Correct Answer

verified

Correct Answer

verified

Multiple Choice

Treasury stock that was purchased for $3,000 is sold for $3,500. As a result of these two transactions combined

A) income will be increased by $500

B) stockholders' equity will be increased by $3,500

C) stockholders' equity will be increased by $500

D) stockholders' equity will not change

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One of the main disadvantages of the corporate form is the

A) inability to raise large amounts of capital

B) double taxation of dividends

C) charter

D) requirement to stock

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The excess of sales price of treasury stock over its cost should be credited to

A) Treasury Stock Receivable

B) Premium on Capital Stock

C) Paid-In Capital from Sale of Treasury Stock

D) Income from Sale of Treasury Stock

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Under the cost method, when treasury stock is purchased by the corporation, the par value and the price at which the stock was originally issued are important.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The par value per share of common stock represents the

A) minimum selling price of the stock established by the articles of incorporation

B) minimum amount the stockholder will receive when the corporation is liquidated

C) dollar amount assigned to each share

D) amount of dividends per share to be received each year

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sabas Company has 20,000 shares of $100 par, 2% cumulative preferred stock and 100,000 shares of $50 par common stock. The following amounts were distributed as dividends: Determine the dividends per share for preferred and common stock for the second year.

A) $2.25 and $0.00

B) $2.25 and $0.45

C) $0.00 and $0.45

D) $2.00 and $0.45

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The number of shares of outstanding stock is equal to the number of shares authorized minus the number of shares issued.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kansas Company acquired a building valued at $210,000 for property tax purposes in exchange for 12,000 shares of its $5 par common stock. The stock is widely traded and sold for $15 per share. At what amount should the building be recorded by Kansas Company?

A) $60,000

B) $180,000

C) $210,000

D) $120,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following are normally found in a corporation's stockholders' equity section except

A) Common Stock

B) Excess of Issue Price Over Par

C) Dividends in Arrears

D) Retained Earnings

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would appear as a prior period adjustment?

A) loss resulting from the sale of fixed assets

B) difference between the actual and estimated uncollectible accounts receivable

C) error in the computation of depreciation expense in the preceding year

D) loss from the restructuring of assets

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

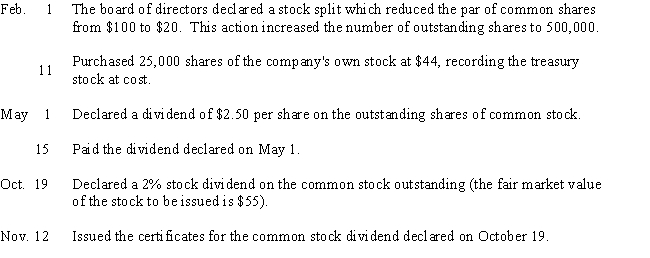

Prepare entries to record the following selected transactions completed during the current fiscal year:

Correct Answer

verified

Correct Answer

verified

True/False

Paid-in capital may originate from real estate transactions.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The issuance of common stock affects both paid-in capital and retained earnings.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 181 - 194 of 194

Related Exams