A) $1,819

B) $1,915

C) $2,016

D) $2,117

E) $2,223

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a Google.com bond will pay $4,500 ten years from now.If the going interest rate on safe 10-year bonds is 4.25%,how much is the bond worth today?

A) $2,819.52

B) $2,967.92

C) $3,116.31

D) $3,272.13

E) $3,435.74

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If CF0 is positive and all the other CFs are negative,then you can still solve for I.

B) If you have a series of cash flows,each of which is positive,you can solve for I,where the solution value of I causes the PV of the cash flows to equal the cash flow at Time 0.

C) If you have a series of cash flows,and CF0 is negative but each of the following CFs is positive,you can solve for I,but only if the sum of the undiscounted cash flows exceeds the cost.

D) To solve for I,one must identify the value of I that causes the PV of the positive CFs to equal the absolute value of the FV of the negative CFs.It is impossible to find the value of I without a computer or financial calculator.

E) If you solve for I and get a negative number,then you must have made a mistake.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A salt mine you inherited will pay you $25,000 per year for 25 years,with the first payment being made today.If you think a fair return on the mine is 7.5%,how much should you ask for it if you decide to sell it?

A) $284,595

B) $299,574

C) $314,553

D) $330,281

E) $346,795

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT,assuming positive interest rates and holding other things constant?

A) Banks A and B offer the same nominal annual rate of interest,but A pays interest quarterly and B pays semiannually.Deposits in Bank B will provide the higher future value if you leave your funds on deposit.

B) The present value of a 5-year,$250 annuity due will be lower than the PV of a similar ordinary annuity.

C) A 30-year,$150,000 amortized mortgage will have larger monthly payments than an otherwise similar 20-year mortgage.

D) A bank loan's nominal interest rate will always be equal to or less than its effective annual rate.

E) If an investment pays 10% interest,compounded annually,its effective annual rate will be less than 10%.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) An investment that has a nominal rate of 6% with semiannual payments will have an effective rate that is smaller than 6%.

B) The present value of a 3-year,$150 annuity due will exceed the present value of a 3-year,$150 ordinary annuity.

C) If a loan has a nominal annual rate of 8%,then the effective rate can never be greater than 8%.

D) If a loan or investment has annual payments,then the effective,periodic,and nominal rates of interest will all be different.

E) The proportion of the payment that goes toward interest on a fully amortized loan increases over time.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If we are given a periodic interest rate,say a monthly rate,we can find the nominal annual rate by multiplying the periodic rate by the number of periods per year.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your investment account pays 8.0%,compounded annually.If you invest $5,000 today,how many years will it take for your investment to grow to $9,140.20?

A) 5.14

B) 5.71

C) 6.35

D) 7.05

E) 7.84

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Julian and Jonathan are twin brothers (and so were born on the same day) .Today,both turned 25.Their grandfather began putting $2,500 per year into a trust fund for Julian on his 20th birthday,and he just made a 6th payment into the fund.The grandfather (or his estate's trustee) will make 40 more $2,500 payments until a 46th and final payment is made on Julian's 65th birthday.The grandfather set things up this way because he wants Julian to work,not be a "trust fund baby," but he also wants to ensure that Julian is provided for in his old age. Until now,the grandfather has been disappointed with Jonathan and so has not given him anything.However,they recently reconciled,and the grandfather decided to make an equivalent provision for Jonathan.He will make the first payment to a trust for Jonathan today,and he has instructed his trustee to make 40 additional equal annual payments until Jonathan turns 65,when the 41st and final payment will be made.If both trusts earn an annual return of 8%,how much must the grandfather put into Jonathan's trust today and each subsequent year to enable him to have the same retirement nest egg as Julian after the last payment is made on their 65th birthday?

A) $3,726

B) $3,912

C) $4,107

D) $4,313

E) $4,528

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose United Bank offers to lend you $10,000 for one year at a nominal annual rate of 8.00%,but you must make interest payments at the end of each quarter and then pay off the $10,000 principal amount at the end of the year.What is the effective annual rate on the loan?

A) 8.24%

B) 8.45%

C) 8.66%

D) 8.88%

E) 9.10%

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a State of North Carolina bond will pay $1,000 ten years from now.If the going interest rate on these 10-year bonds is 5.5%,how much is the bond worth today?

A) $585.43

B) $614.70

C) $645.44

D) $677.71

E) $711.59

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT,assuming positive interest rates and holding other things constant?

A) Banks A and B offer the same nominal annual rate of interest,but A pays interest quarterly and B pays semiannually.Deposits in Bank B will provide the higher future value if you leave your funds on deposit.

B) The present value of a 5-year,$250 annuity due will be lower than the PV of a similar ordinary annuity.

C) A 30-year,$150,000 amortized mortgage will have larger monthly payments than an otherwise similar 20-year mortgage.

D) A bank loan's nominal interest rate will always be equal to or greater than its effective annual rate.

E) If an investment pays 10% interest,compounded quarterly,its effective annual rate will be greater than 10%.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Time lines cannot be constructed for annuities unless all the payments occur at the end of the periods.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you borrowed $14,000 at a rate of 10.0% and must repay it in 5 equal installments at the end of each of the next 5 years.How much interest would you have to pay in the first year?

A) $1,200.33

B) $1,263.50

C) $1,330.00

D) $1,400.00

E) $1,470.00

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

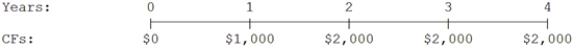

You sold your motorcycle and accepted a note with the following cash flow stream as your payment.What was the effective price you received for the car assuming an interest rate of 6.0%?

A) $5,987

B) $6,286

C) $6,600

D) $6,930

E) $7,277

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Of the following investments,which would have the lowest present value? Assume that the effective annual rate for all investments is the same and is greater than zero.

A) Investment A pays $250 at the end of every year for the next 10 years (a total of 10 payments) .

B) Investment B pays $125 at the end of every 6-month period for the next 10 years (a total of 20 payments) .

C) Investment C pays $125 at the beginning of every 6-month period for the next 10 years (a total of 20 payments) .

D) Investment D pays $2,500 at the end of 10 years (just one payment) .

E) Investment E pays $250 at the beginning of every year for the next 10 years (a total of 10 payments) .

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You were left $100,000 in a trust fund set up by your grandfather.The fund pays 6.5% interest.You must spend the money on your college education,and you must withdraw the money in 4 equal installments,beginning immediately.How much could you withdraw today and at the beginning of each of the next 3 years and end up with zero in the account?

A) $24,736

B) $26,038

C) $27,409

D) $28,779

E) $30,218

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Brockman Corporation's earnings per share were $3.50 last year,and its growth rate during the prior 5 years was 9.0% per year.If that growth rate were maintained,how many years would it take for Brockman's EPS to triple?

A) 9.29

B) 10.33

C) 11.47

D) 12.75

E) 14.02

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you borrowed $12,000 at a rate of 9.0% and must repay it in 4 equal installments at the end of each of the next 4 years.How large would your payments be?

A) $3,704.02

B) $3,889.23

C) $4,083.69

D) $4,287.87

E) $4,502.26

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your aunt has $500,000 invested at 5.5%,and she now wants to retire.She wants to withdraw $45,000 at the beginning of each year,beginning immediately.When she makes her last withdrawal (at the beginning of a year) ,she also wants to have enough left in the account so that you can make a final withdrawal of $50,000 at the end of that year (her last withdrawal is at the beginning of the year,your withdrawal is at the end of that same year) .What is the maximum number of $45,000 withdrawals that she can make and still have enough in the account so that you can make a $50,000 withdrawal at the end of the year of her last withdrawal? (Hint: If your solution for N is not an integer,round down to the nearest whole number. )

A) 13

B) 14

C) 15

D) 16

E) 17

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 165

Related Exams