A) EPS is an excellent measure of how efficiently long-lived assets are being utilized.

B) EPS provides specific information about the ability of a company to repay its long-term debts.

C) EPS makes it easy to compare one company with another.

D) EPS provides information that investors can factor into their expectations about future dividends and stock prices.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about dividends is not correct?

A) Dividends represent a sharing of corporate profits with owners.

B) Both stock dividends and cash dividends reduce Retained Earnings.

C) Cash dividends paid to stockholders reduce net income.

D) Dividends are declared at the discretion of the board of directors.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,2017,Bank & Rupp,Inc.issued 100,000 shares of $1 par value common stock and 1,000 shares of $50 par value,6%,cumulative preferred stock.No dividends were declared in 2017.In 2018,Bank & Rupp declared and paid the preferred stockholders and a $1 per share dividend to its common stockholders.Assuming all shares originally issued are outstanding,the total dividend paid to the preferred stockholders equals:

A) $2,000.

B) $6,000.

C) $3,000.

D) $1,000.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What effect does the purchase of treasury stock have on the balance sheet?

A) Option A

B) Option B

C) Option C

D) Option D

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each term with the appropriate definition.Not all definitions will be used. -Additional Paid-in Capital

A) The total number of shares currently owned by stockholders.

B) The amount above the par value of the stock that owners paid the issuer for the stock.

C) When employees of a company have the opportunity to buy a company's stock in the future at a fixed price.

D) The date on which a company determines who receives a dividend.

E) The date on which a liability is recorded for a dividend.

F) When a company sells issues of stock after its IPO.

G) When owners of the company contribute additional capital beyond what they paid for their stock.

H) When cash or stock dividends are issued according to the proportion of stock owned.

I) The date on which a company authorizes a dividend payment.

J) The date on which a company debits dividends payable and credits cash.

K) Dividends that have not had income tax withheld from them.

L) The total number of shares the company has sold,whether held by stockholders or by the company.

M) The accumulation of all the past dividends the company has not paid.

N) When cash or stock dividends are issued in an equal dollar or share amount per stockholder.

P) D) and F)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Preferred stock differs from common stock in that:

A) preferred stock has more voting power and,as such,greater control over the management of the company.

B) preferred stockholders are paid dividends before common stockholders.

C) preferred stock pays tax-free dividends.

D) preferred stock has no preemptive rights or residual claims.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Corporations are governed by federal law.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Limited liability companies (LLCs) :

A) are like corporations in that the owners have limited liability.

B) are like partnerships in that the owners have unlimited liability.

C) have the tax treatment of corporations.

D) have the tax treatment of sole proprietorships.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A stock dividend transfers:

A) contributed capital to Retained Earnings.

B) Retained Earnings to assets.

C) contributed capital to assets.

D) Retained Earnings to contributed capital.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Buffalo Butter Co.had 40,000 shares of $4 par value common stock outstanding on January 1.On January 20,the company purchased 4,000 of its stock for $16 per share.On July 3,the company reissued 2,000 of the shares at $20 per share.Buffalo Butter uses the cost method to account for its treasury stock. What journal entry will record the reissuance on July 3?

A) Debit Cash and credit Treasury Stock for $40,000

B) Debit Cash for $40,000,credit Treasury Stock for $32,000,and credit Additional Paid-in Capital for $8,000

C) Debit Cash for $40,000,credit Common Stock for $12,000,and credit Additional Paid-in Capital for $28,000

D) Debit Cash for $40,000,credit Common Stock for $32,000,and credit Gain on Reissuance of Stock for $8,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Retained Earnings balance was $64,120 on January 1.Net income for the year was $50,680.If Retained Earnings had a credit balance of $66,640 after closing entries were made for the year,and if additional stock of $14,560 was issued during the year,what was the amount of dividends declared during the year?

A) $48,160

B) $66,360

C) $65,240

D) $36,400

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Geronimo Company issued 20,000 shares of $1 par value common stock at $10 per share.Ms.Elgin,the bookkeeper,recorded this transaction with a $200,000 debit to Cash and a $200,000 credit to Common Stock.As a result of this entry:

A) total assets will be overstated.

B) Additional Paid-In Capital will be understated.

C) total stockholders' equity will be understated.

D) equity will be overstated.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each term with the appropriate definition.Not all definitions will be used. -Partnership

A) A company that is like a partnership in nature except that it has limited liability.

B) A company that has a separate legal identity from its owners.

C) A company that issues stock on one of the major stock exchanges.

D) When companies are obligated to pay preferred stockholders past dividends not yet distributed before paying dividends to owners of common stock.

E) The nominal value per share of stock set by the company's charter.

F) The current stock price.

G) A stock that is currently selling for its original issue price.

H) Stock of companies that tend to pay relatively high dividends compared to the stock price.

I) Stock of companies that tend to reinvest earnings to provide for greater future sales and profits.

J) When stockholders prefer to receive dividends at the end of the year rather than each quarter.

K) An unincorporated business that is owned by a single individual.

L) When preferred stockholders are paid dividends before other stockholders.

M) An unincorporated business owned by two or more individuals.

O) D) and L)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Corporations can raise large amounts of money because:

A) shares of stock can be purchased in small amounts,so even small investors can participate.

B) investors always prefer to invest in stock so they can receive dividends.

C) stocks are always a good investment.

D) investing in the stock market is the surest way to get rich quick.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hazelnut Corporation had 40,000 shares of $4 par value common stock outstanding on January 1.On January 20,the company purchased 4,000 of its stock for $16 per share.On July 3,the company reissued 2,000 of the shares at $20 per share.Hazelnut uses the cost method to account for its treasury stock.Assume the company paid a dividend of $5 per share on August 3.What is the total amount of the dividends that would be paid to the common stockholders?

A) $190,000

B) $200,000

C) $180,000

D) $152,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

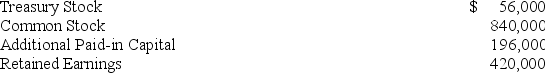

The following information is available from the accounting records of Pecos Company:  What is the amount of stockholders' equity for Pecos Company?

What is the amount of stockholders' equity for Pecos Company?

A) $980,000

B) $1,204,000

C) $1,400,000

D) $1,456,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about business forms is correct?

A) A sole proprietorship is an unincorporated business owned by one person.

B) All partnerships are owned by only two people.

C) A corporation is not a legal entity.

D) An LLC (or limited liability company) has the same tax treatment as a corporation.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bank,Rupp & Baroque,Inc.began on January 1,2017 by issuing 100,000 shares of $1 par value common stock and 1,000 shares of $50 par value,6% cumulative preferred stock.No dividends were declared in 2017 or 2018.Which of the following statements about this situation is correct?

A) Dividends Payable should be reported on the December 31,2017 balance sheet.

B) Dividends Payable should be reported on the December 31,2018 balance sheet.

C) Dividends in arrears should be disclosed in the notes to the 2017 and 2018 financial statements.

D) Dividends expense should be reported on the income statement for the year ended December 31,2017.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements accurately explains why the board of directors of a company whose financial future contains some uncertainties might issue a 2-for-1 stock split rather than declare a 100% stock dividend?

A) A stock split would not reduce the market price per share,whereas a stock dividend would.

B) A stock split would reduce the market price per share,whereas a stock dividend would not.

C) A stock split would increase total stockholders' equity,whereas a stock dividend would not.

D) A stock split would not reduce Retained Earnings,whereas a stock dividend would.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

EPS is a good predictor of:

A) future interest costs.

B) financial leverage.

C) future cash receipts.

D) future stock prices.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 278

Related Exams