.

D) None of these answers is correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Solvency ratios are used to analyze the long-term debt-paying ability and the composition of the financing structure of the firm.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

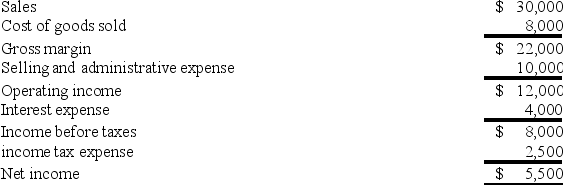

The Poole Company reported the following income for Year 2:

What is the company's net margin? (Rounded to the nearest whole percent. )

What is the company's net margin? (Rounded to the nearest whole percent. )

A) 73%

B) 40%

C) 18%

D) 27%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are considering an investment in Frontier Airlines stock and wish to assess the firm's earnings performance.All of the following ratios can be used to assess profitability except:

A) Average days to collect receivables.

B) Asset turnover.

C) Return on investment.

D) Net margin.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that you are considering purchasing some of a company's long-term bonds as an investment.Which of the company's financial statement ratios would you probably be most interested in?

A) Debt to assets ratio

B) Debt to equity

C) Plant assets to long-term liabilities

D) All of these answers are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

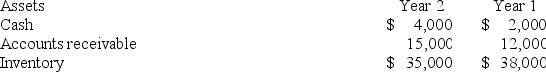

The following balance sheet information was provided by Western Company:

Assuming Year 2 net credit sales totaled $270,000,what was the company's average days to collect receivables? (Use 365 days in a year.Do not round your intermediate calculations. )

Assuming Year 2 net credit sales totaled $270,000,what was the company's average days to collect receivables? (Use 365 days in a year.Do not round your intermediate calculations. )

A) 18.25 days

B) 47.31 days

C) 16.22 days

D) 20.28 days

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The accounting concept or principle that is perhaps the greatest single culprit in distorting the results of financial statement analysis is the:

A) Matching principle.

B) Conservatism concept.

C) Historic cost principle.

D) Time value of money concept.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Martin Company reported net income of $15,000 on gross sales of $80,000.The company has average total assets of $135,000,of which $102,000 is property,plant and equipment.What is the company's return on investment? (Rounded to the nearest decimal point. )

A) 18.8%

B) 11.1%

C) 14.7%

D) 12.5%

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 108

Related Exams