B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If a stock has a required rate of return rs = 12% and its dividend is expected to grow at a constant rate of 5%, this implies that the stock's dividend yield is also 5%.

B) The stock valuation model, P0 = D1/(rs − g) , can be used to value firms whose dividends are expected to decline at a constant rate, i.e., to grow at a negative rate.

C) The price of a stock is the present value of all expected future dividends, discounted at the dividend growth rate.

D) The constant growth model cannot be used for a zero growth stock, where the dividend is expected to remain constant over time.

E) The constant growth model is often appropriate for evaluating start-up companies that do not have a stable history of growth but are expected to reach stable growth within the next few years.

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

From an investor's perspective, a firm's preferred stock is generally considered to be less risky than its common stock but more risky than its bonds. However, from a corporate issuer's standpoint, these risk relationships are reversed: Bonds are the most risky for the firm, preferred is next, and common is least risky.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

McGaha Enterprises expects earnings and dividends to grow at a rate of 25% for the next 4 years, after the growth rate in earnings and dividends will fall to zero, i.e., g = 0. The company's last dividend, D0, was $1.25, its beta is 1.20, the market risk premium is 5.50%, and the risk-free rate is 3.00%. What is the current price of the common stock?

A) $26.77

B) $27.89

C) $29.05

D) $30.21

E) $31.42

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If D1 = $1.50, g (which is constant) = 6.5%, and P0 = $56, what is the stock's expected capital gains yield for the coming year?

A) 6.50%

B) 6.83%

C) 7.17%

D) 7.52%

E) 7.90%

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

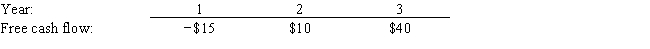

Heath and Logan Inc. forecasts the free cash flows (in millions) shown below. The weighted average cost of capital is 13%, and the FCFs are expected to continue growing at a 5% rate after Year 3. Assuming that the ROIC is expected to remain constant in Year 3 and beyond, what is the Year 0 value of operations, in millions?

A) $315

B) $331

C) $348

D) $367

E) $386

G) A) and E)

Correct Answer

verified

E

Correct Answer

verified

Multiple Choice

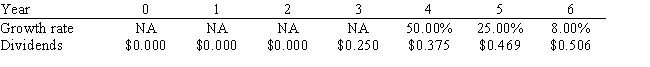

Sawchuck Consulting has been profitable for the last 5 years, but it has never paid a dividend. Management has indicated that it plans to pay a $0.25 dividend 3 years from today, then to increase it at a relatively rapid rate for 2 years, and then to increase it at a constant rate of 8.00% thereafter. Management's forecast of the future dividend stream, along with the forecasted growth rates, is shown below. Assuming a required return of 11.00%, what is your estimate of the stock's current value?

A) $9.94

B) $10.19

C) $10.45

D) $10.72

E) $10.99

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A share of Lash Inc.'s common stock just paid a dividend of $1.00. If the expected long-run growth rate for this stock is 5.4%, and if investors' required rate of return is 11.4%, what is the stock price?

A) $16.28

B) $16.70

C) $17.13

D) $17.57

E) $18.01

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

National Advertising just paid a dividend of D0 = $0.75 per share, and that dividend is expected to grow at a constant rate of 6.50% per year in the future. The company's beta is 1.25, the required return on the market is 10.50%, and the risk-free rate is 4.50%. What is the company's current stock price?

A) $14.52

B) $14.89

C) $15.26

D) $15.64

E) $16.03

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

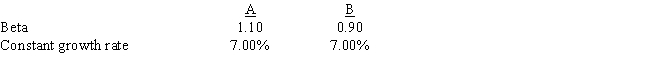

Stocks A and B have the following data. The market risk premium is 6.0% and the risk-free rate is 6.4%. Assuming the stock market is efficient and the stocks are in equilibrium, which of the following statements is CORRECT?

A) Stock A must have a higher dividend yield than Stock B.

B) Stock B's dividend yield equals its expected dividend growth rate.

C) Stock B must have the higher required return.

D) Stock B could have the higher expected return.

E) Stock A must have a higher stock price than Stock B.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Preferred stock is a hybrid⎯a sort of cross between a common stock and a bond⎯in the sense that it pays dividends that normally increase annually like a stock but its payments are contractually guaranteed like interest on a bond.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Franklin Corporation is expected to pay a dividend of $1.25 per share at the end of the year (D1 = $1.25) . The stock sells for $32.50 per share, and its required rate of return is 10.5%. The dividend is expected to grow at some constant rate, g, forever. What is the equilibrium expected growth rate?

A) 6.01%

B) 6.17%

C) 6.33%

D) 6.49%

E) 6.65%

G) A) and D)

Correct Answer

verified

E

Correct Answer

verified

Multiple Choice

If a stock's dividend is expected to grow at a constant rate of 5% a year, which of the following statements is CORRECT? The stock is in equilibrium.

A) The stock's dividend yield is 5%.

B) The price of the stock is expected to decline in the future.

C) The stock's required return must be equal to or less than 5%.

D) The stock's price one year from now is expected to be 5% above the current price.

E) The expected return on the stock is 5% a year.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The expected total return on a share of stock refers to the dividend yield less any commissions paid when the stock is purchased and sold.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

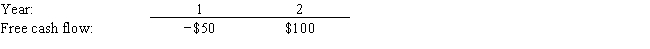

The free cash flows (in millions) shown below are forecast by Parker & Sons. If the weighted average cost of capital is 11% and FCF is expected to grow at a rate of 5% after Year 2, what is the Year 0 value of operations, in millions? Assume that the ROIC is expected to remain constant in Year 2 and beyond (and do not make any half-year adjustments) .

A) $1,456

B) $1,529

C) $1,606

D) $1,686

E) $1,770

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hirshfeld Corporation's stock has a required rate of return of 10.25%, and it sells for $57.50 per share. The dividend is expected to grow at a constant rate of 6.00% per year. What is the expected year-end dividend, D1?

A) $2.20

B) $2.44

C) $2.69

D) $2.96

E) $3.25

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The last dividend paid by Coppard Inc. was $1.25. The dividend growth rate is expected to be constant at 15% for 3 years, after which dividends are expected to grow at a rate of 6% forever. If the firm's required return (rs) is 11%, what is its current stock price?

A) $30.57

B) $31.52

C) $32.49

D) $33.50

E) $34.50

G) C) and D)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

If D1 = $1.25, g (which is constant) = 4.7%, and P0 = $26.00, what is the stock's expected dividend yield for the coming year?

A) 4.12%

B) 4.34%

C) 4.57%

D) 4.81%

E) 5.05%

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Projected free cash flows should be discounted at the firm's weighted average cost of capital to find the value of its operations.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Classified stock differentiates various classes of common stock, and using it is one way companies can meet special needs such as when owners of a start-up firm need additional equity capital but don't want to relinquish voting control.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 91

Related Exams