A) a regressive tax

B) a proportional tax

C) a progressive tax

D) a horizontal equity tax

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The idea that people in equal conditions should pay equal taxes is referred to as

A) horizontal equity.

B) vertical equity.

C) the ability-to-pay principle.

D) the marriage tax.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Who observed that "in this world nothing is certain but death and taxes"?

A) Mark Twain

B) P.T. Barnum

C) Ben Franklin

D) Richard Nixon

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government were to impose a tax that assigned everyone the same tax liability,it would be

A) a lump-sum tax.

B) an equitable tax.

C) supported by the poor.

D) a progressive tax.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 12-2 Suppose Roger and Regina receive great satisfaction from their consumption of cheesecake. Regina would be willing to purchase only one slice and would pay up to $8 for it. Roger would be willing to pay $11 for his first slice, $9 for his second slice, and $5 for his third slice. The current market price is $5 per slice. -Refer to Scenario 12-2.How much consumer surplus does Regina receive from consuming her slice of cheesecake?

A) $3

B) $5

C) $9

D) $12

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Deadweight losses are associated with

A) taxes that distort the incentives that people face.

B) taxes that target expenditures on survivor's benefits for Social Security.

C) taxes that have no efficiency losses.

D) lump-sum taxes.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

European countries tend to rely on which type of tax more so than the United States does?

A) an income tax

B) a lump-sum tax

C) a value-added tax

D) a corrective tax

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The government taxes corporate income on the basis of

A) profit.

B) the amount the firm receives for the goods or services it sells.

C) the number of employees.

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

From the time of Benjamin Franklin to the present,the percentage of the average American's income that goes to pay taxes

A) has decreased from about 20 percent to about 10 percent.

B) has remained constant at about 10 percent.

C) has risen from less than 2 percent to about 44.4 percent.

D) has risen from less than 5 percent to about 33.3 percent.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

European countries tend to rely more on consumption taxes than does the United States.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

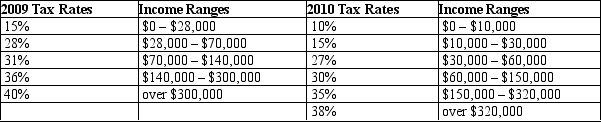

Table 12-12

United States Income Tax Rates for a Single Individual, 2009 and 2010.

-Refer to Table 12-12.Kurt is a single person whose taxable income is $35,000 a year.What is his marginal tax rate in 2009?

-Refer to Table 12-12.Kurt is a single person whose taxable income is $35,000 a year.What is his marginal tax rate in 2009?

A) 15%

B) 28%

C) 31%

D) 36%

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the United States,the payroll tax is also called a

A) dividend income tax.

B) social insurance tax.

C) value added tax.

D) capital gains tax.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In designing a tax system,policymakers have two objectives that are often conflicting.They are

A) maximizing revenue and minimizing costs to taxpayers.

B) efficiency and minimizing costs to taxpayers.

C) efficiency and equity.

D) maximizing revenue and reducing the national debt.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If we want to gauge how much the income tax system distorts incentives,we should use the

A) average tax rate.

B) ability-to-pay principle.

C) total tax revenue collected.

D) marginal tax rate.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The typical state spends the most on

A) education.

B) Medicare and Social Security.

C) highways.

D) defense.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bert faces a progressive tax structure that has the following marginal tax rates: 0 percent on the first $10,000,10 percent on the next $10,000,15 percent on the next $10,000,25 percent on the next $10,000,and 50 percent on all additional income.If Bert earns $75,000,what is his average tax rate?

A) 20 percent

B) 25 percent

C) 30 percent

D) 36.67 percent

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An advantage of a consumption tax over the present tax system is that a consumption tax

A) raises more revenues.

B) would save the government millions in administrative costs.

C) places more of the tax burden on the wealthy.

D) does not discourage saving.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

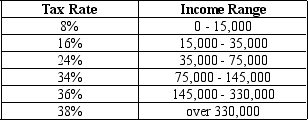

Table 12-2

Consider the tax rates shown in the table below.

-Refer to Table 12-2.If Noah has taxable income of $43,000,his tax liability is

-Refer to Table 12-2.If Noah has taxable income of $43,000,his tax liability is

A) $1,920.

B) $4,400.

C) $6,320.

D) $8,175.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

State and local government spending on public welfare includes

A) trash removal.

B) transfer payments to the poor.

C) libraries.

D) road repairs.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mary values a movie at $15 while Tim values it at $10.The price of the movie is $9.If the government imposes a $2 tax per movie and the price of a movie rises to $11,what part of the deadweight loss comes from Mary and what part comes from Tim?

A) none comes from Mary, $1 comes from Tim

B) none comes from Mary, $3 comes from Tim

C) $2 comes from Mary, $1 comes from Tim

D) $4 comes from Mary, $3 comes from Tim

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 478

Related Exams