A) $20,500 increase

B) $20,000 decrease

C) $20,500 decrease

D) $20,000 increase

F) A) and B)

Correct Answer

verified

A

Correct Answer

verified

True/False

The contribution margin and the manufacturing margin are usually equal.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the ability to sell and the amount of production facilities devoted to each of two products is equal, it is profitable to increase the sales of that product with the highest contribution margin.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not true when determining the selling price for a product?

A) Absorption costing should be used to determine routine pricing which includes both fixed and variable costs.

B) As long as the selling price is set above the variable costs, the company will make a profit in short run.

C) Variable costing is effective when determining short run decisions, but absorption costing is only used for long-term pricing policies.

D) Both variable and absorption pricing plans should be considered, to include several pricing alternatives.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

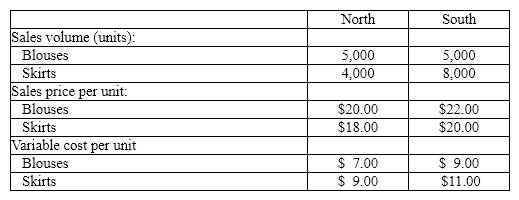

The following data are for Trendy Fashion Apparel:  Determine the contribution margin for:

(a) Skirts

(b) the South Region.

Determine the contribution margin for:

(a) Skirts

(b) the South Region.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under variable costing, which of the following costs would not be included in finished goods inventory?

A) direct labor cost

B) direct materials cost

C) variable factory overhead cost

D) fixed factory overhead cost

F) B) and C)

Correct Answer

verified

Correct Answer

verified

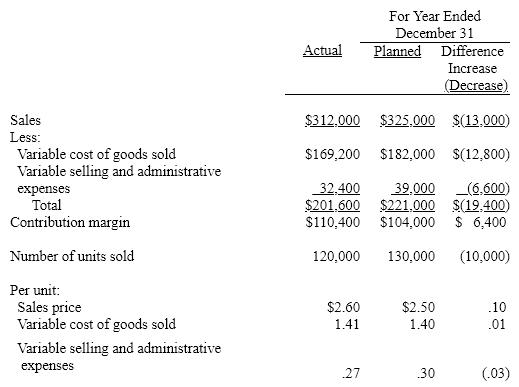

Short Answer

Based upon the following data taken from the records of Bruce Inc., prepare a contribution margin analysis report for the year ended December 31.

Correct Answer

verified

11ec19e2_58b7_dad9_a978_87c1a0ca54c2_TBX9037_00

Correct Answer

verified

Multiple Choice

Under variable costing, which of the following costs would be included in finished goods inventory?

A) neither variable nor fixed factory overhead cost

B) both variable and fixed factory overhead cost

C) only variable factory overhead cost

D) only fixed factory overhead cost

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

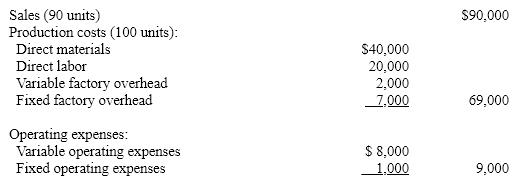

A business operated at 100% of capacity during its first month, with the following results:  What is the amount of the income from operations that would be reported on the absorption costing income statement?

What is the amount of the income from operations that would be reported on the absorption costing income statement?

A) $21,000

B) $18,900

C) $18,200

D) $27,900

F) None of the above

Correct Answer

verified

B

Correct Answer

verified

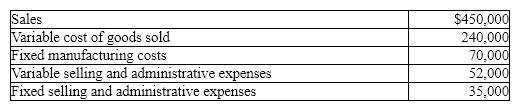

Short Answer

Philadelphia Company has the following information for March:  Determine the March

(a) manufacturing margin

(b) contribution margin

(c) income from operations for Philadelphia Company.

Determine the March

(a) manufacturing margin

(b) contribution margin

(c) income from operations for Philadelphia Company.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under which inventory costing method could increases or decreases in income from operations be misinterpreted to be the result of operating efficiencies or inefficiencies?

A) only variable costing

B) only absorption costing

C) both variable and absorption costing

D) neither variable nor absorption costing

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Direct labor cost is an example of a controllable cost for the supervisor of a manufacturing department.

B) False

Correct Answer

verified

Correct Answer

verified

Matching

Matching

Correct Answer

True/False

In a service firm, it may be necessary to have several activity bases to properly match the change in costs with the changes in various activities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In the absorption costing income statement, deduction of the cost of goods sold from sales yields contribution margin.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For short-run production planning, information in the absorption costing format is more useful to management than is information in the variable costing format.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What term is commonly used to describe the concept whereby the cost of manufactured products is composed of direct materials cost, direct labor cost, and all factory overhead cost?

A) Standard costing

B) Variable costing

C) Absorption costing

D) Marginal costing

F) None of the above

Correct Answer

verified

Correct Answer

verified

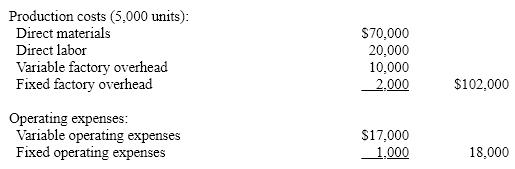

Multiple Choice

A business operated at 100% of capacity during its first month and incurred the following costs:  If 1,000 units remain unsold at the end of the month and sales total $150,000 for the month, what is the amount of the contribution margin that would be reported on the variable costing income statement?

If 1,000 units remain unsold at the end of the month and sales total $150,000 for the month, what is the amount of the contribution margin that would be reported on the variable costing income statement?

A) $51,400

B) $52,000

C) $54,000

D) $53,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

For a period during which the quantity of inventory at the end was larger than that at the beginning, income from operations reported under variable costing will be smaller than income from operations reported under absorption costing.

B) False

Correct Answer

verified

Correct Answer

verified

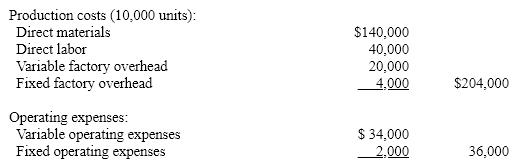

Multiple Choice

A business operated at 100% of capacity during its first month and incurred the following costs:  If 2,000 units remain unsold at the end of the month and sales total $300,000 for the month, what would be the amount of income from operations reported on the variable costing income statement?

If 2,000 units remain unsold at the end of the month and sales total $300,000 for the month, what would be the amount of income from operations reported on the variable costing income statement?

A) $100,800

B) $100,000

C) $114,800

D) $140,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 153

Related Exams