A) A debit to Dividends Payable and a credit to Cash for $680,000.

B) A debit to Dividends and a credit to Dividends Payable for $646,000.

C) A debit to Dividends Payable and a credit to Cash for $646,000.

D) A debit to Dividends and a credit to Dividends Payable for $680,000.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about Retained Earnings is correct?

A) Retained Earnings represents cash available to pay dividends to stockholders.

B) Retained Earnings cannot be restricted by loan covenants.

C) Retained Earnings generally consists of cumulative net income less any net losses and dividends since inception.

D) Retained Earnings is reduced by the par value of the common stock that is issued.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Retained Earnings balance was $22,900 on January 1.Net income for the year was $18,100.If Retained Earnings had a credit balance of $23,800 after closing entries were made for the year,and if additional stock of $5,200 was issued during the year,what was the amount of dividends declared during the year?

A) $17,200

B) $23,700

C) $23,300

D) $13,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

Houghton Company began business on January 1,2015 by issuing all of its 1,000,000 authorized shares of its $1 par value common stock for $20 per share.On June 30,Houghton declared a cash dividend of $1 per share to stockholders of record on July 31.Houghton paid the cash dividend on August 30.On November 1,Houghton reacquired 200,000 of its own shares of stock for $25 per share.On December 22,Houghton resold 100,000 of these shares for $30 per share. Required: Part a.Prepare all of the necessary journal entries to record the events described above. Part b.Prepare the stockholders' equity section of the balance sheet as of December 31,2015 assuming that the net income for the year was $3,000,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a company uses excess cash to buy back some of its outstanding common stock,which of the following ratios will be affected directly in the manner described below?

A) Return on equity (ROE) will decrease.

B) Earnings per share (EPS) will increase.

C) The Price Earnings (PE) ratio will increase.

D) There will not be any effect on the three ratios.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

King Corp.has one million shares outstanding with a par value of $5.On August 24 of this year,it issued a 10% stock dividend when its stock price was $25.As a result of this stock dividend,retained earnings:

A) increased by $500,000.

B) increased by $2,500,000.

C) decreased by $500,000.

D) decreased by $2,500,000.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On April 30,2015,Victoria Secreto sold 1,000 shares of her Limited,Inc.'s common stock to Claire Jewels for $8,000.The stock cost Victoria $5,000.Limited,Inc.'s accounting equation:

A) is not affected because the corporation is separate from its owners.

B) is not affected because of the cost principle.

C) will show an increase in total assets and total stockholders' equity.

D) will show a decrease in total assets and total stockholders' equity.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has outstanding 9 million shares of $2 par value common stock and 1 million shares of $4 par value preferred stock.The preferred stock has an 8% dividend rate.The company declares $600,000 in total dividends for the year.Which of the following is correct if dividends in arrears are $30,000?

A) Preferred stockholders will receive $350,000; common stockholders will receive $250,000.

B) Preferred stockholders will receive $60,000; common stockholders will receive $540,000.

C) Preferred stockholders will receive $320,000; common stockholders will receive $280,000.

D) Preferred stockholders will receive $90,000; common stockholders will receive $510,000.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation had 50,000 shares of $20 par value common stock outstanding.The board of directors declared and issued a 50% stock dividend.The market value of the stock was $27 per share.What is the journal entry to record this stock dividend?

A) Debit Retained Earnings and credit Common Stock for $675,000

B) Debit Retained Earnings and credit Common Stock for $500,000

C) Debit Retained Earnings and credit Cash for $675,000

D) No entry is made to record the stock dividend.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When does a corporation record an increase in Dividends Payable?

A) On the date of record

B) On the date of payment

C) On the declaration date

D) On the date of issuance

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Melrose Inc.buys back 300,000 shares of its stock from investors at $6.50 a share.Two years later,it reissues this stock for $6.00 a share.The stock reissue would be recorded with a debit to Cash for:

A) $1.8 million, a debit to Additional Paid-in Capital for $150,000, and a credit to Treasury Stock for $1.95 million.

B) $1.95 million, a credit to Treasury Stock for $1.8 million, and a credit to Additional Paid-in Capital for $150,000.

C) $1.95 million and a credit to Treasury Stock for $1.95 million.

D) $1.8 million and a credit to Treasury Stock for $1.8 million.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ambiance Inc.buys back 3,000 shares of its $10 par value common stock from investors at $45 per share.This stock repurchase would be recorded with a debit to:

A) Cash and a credit to Treasury Stock for $135,000.

B) Treasury Stock and a credit to Cash for $30,000.

C) Treasury Stock and a credit to Cash for $135,000.

D) Treasury Stock for $30,000, a debit to Additional Paid-in Capital for $105,000, and a credit to Cash for $135,000.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mr.Big received a $5,000 payment from his sole proprietorship,Buy & Large,for work performed by Mr.Big.The payment should be recorded with a $5,000:

A) debit to M. Big, Drawings.

B) debit to Salary Expense.

C) debit to M. Big, Capital.

D) credit to Salary Expense.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements accurately explains why the board of directors of a company whose financial future contains some uncertainties might issue a 2-for-1 stock split rather than declare a 100% stock dividend?

A) A stock split would not reduce the market price per share, whereas a stock dividend would.

B) A stock split would reduce the market price per share, whereas a stock dividend would not.

C) A stock split would increase total stockholders' equity, whereas a stock dividend would not.

D) A stock split would not reduce Retained Earnings, whereas a stock dividend would.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

ROE relates:

A) net income after subtracting preferred dividends to the average common stockholders' equity.

B) total assets to the average common stockholders' equity.

C) EPS to the average common stockholders' equity.

D) net income after subtracting preferred dividends to the price per share.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The term "capitalizing retained earnings" refers to:

A) transferring from Retained Earnings to Common Stock the amount of a stock dividend.

B) the recording of all costs to get an asset in place and ready for its intended use.

C) the issuance of common stock at a price in excess of par value.

D) stockholders contributing additional capital to a corporation.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Corporations can raise large amounts of money because:

A) shares of stock can be purchased in small amounts, so even small investors can participate.

B) investors always prefer to invest in stock so they can receive dividends.

C) stocks are always a good investment.

D) investing in the stock market is the surest way to get rich quick.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

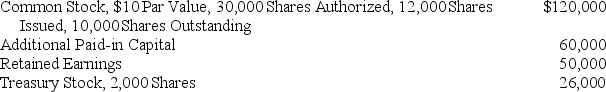

The following data are taken from the stockholders' equity section of the balance sheet of a company:

What was the average issue price per share of the common stock?

What was the average issue price per share of the common stock?

A) $13.00

B) $10.00

C) $15.00

D) $18.00

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

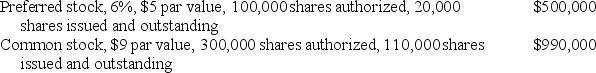

A company has the following paid-in capital:

-Use the information above to answer the following question.If the company pays a $15,000 dividend and the preferred stock is noncumulative,what is the amount the common stockholders will receive?

-Use the information above to answer the following question.If the company pays a $15,000 dividend and the preferred stock is noncumulative,what is the amount the common stockholders will receive?

A) $15,000

B) $9,000

C) $9,900

D) $0

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company issues 100,000 shares of preferred stock for $40 per share.The stock has a fixed dividend rate of 5% and a par value of $3 per share.The company records the issuance with a debit to Cash for:

A) $4 million and a credit to Preferred Stock for $4 million.

B) $300,000 and a credit to Preferred Stock for $300,000.

C) $4 million, a credit to Preferred Stock for $300,000, and a credit to Additional Paid-in Capital for $3.7 million.

D) $300,000, a debit for $3.7 million to Long-term Investments , a credit to Preferred Stock for $300,000, and a credit to Additional Paid-in Capital for $3.7 million.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 253

Related Exams