Correct Answer

verified

Correct Answer

verified

True/False

The product cost concept includes the selling and administrative expenses in the cost amount to which the markup is added to determine product price.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A business is considering a cash outlay of $500,000 for the purchase of land,which it could lease for $40,000 per year.If alternative investments are available that yield a 21% return,the opportunity cost of the purchase of the land is

A) $105,000.

B) $40,000.

C) $65,000.

D) $8,400.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A cost that will not be affected by later decisions is termed an opportunity cost.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When eliminating a product or segment of a business,the fixed costs pertaining to the product or segment will always be eliminated.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When choosing whether or NOT to replace usable fixed assets,management should consider the price at which the asset can be sold.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Differential revenue is the amount of increase or decrease in revenue expected from a particular course of action as compared to an alternative.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

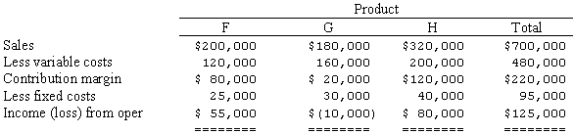

The condensed income statement for a business for the past year is presented as follows:  Management is considering the discontinuance of the manufacture and sale of Product G at the beginning of the current year.The discontinuance would have no effect on the total fixed costs and expenses or on the sales of Products F and H.What is the amount of change in net income for the current year that will result from the discontinuance of Product G?

Management is considering the discontinuance of the manufacture and sale of Product G at the beginning of the current year.The discontinuance would have no effect on the total fixed costs and expenses or on the sales of Products F and H.What is the amount of change in net income for the current year that will result from the discontinuance of Product G?

A) $10,000 increase

B) $20,000 increase

C) $10,000 decrease

D) $20,000 decrease

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In attempting to improve profitability when faced with a bottleneck that is involved in the production of two or more products,which of the following is most important for management to consider?

A) Contribution margin per unit for each product

B) Time required for each different product passing through the bottleneck

C) Selling price or sales revenue generated by each product produced through the bottleneck

D) Contribution margin per bottleneck hour for each product

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What cost concept used in applying the cost-plus approach to product pricing covers selling expenses,administrative expenses,and desired profit in the "markup"?

A) Total cost concept

B) Product cost concept

C) Variable cost concept

D) Sunk cost concept

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sanchez Company is considering replacing equipment that originally cost $300,000 and that has $280,000 accumulated depreciation to date.A new machine will cost $450,000.What is the sunk cost in this situation?

A) $150,000

B) $280,000

C) $20,000

D) $300,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which equation better describes target costing?

A) Selling Price - Desired Profit = Target Costs

B) Selling Price - Target Costs = Profit

C) Target Variable Costs + Contribution Margin = Selling Price

D) Selling Price = Target Variable Costs + Target Fixed Costs + Profit

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The amount of income that would result from an alternative use of cash is called opportunity cost.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT a cost concept commonly used in applying the cost-plus approach to product pricing?

A) Total cost concept

B) Product cost concept

C) Variable cost concept

D) Fixed cost concept

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount of increase or decrease in revenue that is expected from a particular course of action as compared with an alternative is termed

A) manufacturing margin.

B) contribution margin.

C) differential cost.

D) differential revenue.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The total cost concept includes all manufacturing costs minus selling and administrative expenses in the cost amount to which the markup is added to determine product price.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Differential analysis can aid management in making decisions on a variety of alternatives,including whether to discontinue an unprofitable segment and whether to replace usable plant assets.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The markup percentage for the company's product is

A) 21.0%.

B) 25.4%.

C) 15.7%.

D) 24.0%.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

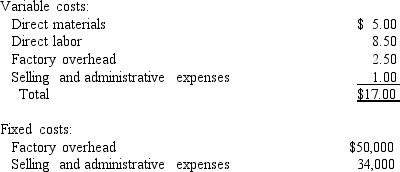

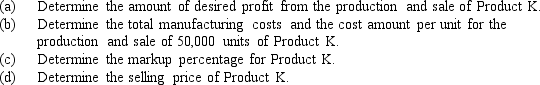

Tidewater Company uses the product cost concept of applying the cost-plus approach to product pricing.The cost and expenses of producing and selling 50,000 units of Product K are as follows:

Tidewater desires a profit equal to a 10% rate of return on invested assets of $1,285,000.

Tidewater desires a profit equal to a 10% rate of return on invested assets of $1,285,000.

Correct Answer

verified

Correct Answer

verified

True/False

The product cost concept includes all manufacturing costs in the cost amount to which the markup is added to determine product price.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 102

Related Exams