A) For mutually exclusive projects with normal cash flows,the NPV and MIRR methods can never conflict,but their results could conflict with the discounted payback and the regular IRR methods.

B) Multiple IRRs can exist,but not multiple MIRRs.This is one reason some people favor the MIRR over the regular IRR.

C) If a firm uses the discounted payback method with a required payback of 4 years,then it will accept more projects than if it used a regular payback of 4 years.

D) The percentage difference between the MIRR and the IRR is equal to the project's cost of capital.

E) The NPV,IRR,MIRR,and discounted payback (using a payback requirement of 3 years or less) methods always lead to the same accept/reject decisions for independent projects.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lancaster Corp.is considering two equally risky,mutually exclusive projects,both of which have normal cash flows.Project A has an IRR of 11%,while Project B's IRR is 14%.When the cost of capital is 8%,the projects have the same NPV.Given this information,which of the following statements is CORRECT?

A) If the cost of capital is 9%,Project A's NPV will be higher than Project B's.

B) If the cost of capital is 6%,Project B's NPV will be higher than Project A's.

C) If the cost of capital is greater than 14%,Project A's IRR will exceed Project B's.

D) If the cost of capital is 9%,Project B's NPV will be higher than Project A's.

E) If the cost of capital is 13%,Project A's NPV will be higher than Project B's.

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Because "present value" refers to the value of cash flows that occur at different points in time,a series of present values of cash flows should not be summed to determine the value of a capital budgeting project.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A project's IRR is independent of the firm's cost of capital.In other words,a project's IRR doesn't change with a change in the firm's cost of capital.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In theory,capital budgeting decisions should depend solely on forecasted cash flows and the opportunity cost of capital.The decision criterion should not be affected by managers' tastes,choice of accounting method,or the profitability of other independent projects.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suzanne's Cleaners is considering a project that has the following cash flow data.What is the project's payback? Year 0 1 2 3 4 5 Cash flows −$1,100 $300 $310 $320 $330 $340

A) 2.31 years

B) 2.56 years

C) 2.85 years

D) 3.16 years

E) 3.52 years

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Assuming that their NPVs based on the firm's cost of capital are equal,the NPV of a project whose cash flows accrue relatively rapidly will be more sensitive to changes in the discount rate than the NPV of a project whose cash flows come in later in its life.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

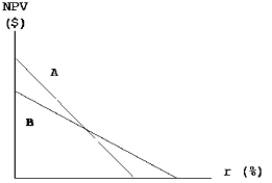

Projects A and B have identical expected lives and identical initial cash outflows (costs) .However,most of one project's cash flows come in the early years,while most of the other project's cash flows occur in the later years.The two NPV profiles are given below:  Which of the following statements is CORRECT?

Which of the following statements is CORRECT?

A) More of Project B's cash flows occur in the later years.

B) We must have information on the cost of capital in order to determine which project has the larger early cash flows.

C) The NPV profile graph is inconsistent with the statement made in the problem.

D) The crossover rate,i.e. ,the rate at which Projects A and B have the same NPV,is greater than either project's IRR.

E) More of Project A's cash flows occur in the later years.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

If the IRR of normal Project X is greater than the IRR of mutually exclusive (and also normal)Project Y,we can conclude that the firm should always select X rather than Y if X has NPV > 0.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The NPV and IRR methods,when used to evaluate two equally risky but mutually exclusive projects,will lead to different accept/reject decisions and thus capital budgets if the cost of capital at which the projects' NPV profiles cross is less than the projects' cost of capital.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are considering two mutually exclusive,equally risky,projects.Both have IRRs that exceed the cost of capital.Which of the following statements is CORRECT? Assume that the projects have normal cash flows,with one outflow followed by a series of inflows.

A) If the cost of capital is greater than the crossover rate,then the IRR and the NPV criteria will not result in a conflict between the projects.The same project will rank higher by both criteria.

B) If the cost of capital is less than the crossover rate,then the IRR and the NPV criteria will not result in a conflict between the projects.The same project will rank higher by both criteria.

C) For a conflict to exist between NPV and IRR,the initial investment cost of one project must exceed the cost of the other.

D) For a conflict to exist between NPV and IRR,one project must have an increasing stream of cash flows over time while the other has a decreasing stream.If both sets of cash flows are increasing or decreasing,then it would be impossible for a conflict to exist,even if one project is larger than the other.

E) If the two projects' NPV profiles do not cross,then there will be a sharp conflict as to which one should be selected.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

McGlothin Inc.is considering a project that has the following cash flow data.What is the project's payback? Year 0 1 2 3 Cash flows −$1,150 $500 $500 $500

A) 1.86 years

B) 2.07 years

C) 2.30 years

D) 2.53 years

E) 2.78 years

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If the cost of capital declines,this lowers a project's NPV.

B) The NPV method is regarded by most academics as being the best indicator of a project's profitability;hence,most academics recommend that firms use only this one method.

C) A project's NPV depends on the total amount of cash flows the project produces,but because the cash flows are discounted at the cost of capital,it does not matter if the cash flows occur early or late in the project's life.

D) The NPV and IRR methods may give different recommendations regarding which of two mutually exclusive projects should be accepted,but they always give the same recommendation regarding the acceptability of a normal,independent project.

E) The NPV method was once the favorite of academics and business executives,but today most authorities regard the MIRR as being the best indicator of a project's profitability.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Under certain conditions,a project may have more than one IRR.One such condition is when,in addition to the initial investment at time = 0,a negative cash flow (or cost)occurs at the end of the project's life.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The primary reason that the NPV method is conceptually superior to the IRR method for evaluating mutually exclusive investments is that multiple IRRs may exist,and when that happens,we don't know which IRR is relevant.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) One defect of the IRR method versus the NPV is that the IRR does not take account of the time value of money.

B) One defect of the IRR method versus the NPV is that the IRR does not take account of the cost of capital.

C) One defect of the IRR method versus the NPV is that the IRR values a dollar received today the same as a dollar that will not be received until sometime in the future.

D) One defect of the IRR method versus the NPV is that the IRR does not take proper account of differences in the sizes of projects.

E) One defect of the IRR method versus the NPV is that the IRR does not take account of cash flows over a project's full life.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Martin Manufacturing is considering two normal,equally risky,mutually exclusive,but not repeatable projects.Martin's cost of capital is 10%.The two projects have the same investment costs,but Project A has an IRR of 15%,while Project B has an IRR of 20%.Assuming the projects' NPV profiles cross in the upper right quadrant,which of the following statements is CORRECT?

A) Since the projects are mutually exclusive,the firm should always select Project B.

B) If the crossover rate is 8%,Project B will have the higher NPV.

C) Only one project has a positive NPV.

D) If the crossover rate is 8%,Project A will have the higher NPV.

E) Each project must have a negative NPV.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The IRR method can never be subject to the multiple IRR problem,while the MIRR method can be.

B) One reason some people prefer the MIRR to the regular IRR is that the MIRR is based on a generally more reasonable reinvestment rate assumption.

C) The higher the cost of capital,the shorter the discounted payback period.

D) The MIRR method assumes that cash flows are reinvested at the crossover rate.

E) The MIRR and NPV decision criteria can never conflict.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is NOT a disadvantage of the regular payback method?

A) Ignores cash flows beyond the payback period.

B) Does not directly account for the time value of money.

C) Does not provide any indication regarding a project's liquidity or risk.

D) Does not take account of differences in size among projects.

E) Lacks an objective,market-determined benchmark for making decisions.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

An increase in the firm's cost of capital will decrease projects' NPVs,which could change the accept/reject decision for any potential project.However,such a change would have no impact on projects' IRRs.Therefore,the accept/reject decision under the IRR method is independent of the cost of capital.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 80

Related Exams