A) short run and supposes that the price level adjusts to bring money supply and money demand into balance.

B) short run and supposes that the interest rate adjusts to bring money supply and money demand into balance.

C) long run and supposes that the price level adjusts to bring money supply and money demand into balance.

D) long run and supposes that the interest rate adjusts to bring money supply and money demand into balance.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Fed conducts open-market purchases,then which of the following quantities increase(s) ?

A) interest rates and investment spending

B) interest rates,but not investment spending

C) investment spending,but not interest rates

D) neither interest rates nor investment spending

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

People hold money primarily because it

A) has a guaranteed nominal return.

B) serves as a store of value.

C) can directly be used to buy goods and services.

D) functions as a unit of account.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Because the liquidity-preference framework focuses on the

A) short run,it assumes the price level adjusts to bring the money market to equilibrium.

B) short run,it assumes the interest rate adjusts to bring the money market to equilibrium.

C) long run,it assumes the price level adjusts to bring the money market to equilibrium.

D) long run,it assumes the interest rate adjusts to bring the money market to equilibrium.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in government spending initially and primarily shifts

A) aggregate demand to the right.

B) aggregate demand to the left.

C) aggregate supply to the right.

D) neither aggregate demand nor aggregate supply in either direction.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct for the short run?

A) Output is determined by the amount of capital,labor,and technology; the interest rate adjusts to balance the supply and demand for money; the price level adjusts to balance the supply and demand for loanable funds.

B) Output is determined by the amount of capital,labor,and technology; the interest rate adjusts to balance the supply and demand for loanable funds; the price level adjusts to balance the supply and demand for money.

C) Output responds to the aggregate demand for goods and services; the interest rate adjusts to balance the supply and demand for money; the price level is relatively slow to adjust.

D) Output responds to the aggregate demand for goods and services; the interest rate adjusts to balance the supply and demand for loanable funds; the price level adjusts to balance the supply and demand for money.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

For a country such as the U.S.,the wealth effect exerts a very important influence on the slope of the aggregate-demand curve,since U.S.wealth is large relative to wealth in most other countries.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the multiplier is 5,then the MPC is

A) 0.05.

B) 0.5.

C) 0.6.

D) 0.8.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sometimes during wars,government expenditures are larger than normal.To reduce the effects this spending creates on interest rates,

A) the Federal Reserve could increase the money supply by buying bonds.

B) the Federal Reserve could increase the money supply by selling bonds.

C) the Federal Reserve could decrease the money supply by buying bonds.

D) the Federal Reserve could decrease the money supply by selling bonds.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the long run,the level of output

A) depends on the money supply.

B) depends on the price level.

C) is determined by supply-side factors.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The theory of liquidity preference assumes that the nominal supply of money is determined by the

A) level of real output only.

B) interest rate only.

C) level of real output and by the interest rate.

D) Federal Reserve.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Liquidity preference refers directly to Keynes' theory concerning

A) the effects of changes in money demand and supply on interest rates.

B) the effects of changes in money demand and supply on exchange rates.

C) the effects of wealth on expenditures.

D) the difference between temporary and permanent changes in income.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Fed is concerned about stock market booms because the booms

A) increase consumption spending.

B) increase investment spending.

C) increase both consumption and investment spending.

D) None of the above is correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Marcus is of the opinion that the theory of liquidity preference explains the determination of the interest rate very well.Most economists would say that Marcus's opinion is

A) Keynesian in nature,and that his view is more valid for the long run than for the short run.

B) classical in nature,and that his view is more valid for the long run than for the short run.

C) Keynesian in nature,and that his view is more valid for the short run than for the long run.

D) classical in nature,and that his view is more valid for the short run than for the long run.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things the same,which of the following responses would we expect from an increase in U.S.interest rates?

A) Your aunt puts more money in her savings account.

B) Foreign citizens decide to buy fewer U.S.bonds.

C) You decide to purchase a new oven for your cookie factory.

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The exchange-rate effect is based,in part,on the idea that

A) a decrease in the price level reduces the interest rate.

B) an increase in the price level causes investors to move some of their funds overseas.

C) an increase in the price level causes domestic goods to become less expensive relative to foreign goods.

D) a decrease in the price level reduces spending on net exports.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government cuts the tax rate,workers get to keep

A) less of each additional dollar they earn,so work effort increases,and aggregate supply shifts right.

B) less of each additional dollar they earn,so work effort decreases,and aggregate supply shifts left.

C) more of each additional dollar they earn,so work effort increases,and aggregate supply shifts right.

D) more of each additional dollar they earn,so work effort decreases,and aggregate supply shifts left.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

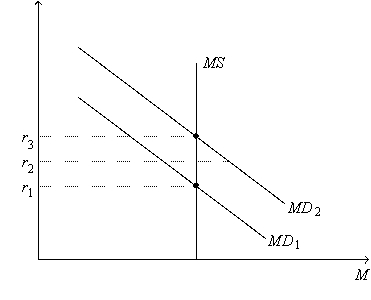

Figure 24-4.On the figure,MS represents money supply and MD represents money demand.  -Refer to Figure 24-4.Which of the following events could explain a shift of the money-demand curve from MD1 to MD2?

-Refer to Figure 24-4.Which of the following events could explain a shift of the money-demand curve from MD1 to MD2?

A) a decrease in the price level

B) a decrease in the cost of borrowing

C) an increase in the price level

D) an increase in the cost of borrowing

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following sequences best explains the negative slope of the aggregate-demand curve?

A) price level demand for money equilibrium interest rate quantity of goods and services demanded

B) price level demand for money equilibrium interest rate quantity of goods and services demanded

C) price level demand for money equilibrium interest rate quantity of goods and services demanded

D) price level equilibrium interest rate demand for money quantity of goods and services demanded

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Liquidity refers to

A) the relation between the price and interest rate of an asset.

B) the risk of an asset relative to its selling price.

C) the ease with which an asset is converted into a medium of exchange.

D) the sensitivity of investment spending to changes in the interest rate.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 321 - 340 of 415

Related Exams