A) as a $100,000 investing inflow,and a $100,000 financing outflow.

B) as a $100,000 investing outflow,and a $100,000 financing inflow.

C) as a $100,000 operating inflow,and a $100,000 financing outflow.

D) in a supplementary schedule.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The introductory phase of a company's life cycle will most likely have net cash:

A) provided by investing activities.

B) used in financing activities.

C) used in investing activities.

D) provided by operating activities.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Under the indirect method,changes in current assets are used in determining cash flows from operating activities and changes in current liabilities are used in determining cash flows from financing activities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Supplemental disclosures required by companies using the indirect method include all of the following except:

A) cash paid for interest.

B) cash paid for income tax.

C) cash paid for dividends.

D) noncash investing and financing activities.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about financing activities is not correct?

A) Cash dividends paid to a company's stockholders are reported as cash outflows from financing activities.

B) When a company issues stock for cash,it reports a cash inflow from financing activities.

C) When a company repurchases stock with cash,it reports a cash outflow for financing activities.

D) When a company repays a loan,it reports a cash inflow from financing activities.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following represent cash outflows from financing activities?

A) Distributing a stock dividend.

B) Paying a bond's face value at maturity.

C) Issuing long-term bonds at a discount.

D) Paying interest on promissory notes.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bracken,Inc.uses the direct method to determine its cash flow from operations.During the year,it had sales revenue of $480,000.Its beginning Accounts Receivable balance was $48,000,and its ending Accounts Receivable balance was $64,000.Its cash collected from customers for the year was:

A) $480,000.

B) $464,000.

C) $496,000.

D) $592,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Major investing and financing activities that do not involve cash do not have to be reported as part of the statement of cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Castle Company's sales revenue was $584,696 and cash collected from customers was $587,003,which of the following would be consistent with this difference?

A) Accounts Receivable could have increased.

B) Cash payments could have been larger than the related expense accounts.

C) Accounts Receivable could have decreased.

D) Cash payments could have been smaller than the related expense accounts.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Two years ago,Bethel,Inc.bought $80,000 in bonds from another company.This month,it sold half of those bonds for $41,280 and purchased the common stock of another company for $2,000.On the statement of cash flows for this accounting period,Bethel would report a net cash:

A) outflow of $39,280 from investing activities.

B) inflow of $39,280 from investing activities.

C) inflow of $41,280 from investing activities.

D) outflow of $41,280 from investing activities.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) Accrual-based net income can be manipulated because it is based on estimates.

B) Cash flows are easily manipulated because they are based on estimates.

C) Accrual-based net income is not easily manipulated because valuation for such items as bad debts and inventory are precise and based on objectively verifiable information.

D) Cash flows are not easily manipulated because they are generated by internal transactions and do not involve external parties.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Matching

Choose the appropriate letter to match the account balance change with the type of adjustment made to net income when using the indirect method to determine net cash flow provided by operating activities.

Correct Answer

Multiple Choice

To determine net cash provided by or used in financing activities,one must analyze the:

A) Notes Receivable and Bonds Payable accounts.

B) Cash account.

C) Common Stock and Retained Earnings accounts.

D) Interest Expense and Dividend Income accounts.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Accrual-basis accounting is superior to cash-basis accounting in that:

A) it provides a better measure of profitability.

B) a statement of cash flows is not needed.

C) the cash balance reported will be greater.

D) there is only one method of preparing the operating activities of the statement of cash flows.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

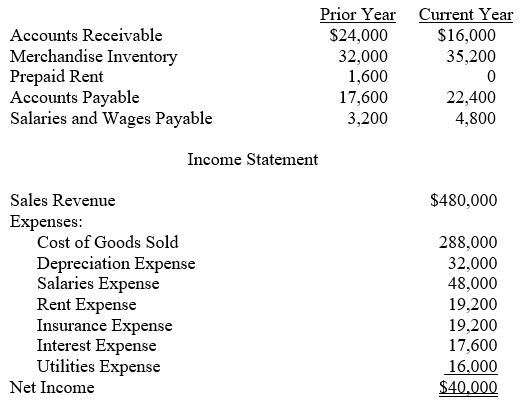

Selected balance sheet information and the income statement for Pioneer Industries for the current year are presented below.

Selected Balance Sheet Accounts

Required:

Prepare the cash flows from operating activities section of the statement of cash flows using the indirect method.

Required:

Prepare the cash flows from operating activities section of the statement of cash flows using the indirect method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Marathon,Inc.showed Salaries and Wages Expense of $244,000 on its income statement.If the Salaries and Wages Payable account was $27,000 at the beginning of the year and $18,500 at the end of the year,how much cash was paid to employees?

A) $217,000

B) $225,500

C) $252,500

D) $235,500

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

In the decline phase,the company continues to enjoy positive operating cash flows but stops spending cash on investing activities and instead uses its cash for financing activities such as repaying lenders and returning excess cash to shareholders.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which phrase below best describes the direct method for reporting operating cash flows?

A) A method that incorporates financing and investing activities into cash flows from operations.

B) A method employing accrual-based accounting to convert cash flows to GAAP Net Income.

C) A summary of operating transactions resulting in either a debit or credit to cash.

D) A series of adjustments to Net Income to arrive at operating cash flows.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following items below will be subtracted in the financing cash flow portion of the statement of cash flows?

A) Net income earned.

B) Bank loans obtained.

C) Payment of dividends.

D) Disposal of equipment.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Subtracting a decrease in Unearned Revenue from net income eliminates the effect of recording revenue that:

A) increased net income,but did not impact cash this period.

B) decreased net income,but did not impact cash this period.

C) increased net income and increased cash flow this period.

D) decreased net income and decreased cash flow this period.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 222

Related Exams