A) 28 days

B) 32 days

C) 35 days

D) 39 days

E) 43 days

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The average accounts receivable balance is a function of both the volume of credit sales and the days sales outstanding.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Albrecht Inc. is a no-growth firm whose sales fluctuate seasonally, causing total assets to vary from $320,000 to $410,000, but fixed assets remain constant at $260,000. If the firm follows a maturity matching (or moderate) working capital financing policy, what is the most likely total of long-term debt plus equity capital?

A) $260,642

B) $274,360

C) $288,800

D) $304,000

E) $320,000

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Changes in a firm's collection policy can affect sales, working capital, and profits.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hardwig Inc. Hardwig Inc. is considering whether to pursue a restricted or relaxed current asset investment policy. The firm's annual sales are expected to total $3,600,000, its fixed assets turnover ratio equals 4.0, and its debt and common equity are each 50% of total assets. EBIT is $150,000, the interest rate on the firm's debt is 10%, and the tax rate is 40%. If the company follows a restricted policy, its total assets turnover will be 2.5. Under a relaxed policy its total assets turnover will be 2.2. -Refer to the data for Hardwig, Inc.Assume now that the company believes that if it adopts a restricted policy, its sales will fall by 15% and EBIT will fall by 10%, but its total assets turnover, debt ratio, interest rate, and tax rate will all remain the same. In this situation, what's the difference between the projected ROEs under the restricted and relaxed policies?

A) 2.24%

B) 2.46%

C) 2.70%

D) 2.98%

E) 3.27%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If a firm has set up a revolving credit agreement with a bank, the risk to the firm of being unable to obtain funds when needed is lower than if it had an informal line of credit.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If one of your firm's customers is "stretching" its accounts payable, this may be a nuisance but it does not represent a real financial cost to your firm as long as the customer periodically pays off its entire balance.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following actions would be likely to shorten the cash conversion cycle?

A) Change the credit terms offered to customers from 3/10 net 30 to 1/10 net 50.

B) Begin to take cash discounts on inventory purchases; the terms are 2/10 net 30.

C) Adopt a new manufacturing process that saves some labor costs but slows down the conversion of raw materials to finished goods from 10 days to 20 days.

D) Change the credit terms offered to customers from 2/10 net 30 to 1/10 net 60.

E) Adopt a new manufacturing process that speeds up the conversion of raw materials to finished goods from 20 days to 10 days.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Short-term marketable securities are held for two separate and distinct purposes: (1) to provide liquidity as a substitute for cash and (2) as a non-operating investment. Marketable securities held while awaiting reinvestment are not available for liquidity purposes.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Short-term financing is riskier than long-term financing since, during periods of tight credit, the firm may not be able to rollover (renew) its debt. This is especially true if the funds are used to finance long-term assets rather than short-term assets.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Accruals are "spontaneous," but unfortunately, due to law and economic forces, firms have little control over the level of these accounts.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Loans from commercial banks generally appear on balance sheets as notes payable. A bank's importance is actually greater than it appears from the dollar amounts shown on balance sheets because banks provide nonspontaneous funds to firms.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Setting up a lockbox arrangement is one way for a firm to speed up the collection of payments from its customers.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A conservative current operating asset financing approach will result in permanent current assets and some seasonal current assets being financed using long-term securities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The facts (1) that no explicit interest is paid on accruals and (2) that the firm can control the level of these accounts at will makes them an attractive source of funding to meet working capital needs.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Since depreciation is a non-cash charge, it neither appears on nor has any effect on the cash budget. Thus, if the depreciation charge for the coming year doubled or halved, this would have no effect on the cash budget.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

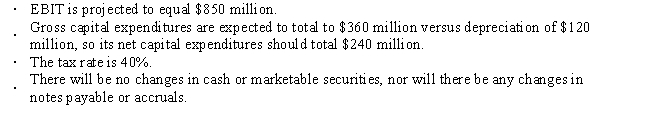

During the coming year, Gold & Gold wants to increase its free cash flow by $180 million, which should result in a higher stock price. The CFO has made these projections for the upcoming year: What increase in net working capital (in millions of dollars) would enable the firm to meet its target increase in FCF?

A) $72

B) $90

C) $108

D) $130

E) $156

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT a situation that might lead a firm to increase its holdings of short-term marketable securities?

A) The firm is going from its peak sales season to its slack season, so its receivables and inventories will experience a seasonal decline.

B) The firm is going from its slack season to its peak sales season, so its receivables and inventories will experience seasonal increases.

C) The firm has just sold long-term securities and has not yet invested the proceeds in operating assets.

D) The firm just won a product liability suit one of its customers had brought against it.

E) The firm must make a known future payment, such as paying for a new plant that is under construction.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 121 - 138 of 138

Related Exams