B) False

Correct Answer

verified

Correct Answer

verified

True/False

A price ceiling is a legal minimum on the price at which a good or service can be sold.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The quantity sold in a market will increase if the government

A) decreases a binding price floor in that market.

B) increases a binding price ceiling in that market.

C) decreases a tax on the good sold in that market.

D) More than one of the above is correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

There are several criticisms of the minimum wage.Which of the following is not one of those criticisms?

A) The minimum wage often hurts those people who it is intended to help.

B) The minimum wage results in an excess supply of low-skilled labor.

C) The minimum wage prevents some unskilled workers from getting needed on-the-job training.

D) The minimum wage fails to raise the wage of any employed person.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A price ceiling caused the gasoline shortage of 1973 in the United States.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a binding price ceiling is imposed on the computer market,then

A) the demand for computers will increase.

B) the supply of computers will decrease.

C) a shortage of computers will develop.

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following observations would be consistent with the imposition of a binding price floor on a market?

A) A smaller quantity of the good is bought and sold after the price floor becomes effective.

B) A larger quantity of the good is demanded after the price floor becomes effective.

C) A smaller quantity of the good is supplied after the price floor becomes effective.

D) All of the above are correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When the government imposes a binding price ceiling on a competitive market,a surplus of the good arises,and sellers must ration the scarce goods among the large number of potential buyers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax is levied on the buyers of a product,then the supply curve

A) will not shift.

B) will shift up.

C) will shift down.

D) will become flatter.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As a rationing mechanism,discrimination according to seller bias is

A) efficient and fair.

B) efficient,but potentially unfair.

C) inefficient,but fair.

D) inefficient and potentially unfair.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Price ceilings and price floors that are binding

A) are desirable because they make markets more efficient and more fair.

B) cause surpluses and shortages to persist since price cannot adjust to the market equilibrium price.

C) can have the effect of restoring a market to equilibrium.

D) are imposed because they can make the poor in the economy better off without causing adverse effects.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A minimum wage that is set above a market's equilibrium wage will result in

A) an excess demand for labor,that is,unemployment.

B) an excess demand for labor,that is,a shortage of workers.

C) an excess supply of labor,that is,unemployment.

D) an excess supply of labor,that is,a shortage of workers.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct?

A) A tax burden falls more heavily on the side of the market that is more elastic.

B) A tax burden falls more heavily on the side of the market that is less elastic.

C) A tax burden falls more heavily on the side of the market that is closer to unit elastic.

D) A tax burden is distributed independently of the relative elasticities of supply and demand.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A tax on buyers shifts the demand curve and the supply curve.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A legal maximum on the price at which a good can be sold is called a price

A) floor.

B) subsidy.

C) support.

D) ceiling.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As rationing mechanisms,prices

A) and long lines are efficient.

B) are efficient,but long lines are inefficient.

C) are inefficient,but long lines are efficient.

D) and long lines are inefficient.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

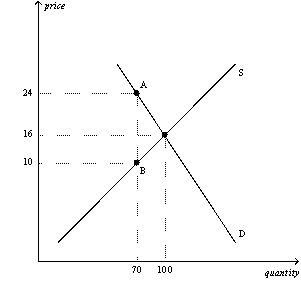

Figure 6-13

The vertical distance between points A and B represents the tax in the market.  -Refer to Figure 6-13.The price that buyers pay after the tax is imposed is

-Refer to Figure 6-13.The price that buyers pay after the tax is imposed is

A) $8.

B) $10.

C) $16.

D) $24.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A minimum wage that is set below a market's equilibrium wage will result in

A) an excess demand for labor,that is,unemployment.

B) an excess demand for labor,that is,a shortage of workers.

C) an excess supply of labor,that is,unemployment.

D) None of the above is correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The presence of a price control in a market for a good or service usually is an indication that

A) an insufficient quantity of the good or service was being produced in that market to meet the public's need.

B) the usual forces of supply and demand were not able to establish an equilibrium price in that market.

C) policymakers believed that the price that prevailed in that market in the absence of price controls was unfair to buyers or sellers.

D) policymakers correctly believed that,in that market,price controls would generate no inequities of their own.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Most economists are in favor of price controls as a way of allocating resources in the economy.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 459

Related Exams