B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A University of Iowa basketball standout is offered a choice of contracts by the New York Liberty.The first one gives her $100,000 one year from today and $100,000 two years from today.The second one gives her $132,000 one year from today and $66,000 two years from today.As her agent,you must compute the present value of each contract.Which of the following interest rates is the lowest one at which the present value of the second contract exceeds that of the first?

A) 7 percent

B) 8 percent

C) 9 percent

D) 10 percent

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming the interest rate is 5 percent,which of the following has the greatest present value?

A) $240 paid in three years

B) $225 paid in two years

C) $210 paid in one year

D) $200 today

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

After the 1982 recession,the U.S.and world economies entered into a long period

A) of high unemployment rates.

B) high inflation rates.

C) that has become known as the "Great Moderation."

D) that has become known as the "Great Recession."

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

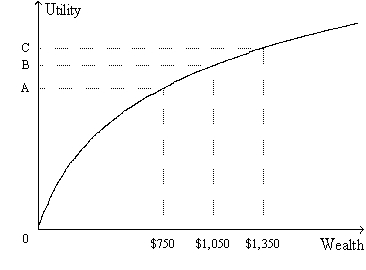

Figure 19-2.The figure shows a utility function for Mary Ann.  -Refer to Figure 19-2.From the appearance of the utility function,we know that

-Refer to Figure 19-2.From the appearance of the utility function,we know that

A) Mary Ann is risk averse.

B) Mary Ann gains more satisfaction when her wealth increases by X dollars than she loses in satisfaction when her wealth decreases by X dollars.

C) the property of increasing marginal utility applies to Mary Ann.

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When you were 10 years old,your grandparents put $500 into an account for you paying 7 percent interest.Now that you are 18 years old,your grandparents tell you that you can take the money out of the account.What is the balance to the nearest cent?

A) $1,200.00

B) $1,111.77

C) $983.58

D) $859.09

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A pharmaceutical company unexpectedly announces that it just developed an important new drug.This news should

A) raise the price of the corporation's stock; if it does not the stock is overvalued.

B) raise the price of the corporation's stock; if it does not the stock is undervalued.

C) reduce the price of the corporation's stock; if it does not the stock is overvalued.

D) reduce the price of the corporation's stock; if it does not the stock is undervalued.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Diminishing marginal utility of wealth implies that the utility function is

A) upward-sloping and has decreasing slope.

B) upward-sloping and has increasing slope.

C) downward-sloping and has decreasing slope.

D) downward-sloping and has increasing slope.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

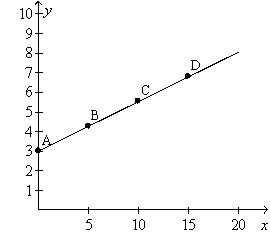

Figure 19-5.On the graph,x represents risk and y represents return.  -Refer to Figure 19-5.Which of the following statements is correct?

-Refer to Figure 19-5.Which of the following statements is correct?

A) At point A the standard deviation of the portfolio is 3.

B) A risk averse person always will choose to be at point A.

C) At point D the portfolio consists of about 15 percent stocks and 85 percent safe assets.

D) The figure shows that the greater the risk,the greater the return.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which,if any,of the present values below are correctly computed?

A) A payment of $1,000 to be received one year from today,with a 8 percent interest rate,has a present value of $945.45.

B) A payment of $1,000 to be received one year from today,with a 9 percent interest rate,has a present value of $911.11.

C) A payment of $1,000 to be received one year from today,with a 10 percent interest rate,has a present value of $905.06.

D) None of the above are correct to the nearest cent.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

HydroGrow is considering building a new greenhouse in which to grow tomatoes.The board meets and decides that this is the right thing to do.Before they can put their plans into action,the interest rate increases.The present value of the returns from this investment project

A) is now lower than it was before,and so Hydro Grow is less likely to build the building.

B) is now lower than it was before,and so HydroGrow is more likely to build the building.

C) is now higher than it was before,and so HydroGrow is less likely to build the building.

D) is now higher than it was before,and so HydroGrow is more likely to build the building.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the interest rate is 7 percent.Consider four payment options: Option A: $500 today. Option B: $550 one year from today. Option C: $575 two years from today. Option D: $600 three years from today. Which of the payments has the lowest present value today?

A) Option A

B) Option B

C) Option C

D) Option D

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A scholarship gives you $1,000 today and promises to pay you $1,000 one year from today.What is the present value of these payments?

A) $2,000/(1 + r) 2.

B) $1,000 + $1,000/(1 + r)

C) $1,000/(1 + r) + $1,000/(1 + r) 2

D) $1,000(1 + r) + $1,000(1 + r) 2

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sometimes On Time (SOT) Airlines is considering buying a new jet.SOT would be more likely to buy a new jet if there were either

A) a decrease in the price of a new jet or a decrease in the interest rate.

B) a decrease in the price of a new jet or an increase in the interest rate.

C) an increase in the price of a new jet or a decrease in the interest rate.

D) an increase in the price of a new jet or an increase in the interest rate.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that fundamental analysis indicates a particular company's stock is overvalued.

A) This means its present value is less than its price.You should consider adding the stock to your portfolio.

B) This means its present value is less than its price.You shouldn't consider adding the stock to your portfolio.

C) This means its present value is more than its price.You should consider adding the stock to your portfolio.

D) This means its present value is more than its price.You shouldn't consider adding the stock to your portfolio.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Imagine that someone offers you $100 today or $200 in 10 years.You would prefer to take the $100 today if the interest rate is

A) 4 percent.

B) 5 percent.

C) 6 percent.

D) None of the above are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are given three options.You may have the balance in an account that has been collecting 5 percent interest for 20 years,the balance in an account that has been collecting 10 percent interest for 10 years,or the balance in an account that has been collecting 20 percent interest for five years.Each account had the same original balance.Which account now has the lowest balance?

A) the first one

B) the second one

C) the third one

D) They all have the same balance.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you are deciding whether or not to buy a particular bond for $2,990.08.If you buy the bond and hold it for 5 years,then at that time you will receive a payment of $5,000.You will buy the bond today if the interest rate is

A) no less than 9.48 percent.

B) no greater than 9.48 percent.

C) no less than 10.83 percent.

D) no greater than 10.83 percent.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If a person had increasing marginal utility,then the decline in utility from losing $1,000 would be greater than the increase in utility from gaining $1,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Financial intermediaries typically require mortgage borrowers to have homeowner's insurance and do credit checks before making the loan.

A) The insurance requirement and the credit check are both designed primarily to reduce adverse selection.

B) The insurance requirement and the credit check are both designed primarily to reduce the risk of moral hazard.

C) The insurance requirement is designed primarily to reduce adverse selection; the credit check is designed primarily to reduce the risk of moral hazard.

D) The insurance requirement is designed primarily to reduce the risk of moral hazard; the credit check is designed primarily to reduce adverse selection.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 301 - 320 of 421

Related Exams