B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You receive a paycheck from your employer, and your pay stub indicates that $400 was deducted to pay the FICA (Social Security/Medicare) tax. Which of the following statements is correct?

A) This type of tax is an example of a payback tax.

B) Your employer is required by law to pay $400 to match the $400 deducted from your check.

C) The $400 that you paid is the true burden of the tax that falls on you, the employee.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

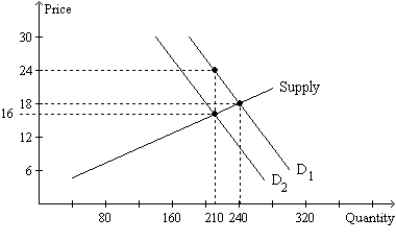

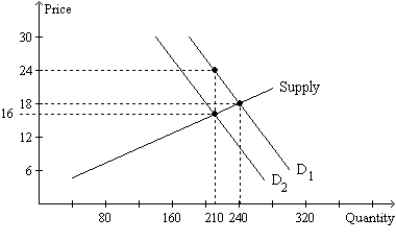

Figure 6-24  -Refer to Figure 6-24. Andrew is a buyer of the good. Taking the tax into account, how much does Andrew effectively pay to acquire one unit of the good?

-Refer to Figure 6-24. Andrew is a buyer of the good. Taking the tax into account, how much does Andrew effectively pay to acquire one unit of the good?

A) $16

B) $18

C) $24

D) $26

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

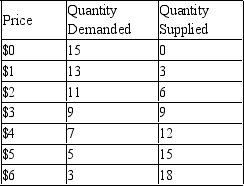

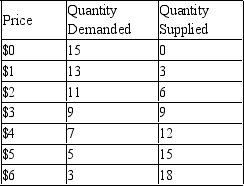

Table 6-4

The following table contains the demand schedule and supply schedule for a market for a particular good. Suppose sellers of the good successfully lobby Congress to impose a price floor $3 above the equilibrium price in this market.

-Refer to Table 6-4. Following the imposition of a price floor $3 above the equilibrium price, irate buyers convince Congress to repeal the price floor and to impose a price ceiling $1 below the former price floor. The resulting shortage is

-Refer to Table 6-4. Following the imposition of a price floor $3 above the equilibrium price, irate buyers convince Congress to repeal the price floor and to impose a price ceiling $1 below the former price floor. The resulting shortage is

A) 0 units.

B) 4 units.

C) 5 units.

D) 10 units.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The true burden of a payroll tax has nothing to do with the percentage of the tax that employers are required to pay.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government removes a $2 tax on buyers of cigars and imposes the same $2 tax on sellers of cigars, then the price paid by buyers will

A) not change, and the price received by sellers will not change.

B) not change, and the price received by sellers will decrease.

C) decrease, and the price received by sellers will not change.

D) decrease, and the price received by sellers will decrease.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The United States is the only country in the world with minimum-wage laws.

B) False

Correct Answer

verified

Correct Answer

verified

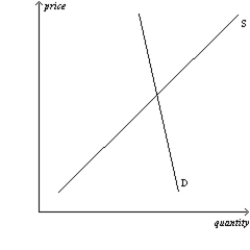

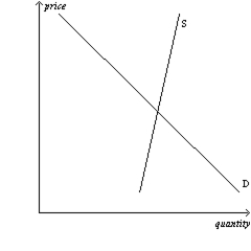

Multiple Choice

Figure 6-30

Panel (a) Panel (b)

Panel (c)

Panel (c)  -Refer to Figure 6-30. In which market will the majority of the tax burden fall on sellers?

-Refer to Figure 6-30. In which market will the majority of the tax burden fall on sellers?

A) the market shown in panel (a) .

B) the market shown in panel (b) .

C) the market shown in panel (c) .

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Regardless of whether a tax is levied on sellers or buyers, taxes discourage market activity.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Figure 6-35  -Refer to Figure 6-35. A price floor set at $60 would create a surplus of 20 units.

-Refer to Figure 6-35. A price floor set at $60 would create a surplus of 20 units.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A binding minimum wage creates a shortage of labor.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Taxes levied on sellers and taxes levied on buyers are equivalent.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A binding minimum wage creates unemployment.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

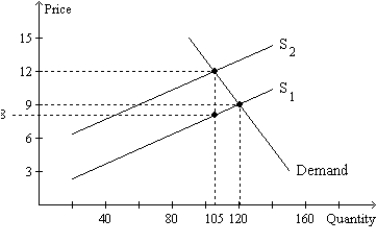

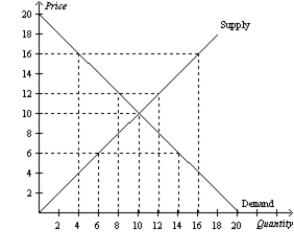

Figure 6-21  -Refer to Figure 6-21. The price that buyers pay after the tax is imposed is

-Refer to Figure 6-21. The price that buyers pay after the tax is imposed is

A) $8.00.

B) $9.00.

C) $10.50.

D) $12.00.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-24  -Refer to Figure 6-24. Suppose sellers, rather than buyers, were required to pay this tax (in the same amount per unit as shown in the graph) . Relative to the tax on buyers, the tax on sellers would result in

-Refer to Figure 6-24. Suppose sellers, rather than buyers, were required to pay this tax (in the same amount per unit as shown in the graph) . Relative to the tax on buyers, the tax on sellers would result in

A) buyers bearing the same share of the tax burden.

B) sellers bearing the same share of the tax burden.

C) the same amount of tax revenue for the government.

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 1990, Congress passed a new luxury tax on items such as yachts, private airplanes, furs, jewelry, and expensive cars. The goal of the tax was to

A) raise revenue from the wealthy.

B) prevent wealthy people from buying luxuries.

C) force producers of luxury goods to reduce employment.

D) limit exports of luxury goods to other countries.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

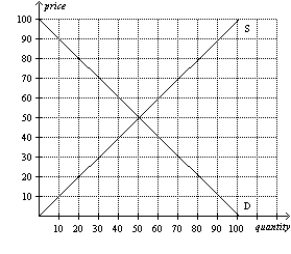

Figure 6-4  -Refer to Figure 6-4. A government-imposed price of $6 in this market could be an example of a (i) binding price ceiling.

(ii) non-binding price ceiling.

(iii) binding price floor.

(iv) non-binding price floor.

-Refer to Figure 6-4. A government-imposed price of $6 in this market could be an example of a (i) binding price ceiling.

(ii) non-binding price ceiling.

(iii) binding price floor.

(iv) non-binding price floor.

A) (i) only

B) (ii) only

C) (i) and (iv) only

D) (ii) and (iii) only

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 6-4

The following table contains the demand schedule and supply schedule for a market for a particular good. Suppose sellers of the good successfully lobby Congress to impose a price floor $3 above the equilibrium price in this market.

-Refer to Table 6-4. How many units of the good are sold after the imposition of the price floor?

-Refer to Table 6-4. How many units of the good are sold after the imposition of the price floor?

A) 3

B) 9

C) 15

D) 18

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price received by sellers in a market will increase if the government decreases a

A) binding price floor in that market.

B) binding price ceiling in that market.

C) tax on the good sold in that market.

D) None of the above is correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax is levied on the buyers of a product, then the supply curve will

A) not shift.

B) shift up.

C) shift down.

D) become flatter.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 241 - 260 of 644

Related Exams