A) 6.20

B) 6.53

C) 6.86

D) 7.20

E) 7.56

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things held constant, which of the following alternatives would increase a company's cash flow for the current year?

A) Increase the number of years over which fixed assets are depreciated for tax purposes.

B) Pay down the accounts payables.

C) Reduce the days' sales outstanding (DSO) without affecting sales or operating costs.

D) Pay workers more frequently to decrease the accrued wages balance.

E) Reduce the inventory turnover ratio without affecting sales or operating costs.

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The current ratio and inventory turnover ratios both help us measure the firm's liquidity. The current ratio measures the relationship of a firm's current assets to its current liabilities, while the inventory turnover ratio gives us an indication of how long it takes the firm to convert its inventory into cash.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If a firm has the highest price/earnings ratio of any firm in its industry, then, other things held constant, this suggests that the board of directors should fire the president.

B) If a firm has the highest market/book ratio of any firm in its industry, then, other things held constant, this suggests that the board of directors should fire the president.

C) Other things held constant, the higher a firm's expected future growth rate, the lower its P/E ratio is likely to be.

D) The higher the market/book ratio, then, other things held constant, the higher one would expect to find the Market Value Added (MVA) .

E) If a firm has a history of high Economic Value Added (EVA) numbers each year, and if investors expect this situation to continue, then its market/book ratio and MVA are both likely to be below average.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

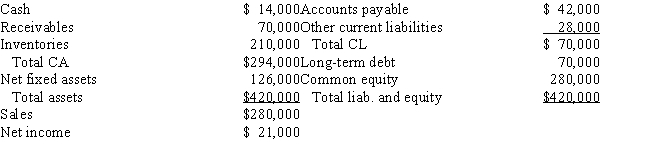

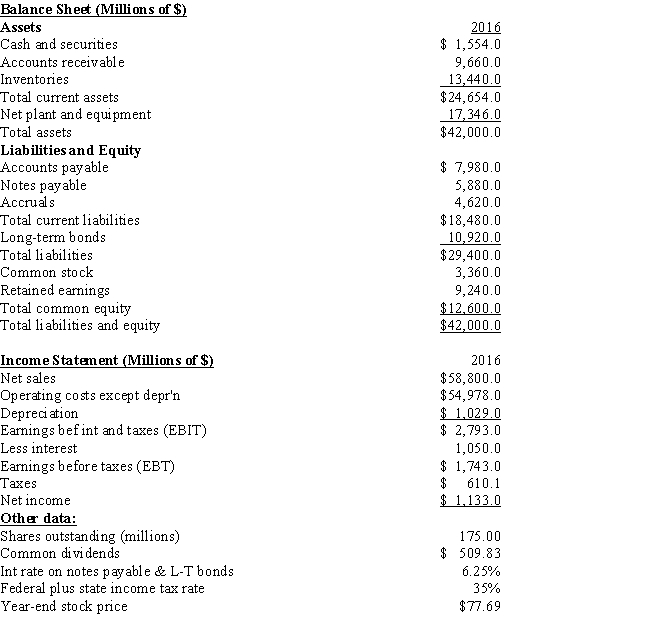

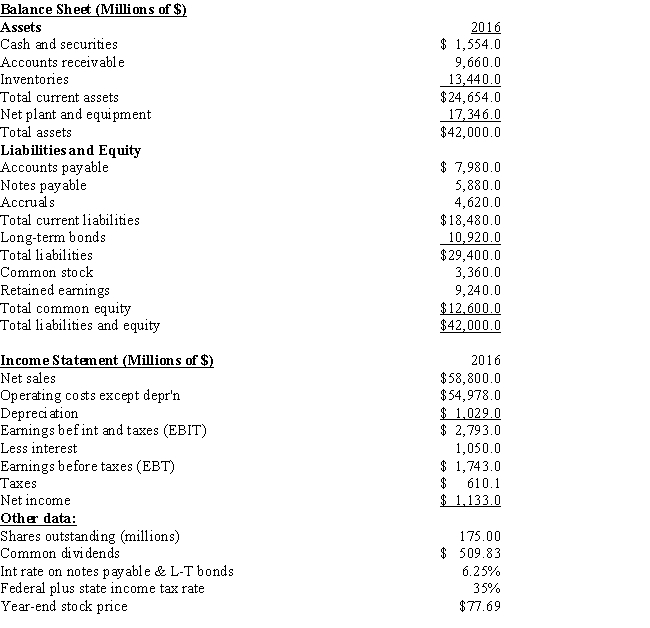

Muscarella Inc. has the following balance sheet and income statement data: The new CFO thinks that inventories are excessive and could be lowered sufficiently to cause the current ratio to equal the industry average, 2.70, without affecting either sales or net income. Assuming that inventories are sold off and not replaced to get the current ratio to the target level, and that the funds generated are used to buy back common stock at book value, by how much would the ROE change?

A) 4.28%

B) 4.50%

C) 4.73%

D) 4.96%

E) 5.21%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

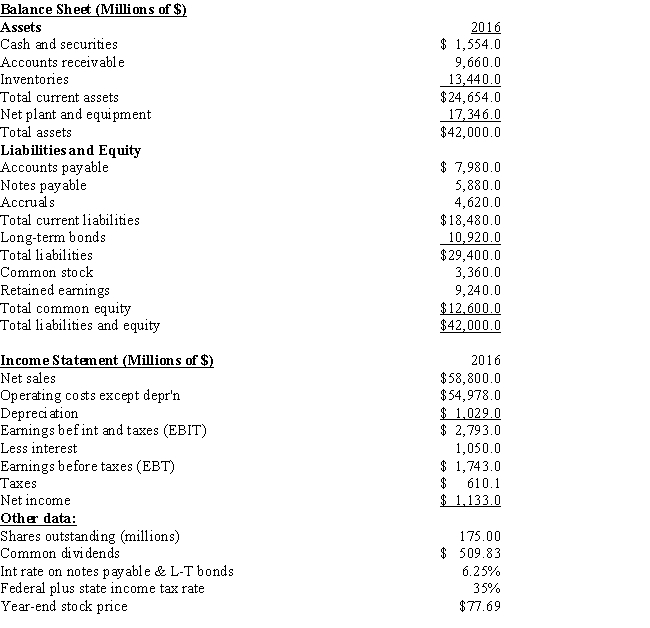

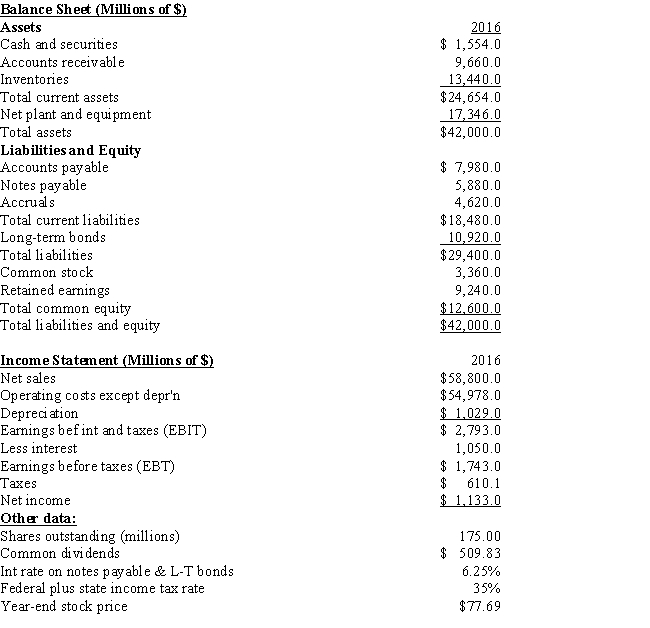

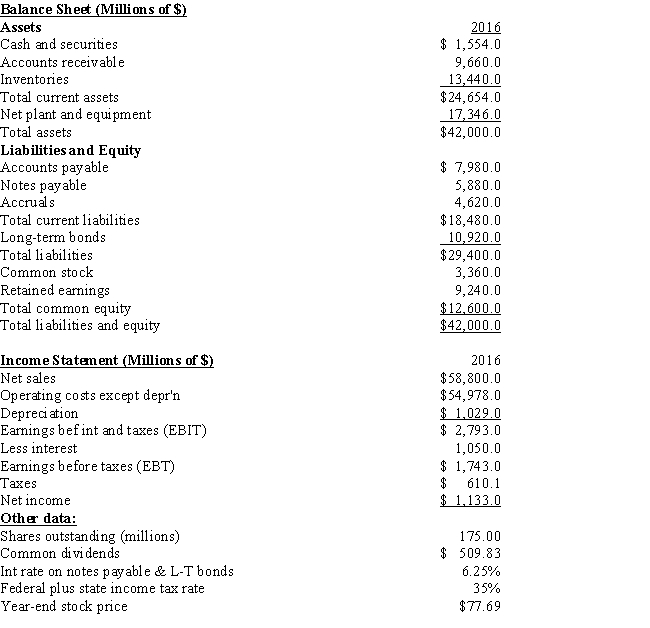

Pettijohn Inc.

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to the data for Pettijohn Inc. What is the firm's ROA?

-Refer to the data for Pettijohn Inc. What is the firm's ROA?

A) 2.70%

B) 2.97%

C) 3.26%

D) 3.59%

E) 3.95%

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pettijohn Inc.

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to the data for Pettijohn Inc. What is the firm's market-to-book ratio?

-Refer to the data for Pettijohn Inc. What is the firm's market-to-book ratio?

A) 0.56

B) 0.66

C) 0.78

D) 0.92

E) 1.08

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Ratio analysis involves analyzing financial statements in order to appraise a firm's financial position and strength.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Orono Corp.'s sales last year were $435,000, its operating costs were $362,500, and its interest charges were $12,500. What was the firm's times interest earned (TIE) ratio?

A) 4.72

B) 4.97

C) 5.23

D) 5.51

E) 5.80

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If a firm increases its sales and cost of goods sold while holding its inventories constant, then, other things held constant, its inventory turnover ratio will decrease.

B) A reduction in inventories held would have no effect on the current ratio.

C) An increase in inventories would have no effect on the current ratio.

D) If a firm increases its sales and cost of goods sold while holding its inventories constant, then, other things held constant, its inventory turnover ratio will increase.

E) A reduction in the inventory turnover ratio will generally lead to an increase in the ROE.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pettijohn Inc.

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to the data for Pettijohn Inc. What is the firm's quick ratio?

-Refer to the data for Pettijohn Inc. What is the firm's quick ratio?

A) 0.49

B) 0.61

C) 0.73

D) 0.87

E) 1.05

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a bank loan officer were considering a company's request for a loan, which of the following statements would you consider to be CORRECT?

A) Other things held constant, the lower the current ratio, the lower the interest rate the bank would charge the firm.

B) The lower the company's EBITDA coverage ratio, other things held constant, the lower the interest rate the bank would charge the firm.

C) Other things held constant, the higher the debt ratio, the lower the interest rate the bank would charge the firm.

D) Other things held constant, the lower the debt ratio, the lower the interest rate the bank would charge the firm.

E) The lower the company's TIE ratio, other things held constant, the lower the interest rate the bank would charge the firm.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pettijohn Inc.

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to the data for Pettijohn Inc. What is the firm's EBITDA coverage?

-Refer to the data for Pettijohn Inc. What is the firm's EBITDA coverage?

A) 3.29

B) 3.46

C) 3.64

D) 3.82

E) 4.01

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) "Window dressing" is any action that improves a firm's fundamental, long-run position and thus increases its intrinsic value.

B) Borrowing by using short-term notes payable and then using the proceeds to retire long-term debt is an example of "window dressing." Offering discounts to customers who pay with cash rather than buy on credit and then using the funds that come in quicker to purchase additional inventories is another example of "window dressing."

C) Borrowing on a long-term basis and using the proceeds to retire short-term debt would improve the current ratio and thus could be considered to be an example of "window dressing."

D) Offering discounts to customers who pay with cash rather than buy on credit and then using the funds that come in quicker to purchase additional inventories is an example of "window dressing."

E) Using some of the firm's cash to reduce long-term debt is an example of "window dressing."

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pettijohn Inc.

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to the data for Pettijohn Inc. What is the firm's ROE?

-Refer to the data for Pettijohn Inc. What is the firm's ROE?

A) 8.54%

B) 8.99%

C) 9.44%

D) 9.91%

E) 10.41%

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investor is considering starting a new business. The company would require $475,000 of assets, and it would be financed entirely with common stock. The investor will go forward only if she thinks the firm can provide a 13.5% return on the invested capital, which means that the firm must have an ROE of 13.5%. How much net income must be expected to warrant starting the business?

A) $52,230

B) $54,979

C) $57,873

D) $60,919

E) $64,125

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year Mason Inc. had a total assets turnover of 1.33 and an equity multiplier of 1.75. Its sales were $195,000 and its net income was $10,549. The CFO believes that the company could have operated more efficiently, lowered its costs, and increased its net income by $5,250 without changing its sales, assets, or capital structure. Had it cut costs and increased its net income in this amount, by how much would the ROE have changed?

A) 5.66%

B) 5.95%

C) 6.27%

D) 6.58%

E) 6.91%

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nikko Corp.'s total common equity at the end of last year was $305,000 and its net income after taxes was $60,000. What was its ROE?

A) 16.87%

B) 17.75%

C) 18.69%

D) 19.67%

E) 20.66%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ziebart Corp.'s EBITDA last year was $390,000 ( = EBIT + depreciation + amortization) , its interest charges were $9,500, it had to repay $26,000 of long-term debt, and it had to make a payment of $17,400 under a long-term lease. The firm had no amortization charges. What was the EBITDA coverage ratio?

A) 7.32

B) 7.70

C) 8.09

D) 8.49

E) 8.92

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year Altman Corp. had $205,000 of assets, $303,500 of sales, $18,250 of net income, and a debt-to-total-assets ratio of 41%. The new CFO believes the firm has excessive fixed assets and inventory that could be sold, enabling it to reduce its total assets to $152,500. Sales, costs, and net income would not be affected, and the firm would maintain the 41% debt ratio. By how much would the reduction in assets improve the ROE?

A) 4.69%

B) 4.93%

C) 5.19%

D) 5.45%

E) 5.73%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 104

Related Exams