A) is calculated as the average number of days from the time a sale is made on account to the time cash is collected.

B) is calculated as the average number of days from the time a sale is made on account to the time payment is due.

C) measures how many times a year receivables go uncollected.

D) measures how many times,on average,the process of selling and collecting is repeated during the period.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Grandview,Inc.uses the allowance method.At December 31,2018,the company's balance sheet reports Accounts Receivable,Net in the amount of $27,200.On January 2,2019,Grandview writes off a $2,400 customer account balance when it becomes clear that the customer will never pay.What is the amount of Accounts Receivable,Net after the write-off?

A) $27,200

B) $2,400

C) $29,600

D) $24,800

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which method for estimating bad debts is generally considered to be the most accurate?

A) Percentage of credit sales

B) Allowance method

C) Specific account method

D) Aging of accounts receivable method

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wheeling Inc.uses the aging of accounts receivable method.Its estimate of uncollectible receivables resulting from the aging analysis equals $5,000.At the end of the year,the balance of Accounts Receivable is $100,000 and the unadjusted debit balance of the Allowance for Doubtful Accounts is $500.Credit sales during the year totaled $150,000.What is the estimated Bad Debt Expense for the current year?

A) $4,500

B) $5,000

C) $5,500

D) $7,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Factoring refers to an arrangement in which a company sells its receivables to another company and receives cash immediately.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under the direct write-off method,the entry to write off a customer's account would include a debit to:

A) Bad Debt Expense and a credit to Allowance for Doubtful Accounts.

B) Bad Debt Expense and a credit to Accounts Receivable.

C) Write-off Expense and a credit to Accounts Receivable.

D) Sales and a credit to Accounts Receivable.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

ABC Corp.received a 3-month,at 8% per year,$1,500 note receivable on November 1.The adjusting entry on December 31 will include a:

A) debit to Interest Revenue of $20.

B) credit to Interest Receivable of $10.

C) credit to Interest Revenue of $120.

D) credit to Interest Revenue of $20.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If your company factors its accounts receivable,it:

A) will focus its collection activities on only the largest Accounts Receivable balances.

B) sells outstanding receivables to another company.

C) will use major national credit cards to allow its customers to pay for goods.

D) will engage in aggressive hounding of its clients to pay their bills.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Notes receivable are typically only used when a company sells large dollar value items (such as cars).

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The potential disadvantages of extending credit include all of the following except:

A) increased bad debt costs.

B) customers buying too much.

C) the need to hire employees to undertake collection efforts.

D) higher wage costs in the accounting department.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The challenge businesses face when estimating the allowance for previously recorded sales is that:

A) at the time of the sale,it is not known which particular customer will not make their payment.

B) past default rates are not a good predictor of future default rates.

C) in bad economic times,fewer customers will have problems with their payments.

D) those sales have been closed into retained earnings.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

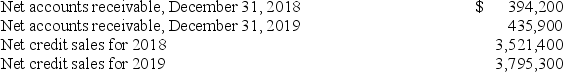

The following information is available:  The days to collect for 2019 is closest to:

The days to collect for 2019 is closest to:

A) 40 days.

B) 41 days.

C) 43 days.

D) 42 days.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The balance of the Allowance for Doubtful Accounts was $12,656 at the beginning of the year and $14,348 at the end of the year.Bad Debt Expense was $3,879 for the year.Recoveries in the amount of $100 were recorded during the year.Which of the following statements is correct?

A) The Allowance for Doubtful Accounts account was retroactively debited for $2,187 to record additional bad debts that became apparent in a future time period.

B) The Allowance for Doubtful Accounts account was debited for $2,287 to record write-offs during the year.

C) The Allowance for Doubtful Accounts account was credited $2,287 for payments from customer whose account balances were previously written off.

D) The Allowance for Doubtful Accounts account was credited $2,187 for the difference between the percent of credit sales method and the aging of accounts receivable method.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On November 1,2018,Lendem,Inc.loaned an employee $100,000 at 6% with both the interest and principal due in one year.No adjusting entries have been recorded in connection with this note.The adjusting entry to record the interest earned but not received as of December 31,2018 includes a:

A) debit to Interest Receivable of $6,000.

B) debit to Interest Payable of $6,000.

C) debit to Cash of $5,000.

D) debit to Interest Receivable of $1,000.

E) debit to Interest Revenue of $1,000.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the term and its definition.There are more definitions than terms. -Days to Collect

A) The portion of Accounts Receivable that the company expects to collect.

B) The time at which a loan must be repaid.

C) An agreement by a borrower to repay the lending company with interest during a specified time period.

D) The days of the year divided by the net sales revenue.

E) A financial statement that shows the calculation of Bad Debt Expense for a company.

F) Total money owed the company for sales made on credit.

G) An account that is debited for the amount of credit sales estimated as uncollectible.

H) A contra-asset account.

I) The time at which a borrower must make annual interest payments.

J) Net credit sales revenue divided by the average net receivables.

K) Net credit sales revenue divided by the net income.

L) The days of the year divided by the receivables turnover ratio.

N) F) and H)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The potential advantages of extending credit to customers include all of the following except higher:

A) wage expenses.

B) profits.

C) customer satisfaction.

D) revenues.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Why is the direct write-off method not allowed under GAAP to account for doubtful accounts?

A) It is too difficult to implement.

B) It is allowed in certain circumstances.

C) It violates the expense recognition principle ("matching") .

D) It is only allowed under IFRS.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Allowance for Doubtful Accounts has a $1,000 debit balance prior to making the end-of-period adjusting entry for bad debts,then it must mean that:

A) $1,000 more accounts receivables were written off than were estimated back when the prior period's adjusting entry for bad debts was recorded.

B) $1,000 fewer accounts receivables were written off than were estimated back when the prior period's adjusting entry for bad debts was recorded.

C) the direct write-off method was used.

D) the aging method was used.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mills Corporation's balance sheet included the following information: If the Allowance account had a credit balance of $27,500 immediately before the year-end adjustment for bad debts and no accounts were written-off or allowed for during the year,what was the amount of Bad Debt Expense recognized during the year?

A) $65,000

B) $27,500

C) $32,500

D) $37,500

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The accounts receivable account for each customer is called a subsidiary account.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 240

Related Exams