A) which is largely due to the success of the negative income tax program.

B) which is largely due to the success of private charities.

C) yet the percentage of children living with only one parent has increased.

D) and the percentage of children living with only one parent has decreased.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

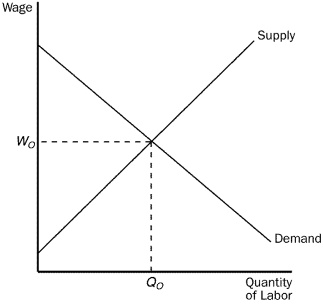

Figure 20-3

-Refer to Figure 20-3.An effective minimum wage would be set at a level

-Refer to Figure 20-3.An effective minimum wage would be set at a level

A) above Wₒ, and employment would rise above Qₒ.

B) above Wₒ, and employment would fall below Qₒ.

C) below Wₒ, and employment would rise above Qₒ.

D) below Wₒ, and employment would fall below Qₒ.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following programs would be favored by philosopher John Rawls and why?

A) A negative income tax because it maximizes the income of the poorest member of society.

B) The Supplemental Security Income (SSI) program because it does not encourage illegitimate births or break up two-parent families.

C) A minimum-wage law because it benefits unskilled workers regardless of their income levels.

D) None of the programs would be favored because each of them forcibly redistributes income that was fairly, if not equally, earned.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a government policy alters the distribution of income to achieve greater income equality,which of the following will happen?

A) Incentives for earning income are distorted.

B) Consumers alter their behavior in response to the policy.

C) The new allocation of resources is less efficient than the pre-policy allocation.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Saving and borrowing is indicative of a family that

A) is most likely to be poor.

B) has a difficult time balancing its standard of living.

C) adjusts its standard of living to reflect transitory changes in income.

D) is most likely millionaires.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that a family saves and borrows to buffer itself against changes in income.These actions relate to which problem in measuring inequality?

A) in-kind transfers

B) negative income tax

C) transitory versus permanent income

D) economic mobility

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The poverty rate is based on a family's

A) income, in-kind transfers, and other government aid.

B) income and in-kind transfers.

C) in-kind transfers only.

D) income only.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Because people can borrow when they are young,the life cycle theory would suggest that one's standard of living depends on

A) lifetime income rather than annual income.

B) aggregate income rather than annual personal income.

C) annual extended family income rather than annual personal income.

D) income averaged across seasons rather than across years.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Poverty is found to be correlated with

A) age and race but not family composition.

B) race only.

C) race and family composition but not age.

D) age, race, and family composition.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 20-2

Poverty Thresholds in 2002, by Size of Family and Number of Related Children Under 18 Years

[Dollars]

![Table 20-2 Poverty Thresholds in 2002, by Size of Family and Number of Related Children Under 18 Years [Dollars] Source: U. S. Bureau of the Census, Current Population Survey. -Refer to Table 20-2.What is the poverty line for a family of three with one child? A) $12,072 B) $12,400 C) $14,480 D) $14,494](https://d2lvgg3v3hfg70.cloudfront.net/TB2178/11ea43b2_bcff_7870_a27f_db7bbac2951c_TB2178_00_TB2178_00_TB2178_00_TB2178_00_TB2178_00.jpg) Source: U. S. Bureau of the Census, Current Population Survey.

-Refer to Table 20-2.What is the poverty line for a family of three with one child?

Source: U. S. Bureau of the Census, Current Population Survey.

-Refer to Table 20-2.What is the poverty line for a family of three with one child?

A) $12,072

B) $12,400

C) $14,480

D) $14,494

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Government programs that take money from high-income people and give it to low-income people typically

A) improve economic efficiency by reducing poverty.

B) reduce economic efficiency because they distort incentives.

C) have no effect on economic efficiency because they both reduce poverty and distort incentives.

D) sometimes improve, sometimes reduce, and sometimes have no effect on economic efficiency.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The economic life cycle describes how young people usually have higher savings rates than middle-aged people.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

About four out of five millionaires in the United States earned their money rather than inherited it.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which political philosophy focuses on the process of determining the distribution of income rather than on the outcome?

A) utilitarianism

B) liberalism

C) libertarianism

D) None of the above is correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A government's policy of redistributing income makes the income distribution more equitable,

A) distorts incentives, and makes the allocation of resources more efficient.

B) alters behavior, and makes the allocation of resources more efficient.

C) distorts incentives but does not alter behavior.

D) distorts incentives, and makes the allocation of resources less efficient.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 20-2

Poverty Thresholds in 2002, by Size of Family and Number of Related Children Under 18 Years

[Dollars]

![Table 20-2 Poverty Thresholds in 2002, by Size of Family and Number of Related Children Under 18 Years [Dollars] Source: U. S. Bureau of the Census, Current Population Survey. -Refer to Table 20-2.What is the poverty line for a family of six with three children? A) $21,469 B) $24,797 C) $25,738 D) $28,718](https://d2lvgg3v3hfg70.cloudfront.net/TB2178/11ea43b2_bcff_7870_a27f_db7bbac2951c_TB2178_00_TB2178_00_TB2178_00_TB2178_00_TB2178_00.jpg) Source: U. S. Bureau of the Census, Current Population Survey.

-Refer to Table 20-2.What is the poverty line for a family of six with three children?

Source: U. S. Bureau of the Census, Current Population Survey.

-Refer to Table 20-2.What is the poverty line for a family of six with three children?

A) $21,469

B) $24,797

C) $25,738

D) $28,718

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not correct?

A) Two key elements of welfare reform are work requirements and limiting the time that recipients can receive benefits.

B) The Earned Income Tax Credit (EITC) is very similar to a negative income tax.

C) Minimum wage laws will likely increase unemployment.

D) The elderly are more likely to be poor than single mothers.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In-kind transfers are politically popular because

A) they provide high quality food and shelter.

B) they provide cash.

C) allow resale of food stamps for cash, if needed.

D) the public believes that the aid is not going to support addictions.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The invisible hand of the marketplace acts to allocate resources efficiently,but it does not necessarily ensure that resources are allocated fairly.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a question that economists try to answer when measuring the distribution of income?

A) How much inequality is there in our society?

B) How many people live in poverty?

C) How often do people receive raises?

D) What problems arise in measuring the amount of inequality?

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 247

Related Exams