A) $44,000 decrease

B) $44,000 increase

C) $64,000 increase

D) $64,000 decrease

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

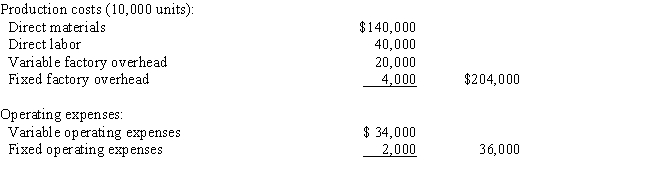

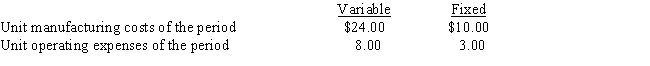

A business operated at 100% of capacity during its first month and incurred the following costs:

If 2,000 units remain unsold at the end of the month and sales total $300,000 for the month,what is the amount of the manufacturing margin that would be reported on the variable costing income statement?

If 2,000 units remain unsold at the end of the month and sales total $300,000 for the month,what is the amount of the manufacturing margin that would be reported on the variable costing income statement?

A) $104,000

B) $106,000

C) $140,000

D) not reported

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under absorption costing,which of the following costs would not be included in finished goods inventory?

A) direct labor cost

B) direct materials cost

C) variable and fixed factory overhead cost

D) variable and fixed selling and administrative expenses

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If variable cost of goods sold totaled $90,000 for the year (18,000 units at $5.00 each) and the planned variable cost of goods sold totaled $86,400 (16,000 units at $5.40 each) ,the effect of the unit cost factor on the change in contribution margin is:

A) $6,400 decrease

B) $6,400 increase

C) $7,200 increase

D) $7,200 decrease

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

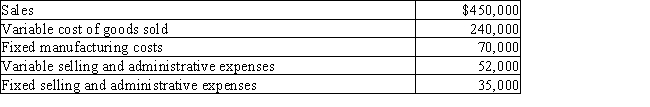

Philadelphia Company has the following information for March:

Determine the March (a)manufacturing margin,(b)contribution margin,and (c)income from operations for Philadelphia Company.

Determine the March (a)manufacturing margin,(b)contribution margin,and (c)income from operations for Philadelphia Company.

Correct Answer

verified

Correct Answer

verified

True/False

The contribution margin and the manufacturing margin are usually equal.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In evaluating the performance of salespersons,the salesperson with the highest level of sales should be evaluated as the best performer.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be included in the cost of a product manufactured according to variable costing?

A) sales commissions

B) office supply costs

C) interest expense

D) direct materials

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not be an appropriate activity base for cost analysis in a service firm?

A) lawns mowed

B) inventory produced

C) customers served

D) haircuts given

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

In the absorption costing income statement,deduction of the cost of goods sold from sales yields gross profit.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the variable costing income statement,deduction of variable selling and administrative expenses from manufacturing margin yields:

A) differential margin

B) contribution margin

C) gross profit

D) marginal expenses

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

On the variable costing income statement,variable costs are deducted from contribution margin to yield manufacturing margin.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

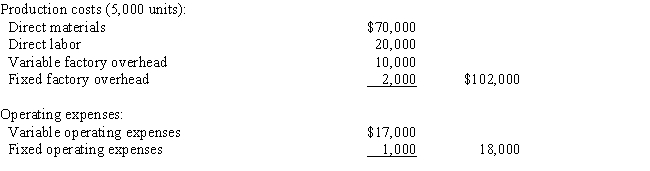

A business operated at 100% of capacity during its first month and incurred the following costs:

If 1,000 units remain unsold at the end of the month and sales total $150,000 for the month,what would be the amount of income from operations reported on the absorption costing income statement?

If 1,000 units remain unsold at the end of the month and sales total $150,000 for the month,what would be the amount of income from operations reported on the absorption costing income statement?

A) $50,400

B) $70,000

C) $52,000

D) $68,400

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In contribution margin analysis,the effect of a difference in the number of units sold,assuming no change in unit sales price or cost,is termed the quantity factor.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

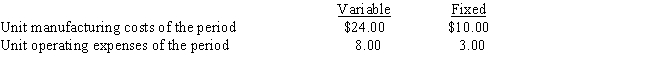

The level of inventory of a manufactured product has increased by 8,000 units during a period.The following data are also available:

What would be the effect on income from operations if variable costing is used rather than absorption costing?

What would be the effect on income from operations if variable costing is used rather than absorption costing?

A) $80,000 decrease

B) $80,000 increase

C) $104,000 decrease

D) $104,000 increase

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

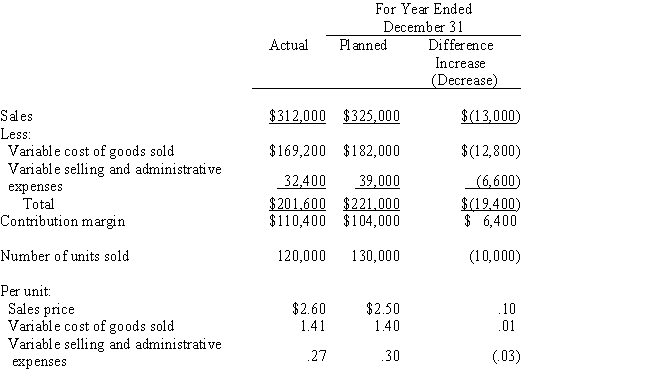

Based upon the following data taken from the records of Bruce Inc.,prepare a contribution margin analysis report for the year ended December 31.

Correct Answer

verified

Correct Answer

verified

Essay

Fixed costs are $10 per unit and variable costs are $25 per unit.Production was 13,000 units,while sales were 12,000 units.Determine (a)whether variable costing income from operations is less than or greater than absorption costing income from operations,and (b)the difference in variable costing and absorption costing income from operations.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The level of inventory of a manufactured product has increased by 5,000 units during a period.The following data are also available:

What would be the effect on income from operations if variable costing is used rather than absorption costing?

What would be the effect on income from operations if variable costing is used rather than absorption costing?

A) $50,000 decrease

B) $50,000 increase

C) $65,000 increase

D) $65,000 decrease

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

For a period during which the quantity of inventory at the end was larger than that at the beginning,income from operations reported under variable costing will be smaller than income from operations reported under absorption costing.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The absorption costing income statement does not distinguish between variable and fixed costs.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 151

Related Exams