A) fences.

B) trees and shrubs.

C) outdoor lighting.

D) All of the above.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Computer equipment was acquired at the beginning of the year at a cost of $56,000 with an estimated residual value of $5,000 and an estimated useful life of 5 years.Determine the second year's depreciation using straight-line depreciation.

A) $10,200

B) $22,400

C) $11,200

D) $12,200

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Goodwill is

A) amortized similar to other intangibles.

B) only written down if an impairment in value occurs.

C) charged to expense immediately.

D) amortized over 40 years or its economic life,whichever is shorter.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A current asset account must be increased for revenue expenditures since they only benefit the current period.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If an asset is discarded,a loss is recognized equal to the salvage value.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The acquisition costs of property,plant,and equipment should include all normal,reasonable,and necessary costs to get the asset in place and ready for use.

B) False

Correct Answer

verified

Correct Answer

verified

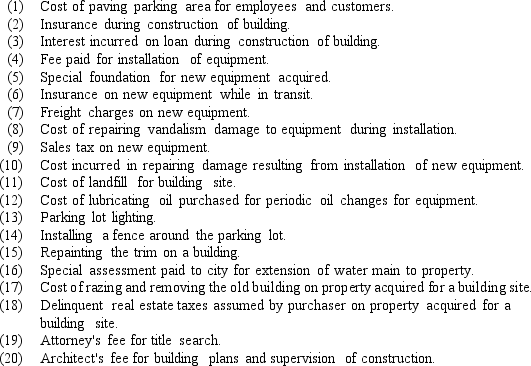

Essay

Identify each of the following expenditures as chargeable to (a)Land, (b)Land Improvements, (c)Buildings, (d)Machinery and Equipment,or (e)other account.

Correct Answer

verified

Correct Answer

verified

True/False

Goodwill equals the purchase price of a company over the fair market value of its net assets.

B) False

Correct Answer

verified

Correct Answer

verified

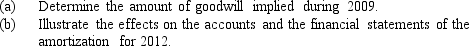

Essay

During 2009,Lexie,Inc.acquired Lena,Inc.for $10,000,000.The fair market value of the net assets of Lena,Inc.was $8,500,000 on the date of purchase.During 2012,Lexie,Inc.determined the goodwill resulting from the Lena acquisition was impaired and had a value of $1,000,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A machine with a useful life of 10 years and a residual value of $4,000 was purchased for $30,000.What is annual depreciation under the straight-line method?

A) $3,000

B) $3,400

C) $2,600

D) $5,200

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a fixed asset with an original cost of $18,000 and accumulated depreciation of $2,000 is sold for $15,000,the company must

A) recognize a loss on the income statement under other expenses.

B) recognize a loss on the income statement under operating expenses.

C) recognize a gain on the income statement under other revenues.

D) Gains and losses are not to be recognized upon the sell of fixed assets.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Residual value is ignored under double-declining-balance depreciation except for the final year.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A machine was purchased for $60,000.It has a useful life of 5 years and a residual value of $6,000.Under the straight-line method,what is annual depreciation expense?

A) $13,200

B) $12,000

C) $11,000

D) $10,800

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The process of transferring the cost of metal ores and other minerals removed from the earth to an expense account is called

A) depletion.

B) deferral.

C) amortization.

D) depreciation.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fixed assets are ordinarily presented in the balance sheet

A) at current market values.

B) at replacement costs.

C) at cost less accumulated depreciation.

D) in a separate section along with intangible assets.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

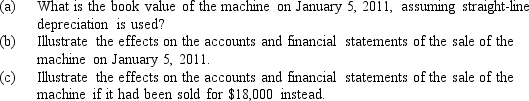

Essay

Equipment with a useful life of 5 years and a residual value of $6,000 was purchased on January 3,2006,for $48,500.The machine was sold on January 5,2011,for $13,000.

Correct Answer

verified

Correct Answer

verified

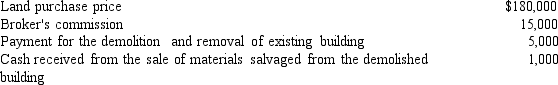

Essay

What is the cost of the land,based on the following data?

Correct Answer

verified

Correct Answer

verified

True/False

The double-declining-balance method of depreciation is referred to as an accelerated method.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A gain is recorded on the sale of fixed assets when

A) the asset is sold for a price less than its book value.

B) the asset's book value is less than the cash received.

C) accumulated depreciation is less than the cash received.

D) None of the above.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Drilling Company purchased a mining site for $500,000 on July 1,2010.The company expects to mine ore for the next 10 years and anticipates that a total of 100,000 tons will be recovered.The estimated residual value of the property is $80,000.During 2010 the company extracted 6,500 tons of ore.The depletion expense for 2010 is

A) $37,700.

B) $42,000.

C) $32,500.

D) $27,300.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 86

Related Exams