A) liberalism.

B) libertarianism.

C) mobilism.

D) utilitarianism.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

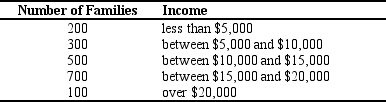

The poverty line in the country of Inequalia is $10,000.The distribution of income for Inequalia is as follows:  The poverty rate in Inequalia is

The poverty rate in Inequalia is

A) 11.1 percent.

B) 16.7 percent.

C) 27.8 percent.

D) 55.5 percent.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The poverty rate is a measure of the percentage of people whose incomes fall below

A) a relative level of income.

B) an absolute level of income.

C) the median income for a family of three.

D) the bottom 20 percent of the income distribution.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A binding minimum wage

A) affects employees but not employers.

B) lowers the productivity of workers.

C) raises the cost of labor to firms.

D) All of the above are correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

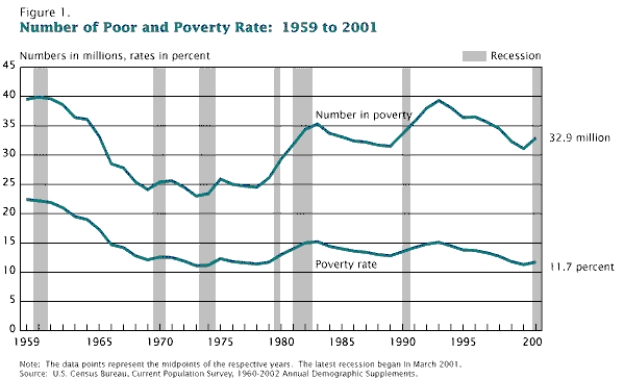

Figure 20-2

Number of Poor

-Refer to Figure 20-2.Between 1965 and 2001,during recessions (the shaded bars) the number of individuals in poverty has

-Refer to Figure 20-2.Between 1965 and 2001,during recessions (the shaded bars) the number of individuals in poverty has

A) increased.

B) decreased.

C) not changed.

D) decreased and then increased.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

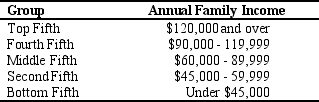

Table 20-3

The Distribution of Income in Hapland

-Refer to Table 20-3.If the poverty rate is 23%,where is the poverty line in Hapland?

-Refer to Table 20-3.If the poverty rate is 23%,where is the poverty line in Hapland?

A) under $45,000

B) between $45,000 and $59,999

C) between $60,000 and $89,999

D) between $90,000 and $119,999

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

When the government enacts policies to make the distribution of income more equitable,it distorts incentives,alters behavior,and makes the allocation of resources less efficient.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 20-9

Poverty Thresholds in 2002, by Size of Family and Number of Related Children Under 18 Years

[Dollars]

![Table 20-9 Poverty Thresholds in 2002, by Size of Family and Number of Related Children Under 18 Years [Dollars] Source: U. S. Bureau of the Census, Current Population Survey. -Refer to Table 20-9.What is the poverty line for a family of six with three children? A) $21,469 B) $24,797 C) $25,738 D) $28,718](https://d2lvgg3v3hfg70.cloudfront.net/TB2185/11ea33e9_388d_e064_ac7d_d3b8556c5ada_TB2185_00_TB2185_00_TB2185_00_TB2185_00_TB2185_00_TB2185_00.jpg) Source: U. S. Bureau of the Census, Current Population Survey.

-Refer to Table 20-9.What is the poverty line for a family of six with three children?

Source: U. S. Bureau of the Census, Current Population Survey.

-Refer to Table 20-9.What is the poverty line for a family of six with three children?

A) $21,469

B) $24,797

C) $25,738

D) $28,718

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Governments enact policies to

A) make the distribution of income more efficient.

B) make the distribution of income more equal.

C) maximize the use of the welfare system.

D) minimize the use of in-kind transfers.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Critics of the minimum wage argue that

A) labor demand is inelastic so firms can adjust production.

B) too many older employees benefit at the expense of teenage workers.

C) many minimum-wage earners are teenagers from middle-class families.

D) All of the above are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

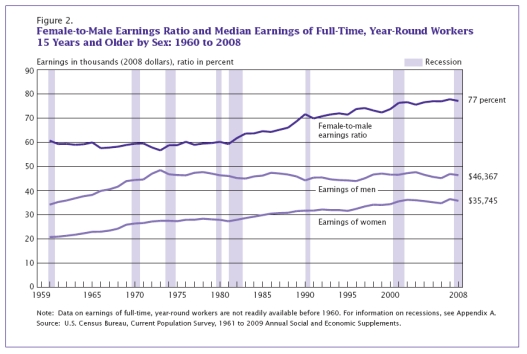

Figure 20-1

-Refer to Figure 20-1.The ratio of female-to-male earnings has increased steadily from about 1980 to 2008 because the earnings of men

-Refer to Figure 20-1.The ratio of female-to-male earnings has increased steadily from about 1980 to 2008 because the earnings of men

A) increased steadily but by approximately half of the increase in the earnings of women.

B) decreased while the earnings of women increased.

C) stayed relatively constant while the earnings of women increased.

D) decreased by substantially more than the decrease in the earnings of women.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not correct?

A) A negative income tax only applies to working people, so it encourages people to get full-time work.

B) Supporters advocate the use of the Earned Income Tax Credit as a way to help the working poor.

C) A negative income tax subsidizes the incomes of poor people.

D) An advantage of a negative income tax is that it is not based on the number of children, so it does not provide incentives for unmarried women to have children.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

About half of black and Hispanic children in female-headed households live in poverty.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A utilitarian government must

A) calculate the utility of each individual in society.

B) avoid enacting any policies that redistribute income from the rich to the poor.

C) balance the gains from greater equality against the losses from distorted incentives.

D) pursue policies that do not affect the middle class.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The poverty rate is

A) a measure of income inequality across families.

B) the percentage of the population whose family income falls below a specified level.

C) an absolute level of income set by the federal government for each family size.

D) measured by the number of in-kind transfers that a family receives.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which group (or groups) would be the most upset by wide variation in the income distribution?

A) utilitarians

B) utilitarians and liberals

C) libertarians

D) liberals and libertarians

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Medicaid and food stamps are

A) available only to the elderly.

B) forms of in-kind assistance.

C) forms of cash assistance.

D) transfer payments.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A typical worker's normal or average income is called

A) the life cycle.

B) permanent income.

C) transitory income.

D) in-kind transfers.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2008,the poverty line for a family of four in the U.S.was

A) $56,194.

B) $22,025.

C) $19,971.

D) $12,603.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) The poverty line is a relative standard.

B) More families are pushed above the poverty line as economic growth pushes the entire income distribution upward.

C) Increasing income inequality reduces poverty.

D) Economic growth, by definition, affects all families equally.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 201 - 220 of 374

Related Exams