Filters

Question type

A) $14.52

B) $14.89

C) $15.26

D) $15.64

E) $16.03

F) C) and D)

G) A) and E)

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Question 52

Multiple Choice

If D0 = $1.75,g (which is constant) = 3.6%,and P0 = $32.00,what is the stock's expected total return for the coming year?

A) 8.37%

B) 8.59%

C) 8.81%

D) 9.03%

E) 9.27%

F) B) and D)

G) A) and C)

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Question 53

True/False

A proxy is a document giving one party the authority to act for another party,including the power to vote shares of common stock.Proxies can be important tools relating to control of firms.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 54

True/False

The expected total return on a share of stock refers to the dividend yield less any commissions paid when the stock is purchased and sold.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 55

True/False

Preferred stock is a hybrid⎯a sort of cross between a common stock and a bond⎯in the sense that it pays dividends that normally increase annually like a stock but its payments are contractually guaranteed like interest on a bond.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 56

True/False

According to the basic FCF stock valuation model,the value an investor should assign to a share of stock is dependent on the length of time he or she plans to hold the stock.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 57

Multiple Choice

Lance Inc.'s free cash flow was just $1.00 million.If the expected long-run growth rate for this company is 5.4%,if the weighted average cost of capital is 11.4%,Lance has $4 million in short-term investments and $3 million in debt,and 1 million shares outstanding,what is the intrinsic stock price?

A) $17.28

B) $17.70

C) $18.13

D) $18.57

E) $19.01

F) A) and B)

G) B) and E)

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Question 58

Multiple Choice

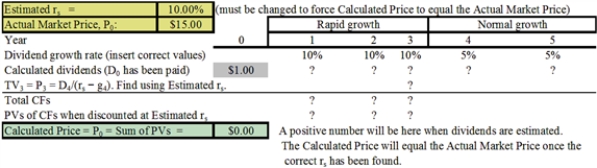

Julia Saunders is your boss and the treasurer of Foster Carter Enterprises (FCE) .She asked you to help her estimate the intrinsic value of the company's stock.FCE just paid a dividend of $1.00,and the stock now sells for $15.00 per share.Julia asked a number of security analysts what they believe FCE's future dividends will be,based on their analysis of the company.The consensus is that the dividend will be increased by 10% during Years 1 to 3,and it will be increased at a rate of 5% per year in Year 4 and thereafter.Julia asked you to use that information to estimate the required rate of return on the stock,rs,and she provided you with the following template for use in the analysis:  Julia told you that the growth rates in the template were just put in as a trial,and that you must replace them with the analysts' forecasted rates to get the correct forecasted dividends and then the estimated TV.She also notes that the estimated value for rs, at the top of the template,is also just a guess,and you must replace it with a value that will cause the Calculated Price shown at the bottom to equal the Actual Market Price.She suggests that,after you have put in the correct dividends,you can manually calculate the price,using a series of guesses as to the Estimated rs.The value of rs that causes the calculated price to equal the actual price is the correct one.She notes,though,that this trial-and-error process would be quite tedious,and that the correct rs could be found much faster with a simple Excel model,especially if you use Goal Seek.What is the value of rs?

Julia told you that the growth rates in the template were just put in as a trial,and that you must replace them with the analysts' forecasted rates to get the correct forecasted dividends and then the estimated TV.She also notes that the estimated value for rs, at the top of the template,is also just a guess,and you must replace it with a value that will cause the Calculated Price shown at the bottom to equal the Actual Market Price.She suggests that,after you have put in the correct dividends,you can manually calculate the price,using a series of guesses as to the Estimated rs.The value of rs that causes the calculated price to equal the actual price is the correct one.She notes,though,that this trial-and-error process would be quite tedious,and that the correct rs could be found much faster with a simple Excel model,especially if you use Goal Seek.What is the value of rs?

A) 11.84%

B) 12.21%

C) 12.58%

D) 12.97%

E) 13.36%

F) A) and D)

G) A) and C)

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Question 59

Multiple Choice

A stock is expected to pay a dividend of $0.75 at the end of the year.The required rate of return is rs = 10.5%,and the expected constant growth rate is g = 6.4%.What is the stock's current price?

A) $17.39

B) $17.84

C) $18.29

D) $18.75

E) $19.22

F) None of the above

G) D) and E)

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Question 60

Multiple Choice

Reynolds Construction's value of operations is $750 million based on the free cash flow valuation model.Its balance sheet shows $50 million of short-term investments that are unrelated to operations,$100 million of accounts payable,$100 million of notes payable,$200 million of long-term debt,$40 million of common stock (par plus paid-in-capital) ,and $160 million of retained earnings.What is the best estimate for the firm's value of equity,in millions?

A) $429

B) $451

C) $475

D) $500

E) $525

F) A) and C)

G) A) and B)

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Question 61

Multiple Choice

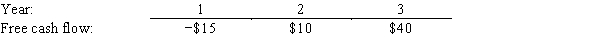

Heath and Logan Inc.forecasts the free cash flows (in millions) shown below.The weighted average cost of capital is 13%,and the FCFs are expected to continue growing at a 5% rate after Year 3.Assuming that the ROIC is expected to remain constant in Year 3 and beyond,what is the Year 0 value of operations,in millions?

A) $315

B) $331

C) $348

D) $367

E) $386

F) A) and B)

G) B) and D)

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 91 of 91

Related Exams