Filters

Question type

A) 5 years

B) 4 years

C) 6 years

D) 3 years

E) C) and D)

F) None of the above

F) None of the above

Correct Answer

verified

Correct Answer

verified

Question 102

Essay

Determine the average rate of return for a project that is estimated to yield total income of $600,000 over 4 years,cost $840,000,and has an $80,000 residual value.Round percentage answers to one decimal place.

Correct Answer

verified

Correct Answer

verified

Question 103

Multiple Choice

Using the tables above,what is the present value of $3,000 (rounded to the nearest dollar) to be received at the end of each of the next 4 years,assuming an earnings rate of 12%?

A) $10,815

B) $7,206

C) $9,111

D) $1,908

E) C) and D)

F) All of the above

F) All of the above

Correct Answer

verified

Correct Answer

verified

Question 104

Essay

Sunrise Inc.is considering a capital investment proposal that costs $227,500 and has an estimated life of 4 years and no residual value.The estimated net cash flows are as follows:

The minimum desired rate of return for net present value analysis is 10%.The present value of $1 at compound interest rates of 10% for 1,2,3,and 4 years is 0.909,0.826,0.751,and 0.683,respectively.Determine the net present value.Round interim answers to the nearest dollar.

The minimum desired rate of return for net present value analysis is 10%.The present value of $1 at compound interest rates of 10% for 1,2,3,and 4 years is 0.909,0.826,0.751,and 0.683,respectively.Determine the net present value.Round interim answers to the nearest dollar.

Correct Answer

verified

Correct Answer

verified

Question 105

Multiple Choice

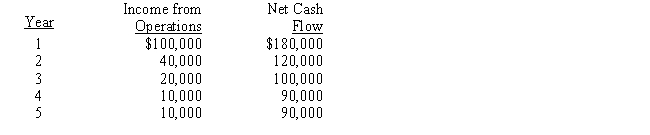

The management of Zesty Corporation is considering the purchase of a new machine costing $400,000.The company's desired rate of return is 10%.The present value factors for $1 at compound interest of 10% for Years 1 through 5 are 0.909,0.826,0.751,0.683,and 0.621,respectively.In addition to the foregoing information,use the following data in determining the acceptability in this situation:

The cash payback period for this investment is

The cash payback period for this investment is

A) 5 years

B) 4 years

C) 2 years

D) 3 years

E) A) and B)

F) All of the above

F) All of the above

Correct Answer

verified

Correct Answer

verified

Question 106

Multiple Choice

All of the following qualitative considerations may impact upon capital investment analysis except

A) manufacturing productivity

B) manufacturing sunk cost

C) manufacturing flexibility

D) market opportunities

E) None of the above

F) B) and C)

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 181 - 186 of 186

Related Exams