A) If other assets are unchanged, stockholders' equity must be increasing.

B) If other assets are unchanged, stockholders' equity must be decreasing.

C) If stockholders' equity is unchanged, another asset must be decreasing.

D) If stockholders' equity is unchanged, other assets must be unchanged.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 5,Arlington Inc.purchases $23,000 of supplies; payment is not required until February 4.What action should be taken by Arlington Inc.on January 5?

A) No journal entry is required; this transaction should not be recorded until the payment is made.

B) A journal entry that includes a credit to Accounts Payable should be prepared.

C) A journal entry that includes a debit to Accounts Payable should be prepared.

D) A journal entry that includes a debit to Prepaid Expenses should be prepared.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume a company only entered into financing and investing activities and has prepared its journal entries and posted them to T-accounts.How would the related account balances be listed on its trial balance?

A) Credits first, followed by debits

B) Debits first, followed by credits

C) Alphabetically

D) In descending order by dollar amount

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The principle that is used to measure the amount assets are to be recorded at when exchanged is called the ______ principle.

A) cash

B) cost

C) assets

D) separate entity

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stockholders' equity in a corporation consists of:

A) Amounts invested and reinvested by a company's owners.

B) Resources presently owned by a business that generate future economic benefits.

C) Amounts invested in assets that will be used for one or more years.

D) Amounts presently owed by a business.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) A current ratio of 1.60 means the company's current assets are probably not sufficient to pay its current liabilities.

B) The separate entity assumption requires that the financial activities of the owners of a company be reported on the company's balance sheet.

C) The cost principle states that recording activities at cost will result in the balance sheet representing the true value of the company.

D) A transaction is recorded if it has a measurable financial effect on the assets, liabilities or stockholders' equity of a business.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a company pays back money borrowed from a bank,which of the following would be included in the journal entry to record this transaction?

A) Credit Notes Payable and debit Common Stock

B) Debit Cash and credit Notes Payable

C) Debit Cash and credit Common Stock

D) Credit Cash and debit Notes Payable

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the minimum number of accounts that must be involved in any transaction?

A) One

B) Two

C) Three

D) There is no minimum.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

CheapBooks Incorporated (CBI)had the following business activities: 1.Stockholders invest $25,000 cash in the corporation. 2.CBI purchased $400 of office supplies on credit. 3.CBI purchased office equipment for $7,000,paying $2,500 in cash and signing a 30-day note payable for the remainder. 4.CBI paid $200 cash on account for office supplies purchased in transaction 2. 5.CBI purchased two acres of land for $10,000,signing a 2-year note payable. 6.CBI sold one acre of land at one-half of the total cost of the two acres,receiving the full amount or $5,000 in cash. 7.CBI made a payment of $5,000 on its 2-year note.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A noncurrent liability is one that the company:

A) has owed for over one year.

B) has owed for over five years.

C) will not pay within 12 months.

D) will not pay within five years.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the effect on the balance sheet if a company purchases equipment using cash?

A) No effect on total assets; Decrease total liabilities; Increase total stockholders' equity

B) Increase total assets; Increase total liabilities; Increase total stockholders' equity

C) Decrease total assets; No effect on total liabilities; Increase total stockholders' equity

D) No effect on total assets; No effect on total liabilities; No effect on total stockholders' equity

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

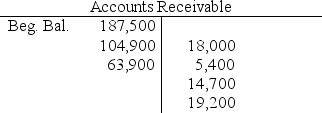

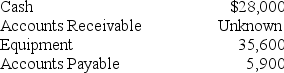

Partial list of account balances at the end of the year:

Partial list of account balances at the end of the year:

-Use the information above to answer the following question.Which of the following is an accurate description of the economic events involving Accounts Receivable as documented in the T-account above?

-Use the information above to answer the following question.Which of the following is an accurate description of the economic events involving Accounts Receivable as documented in the T-account above?

A) Sales to customers on account exceeded the payments received from customers on account.

B) Payments received from customers on account exceeded the sales made to customers on account.

C) The company paid off its debt more than it incurred new debt.

D) The company incurred more debt than it paid off.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Accounts Receivable account:

A) has a normal credit balance.

B) is increased by a debit.

C) is a liability.

D) is increased when a company receives cash from its customers.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The classified balance sheet for a company reported current assets of $1,623,850, total liabilities of $799,540, Common Stock of $1,000,000, and Retained Earnings of $130,260.The current ratio was 2.5. -Use the information above to answer the following question.Which of the following statements is not correct?

A) Total Assets are $1,929,800.

B) Total Stockholders' equity is $1,130,260.

C) Noncurrent liabilities are $130,260.

D) The amount of current assets is 2.5 times the amount of current liabilities.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Oats,Inc.has $14,000 in Cash,$37,000 in Accounts Receivable,$2,500 in Supplies,$52,000 in Accounts Payable and $12,400 in Wages Payable.If Oats uses Cash to pay off $8,000 of the Wages Payable,which of the following statements is correct?

A) The company's current ratio will not change since current assets decreased by the same amount that current liabilities increased.

B) The company will look more favorable to creditors.

C) The company has a greater ability to pay current liabilities.

D) The company's current ratio will decrease.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding debits and credits is always correct?

A) Debits decrease accounts while credits increase them.

B) The total value of all debits recorded in the ledger must equal the total value of all credits recorded in the ledger.

C) The total value of all debits to a particular account must equal the total value of all credits to that account.

D) The normal balance for an account is the side on which it decreases.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Purrfect Pets,Inc.makes a $10,000 payment on account.This would result in a:

A) $10,000 credit to Cash and a $10,000 credit to Accounts Payable.

B) $10,000 debit to Cash and a $10,000 debit to Accounts Payable.

C) $10,000 debit to Accounts Payable and a $10,000 credit to Cash.

D) $10,000 debit to Cash and a $10,000 credit to Accounts Payable.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Typical cash flows from investing activities include:

A) payments to purchase property and equipment.

B) repayment of loans.

C) proceeds from issuing notes payable.

D) receipts from cash sales.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a company borrows money from a bank and signs an agreement to repay the loan several years from now,in which account would the company report the amount borrowed?

A) Common Stock

B) Accounts Payable

C) Notes Payable (long-term)

D) Retained Earnings

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about the balance sheet is correct?

A) A classified balance sheet is one that contains privileged information.

B) Current liabilities are debts and other obligations that will be paid or fulfilled within 12 months of the balance sheet date.

C) All companies use the chart of account names defined by the Financial Accounting Standards Board (FASB) .

D) A balance sheet is prepared for a period of time.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 193

Related Exams