A) exchange rates were revalued in the Bretton Woods agreement.

B) exchange rates have been allowed to float.

C) the United States returned to a gold standard.

D) the zone of monetary stability has been limited to the U.S., Canada, and Mexico.

F) A) and D)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Ecuador does not have its own national currency, circulating the U.S. dollar instead. About how many countries do not have their own national currency?

A) 10

B) 20

C) 30

D) 40

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The euro zone remarkably comparable to the United States in terms of

A) population size.

B) GDP.

C) international trade share.

D) all of the above

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under the Bretton Woods system

A) there was an explicit set of rules about the conduct of international monetary policies.

B) each country was responsible for maintaining its exchange rate within 1 percent of the adopted par value by buying or selling foreign exchanges as necessary.

C) the U.S. dollar was the only currency that was fully convertible to gold.

D) all of the above

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A booming economy with a fixed or stable nominal exchange rate

A) inevitably brings about an appreciation of the real exchange rate.

B) inevitably brings about a depreciation of the real exchange rate.

C) inevitably brings about a stabilization of the real exchange rate.

D) inevitably brings about increased volatility of the real exchange rate.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 1963, President John Kennedy imposed the Interest Equalization Tax (IET) on U.S. purchases of foreign securities. The IET was designed to

A) decrease the cost of foreign borrowing in the U.S. bond market.

B) increase the cost of foreign borrowing in the U.S. bond market.

D) undefined

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Put the following in correct date order:

A) Jamaica Agreement, Bretton Woods Agreement, Smithsonian Agreement.

B) Smithsonian Agreement, Bretton Woods Agreement, Jamaica Agreement.

C) Bretton Woods Agreement, Smithsonian Agreement, Jamaica Agreement.

D) Bretton Woods Agreement, Jamaica Agreement, Smithsonian Agreement.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that country A and country B are both on a bimetallic standard. In country A the ratio is 15 to one (i.e. an ounce of gold is worth 15 times as much as an ounce of silver in that currency) , while in country B the ratio is ten to one. If the free flow of capital is allowed between countries A and B is this a sustainable framework?

A) Yes

B) No

C) There is not enough information to make an informed determination.

E) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

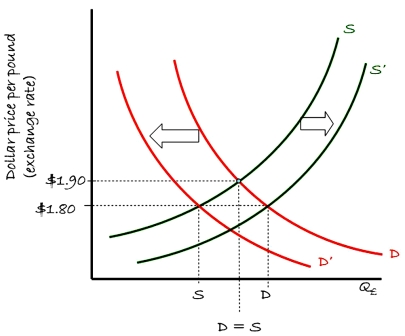

Consider the supply-demand framework for the British pound relative to the U.S. dollar shown in the nearby chart. The exchange rate is currently $1.80 = £1.00. Which of the following is correct?

A) To "fix" the exchange rate at $1.80 = £1.00, the Federal Reserve could use contractionary monetary policy to shift the demand curve to the left.

B) To "fix" the exchange rate at $1.80 = £1.00, the U.S. government could use contractionary fiscal policy to shift the demand curve to the left.

C) The British Government could use fiscal or monetary policy to shift the supply curve to the right to fix the exchange rate to $1.80 = £1.00.

D) All of the above.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Following the introduction of the euro, the national central banks of the euro-12 nations

A) disbanded.

B) formed the ESCB, which is analogous to the Federal Reserve System in the U.S.

C) continue to perform important functions in their jurisdictions.

D) b and c are correct

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

With regard to the current exchange rate arrangement between Italy and Germany, it is best characterized as

A) independent floating (market determined) .

B) managed float.

C) an exchange arrangement with no separate legal tender.

D) pegged exchange rate within a horizontal band.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the outbreak of World War I

A) major countries such as Great Britain, France, Germany and Russia suspended redemption of banknotes in gold.

B) major countries such as Great Britain, France, Germany and Russia imposed embargoes on the export of gold.

C) the classical gold standard was abandoned.

D) all of the above

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The growth of the Eurodollar market, which is a transnational, unregulated fund market

A) was encouraged by U.S. legislation designed to stem the outflow of dollars from the U.S.

B) was discouraged by U.S. legislation designed to stem the outflow of dollars from the U.S.

D) undefined

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Willem Duisenberg, the first president of the European Central Bank, defined "price stability" as an annual inflation rate of

A) "no more than five percent."

B) "less than but close to 2 percent."

C) "absolutely no more than zero percent."

D) "no more than three percent."

F) All of the above

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

The Asian Currency Crisis

A) happened just prior to the Mexican peso crisis.

B) turned out to be far more serious than the Mexican peso crisis in terms of the extent of contagion.

C) was limited to Asian currencies.

D) was almost over before anyone outside the pacific rim noticed.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price-specie-flow mechanism will work only if governments are willing to play by the rules of the game by letting the money stock rise and fall as gold flows in and out. Once the government demonetizes (neutralizes) gold, the mechanism will break down. In addition, the effectiveness of the mechanism depends on

A) the income elasticity of the demand for imports.

B) the price elasticity of the demand for imports.

C) the price elasticity of the supply of imports.

D) the income elasticity of the supply of imports.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Benefits from adopting a common European currency include

A) reduced transaction costs.

B) elimination of exchange rate risk.

C) increased price transparency will promote Europe-wide competition.

D) all of the above

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Another name for the incompatible trinity is the

A) Tobin Tax.

B) Triffin Paradox.

C) Trilemma.

D) None of the above

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The monetary system of bimetallism is unstable. Due to the fluctuation of the commercial value of the metals,

A) the metal with a commercial value lower than the currency value tends to be used as metal and is withdrawn from circulation as money (Gresham's Law) .

B) the metal with a commercial value higher than the currency value tends to be used as money (Gresham's Law) .

C) the metal with a commercial value higher than the currency value tends to be used as metal and is withdrawn from circulation as money (Gresham's Law) .

D) none of the above

F) All of the above

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

In the years leading to the collapse of the Bretton Woods system

A) it became clear that the dollar was undervalued.

B) it became clear that the dollar was overvalued.

D) undefined

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 100

Related Exams