A) customers are dissatisfied with the product or service they bought.

B) the company is effectively managing its receivables.

C) the company has begun estimating the amount of uncollectibles using percentage of net sales rather than aging the receivables.

D) the company's payment terms have been tightened and customers are paying within the payment period granted.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Accounts Receivable,Net (or Net Accounts Receivable) equals Accounts Receivable (gross) minus:

A) Cost of Goods Sold.

B) Bad Debt Expense.

C) Allowance for Doubtful Accounts.

D) Current Liabilities.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Interest on a two-month,7%,$1,000 note would be calculated as $1,000 × 0.07 × 2/12.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The advantage of extending credit to customers is that it helps customers to buy products and services,thereby increasing the seller's revenue.The disadvantages of extending credit are costs related to:

A) increased sales.

B) bad debt expense.

C) increased notes receivable.

D) marketing.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The adjusting entry to record the allowance for doubtful accounts includes a:

A) debit to Bad Debt Expense.

B) debit to Allowance for Doubtful Accounts.

C) debit to Sales Revenue.

D) credit to Accounts Receivable.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the term and its definition.There are more definitions than terms. -Accounts Receivable

A) The portion of Accounts Receivable that the company expects to collect.

B) The time at which a loan must be repaid.

C) An agreement by a borrower to repay the lending company with interest during a specified time period.

D) The days of the year divided by the net sales revenue.

E) A financial statement that shows the calculation of Bad Debt Expense for a company.

F) Total money owed the company for sales made on credit.

G) An account that is debited for the amount of credit sales estimated as uncollectible.

H) A contra-asset account.

I) The time at which a borrower must make annual interest payments.

J) Net credit sales revenue divided by the average net receivables.

K) Net credit sales revenue divided by the net income.

L) The days of the year divided by the receivables turnover ratio.

N) C) and K)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Maple Broadcasting Co.lends $20,000 to an employee who signs a 9%,6-month promissory note.What is the total amount of interest on this note?

A) $1,800

B) $900

C) $20,900

D) $5,400

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which method requires first estimating the desired amount for the Allowance for Doubtful Accounts and then determining the amount of the expense required to get to this desired balance given the amount of the unadjusted balance?

A) Aging of accounts receivable method

B) Percentage of credit sales method

C) Direct write-off method

D) Percentage of bad debts method

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On March 1,Preston Corporation loans $3,000 to an employee and receives a 5%,three-month note.Interest will be paid when the note matures on May 31.Assuming that interest on the note has not previously been accrued,what entry will Preston make on April 30?

A) Debit Interest Revenue and credit Interest Receivable $25.

B) Debit Interest Receivable and credit Interest Revenue $25.

C) Debit Interest Receivable and credit Interest Revenue $50.

D) Debit Cash and credit Interest Revenue for $50.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a company has earned interest in the current period but has not yet recorded the interest,what type of adjustment is the company required to make?

A) Make an adjusting entry at the end of the current period to accrue the interest earned.

B) Make no adjusting entry at the end of the period because interest has not been earned yet.

C) Make an adjusting entry at the end of the next period to accrue interest earned.

D) No adjustment is necessary until the cash is collected.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Morrow Inc.uses the percentage of credit sales method of estimating doubtful accounts.The Allowance for Doubtful Accounts has an unadjusted credit balance of $2,700 and the company had $140,000 of net credit sales during the period.Morrow has experienced bad debt losses of 6% of credit sales in prior periods.After making the adjusting entry for estimated bad debts,what is the ending balance in the Allowance for Doubtful Accounts account?

A) $11,100

B) $8,400

C) $8,238

D) $5,700

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,a company lends a customer $90,000 for one year at a 7% annual interest rate.The note requires the payment of interest twice each year on June 30 and December 31.An adjusting entry to accrue interest is recorded at the end of every month.On July 2,a check for the interest payment for January through June comes in the mail.What journal entry will the company record on July 2?

A) Debit Interest Receivable for $3,150 and credit Interest Revenue for $3,150.

B) Debit Cash for $3,150 and credit Notes Receivable for $3,150.

C) Debit Interest Revenue for $3,150 and credit Cash for $3,150.

D) Debit Cash for $3,150 and credit Interest Receivable for $3,150.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

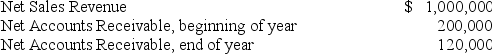

The financial statements of Pomegranate Produce contained the following information:  What is the receivables turnover ratio?

What is the receivables turnover ratio?

A) 5.00 times

B) 6.25 times

C) 12.50 times

D) 8.34 times

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the interest formula,the interest rate is on a(n) ________ basis;therefore,the time variable must reflect how many ________ out of ________ in the interest period.

A) monthly;months;6

B) annual;years;1

C) monthly;months;12

D) annual;months;12

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To ensure that the Allowance for Doubtful Accounts account does not become materially misstated over time,companies revise overestimates of prior periods by:

A) recording a retroactive correcting entry.

B) lowering estimates in the current period.

C) increasing estimates in the current period.

D) notifying the users of its financial statements of the error.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The Allowance for Doubtful Accounts account is a temporary account,which is closed to Retained Earnings at the end of the accounting period.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a company factors its receivables,its receivables turnover ratio will be higher than it would have been if the receivables had not been factored.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lakeview Inc.uses the allowance method.During the year,Lakeview concludes that specific customers will never pay their account balances,which total $6,844.The entry to record the write-off of these accounts receivable would debit:

A) Accounts Receivable and credit Allowance for Doubtful Accounts for $6,844.

B) Accounts Receivable and credit Bad Debt Expense for $6,844.

C) Bad Debt Expense and credit Accounts Receivable for $6,844.

D) Allowance for Doubtful Accounts and credit Accounts Receivable for $6,844.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is recorded with a debit to Cash and a credit to Notes Receivable?

A) The adjusting entry to record interest owed.

B) The receipt of an interest payment.

C) The receipt of the principal payment.

D) The issuance of a note.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The direct write-off method for uncollectible accounts is not allowed by GAAP because it understates the net realizable value of accounts receivable and violates the expense recognition principle.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 240

Related Exams