A) VISA pays Santiago the full amount of purchase,without charging a fee.

B) VISA will wait until the customer makes payment to the credit card company until forwarding payment to Santiago.

C) Santiago does not have to collect directly from customers.

D) Santiago must bear any losses from uncollectible accounts.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The direct write-off method:

A) results in better matching of costs with revenues than the allowance method.

B) is an acceptable method under generally accepted accounting principles (GAAP) .

C) requires that losses from bad debts be recorded in the period in which sales are made.

D) does not report accounts receivable on the balance sheet at their net realizable value.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

ABC Corp.received a 3-month,8% per year,$1,500 note receivable on December 1.The adjusting entry on December 31 will include a:

A) debit to Interest Revenue of $10.

B) credit to Interest Receivable of $20.

C) credit to Interest Revenue of $30.

D) debit to Interest Receivable of $10.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using the allowance method,which is the correct adjusting journal entry to record bad debt expense?

A) Debit Bad Debt Expense and credit Allowance for Doubtful Accounts.

B) Debit Allowance for Bad Debt Expense and credit Bad Debt Expense.

C) Debit Bad Debt Expense and credit Sales Revenue.

D) Debit Bad Debt Expense and credit Accounts Receivable.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the end of the period,the manager of Olive Co.estimated that $80,000 of its accounts receivable were uncollectible.If the Allowance for Doubtful Accounts has a credit balance of $22,400,which of the following sets forth the adjusting entry to record bad debts for the period? Assume the allowance method is used.

A) Debit Bad Debt Expense and credit Accounts Receivable for $80,000.

B) Debit Bad Debt Expense and credit Allowance for Doubtful Accounts for $57,600.

C) Debit Bad Debt Expense and credit Allowance for Doubtful Accounts for $80,000.

D) Debit Bad Debt Expense and credit Accounts Receivable for $57,600.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cambridge Co.uses the allowance method.During January 2019,Cambridge writes off a $640 customer account balance when it becomes clear that the customer will never pay.The entry to record the write-off will:

A) decrease total assets by $640.

B) decrease net income in 2019 by $640.

C) decrease net accounts receivable by $640.

D) not affect expenses in 2019.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following will likely be incurred by a company that extends credit except:

A) increased revenues.

B) increased wage costs.

C) increased advertising expenses.

D) a delay in the receipt of cash.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following are similarities between a six-month note receivable and an account receivable? They both are:

A) formal written contracts.

B) interest bearing.

C) current liabilities.

D) current assets.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If the receivables turnover ratio rises significantly,the increase may be a signal that the company is extending credit to high-risk borrowers or allowing an overly generous repayment schedule.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Specialty Inc.converts an existing account receivable to a note receivable to allow an extended payment period.Specialty receives a $2,000,3-month,12% promissory note from its customer.What entry will Specialty make upon receipt of the note?

A) Debit Notes Receivable and credit Accounts Receivable for $2,060.

B) Debit Accounts Receivable and credit Notes Receivable for $2,000.

C) Debit Notes Receivable for $2,000,debit Interest Receivable for $60,credit Accounts Receivable for $2,000,and credit Interest Revenue for $60.

D) Debit Notes Receivable and credit Accounts Receivable for $2,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

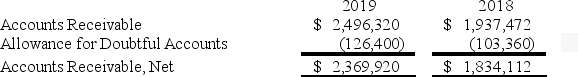

Assume Zap Industries reported the following adjusted account balances at year-end.  Assume the company recorded no write-offs or recoveries during 2019.What was the amount of Bad Debt Expense reported in 2019?

Assume the company recorded no write-offs or recoveries during 2019.What was the amount of Bad Debt Expense reported in 2019?

A) $126,400

B) $103,360

C) $46,080

D) $23,040

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about the receivables turnover analysis is correct?

A) Accounts receivable decline as companies sell on credit.

B) Accounts receivable increase as companies receive payment.

C) Receivables turnover refers to how fast receivables are collected.

D) The days to collect will increase as the receivables turnover increases.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An objective of the expense recognition principle ("matching") is to have bad debt expense debited in:

A) the same period that the related accounts receivable is determined to be uncollectible.

B) the same period the related credit sales are recorded.

C) a later period after the related credit sales are recorded.

D) the period that a customer eventually becomes bankrupt.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The direct write-off method is not allowed under GAAP because it violates the:

A) cost principle.

B) revenue recognition principle.

C) sales method.

D) expense recognition principle ("matching") .

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your company converted an existing account receivable in the amount of $5,000 to a note receivable to allow an extended payment period.The note is due in one year and includes an annual interest rate of 5%.The customer repays the principal at the maturity date.The entry to record the receipt of the principal includes a debit to:

A) Cash and credit to Notes Receivable.

B) Notes Receivable and credit to Accounts Receivable.

C) Cash and credit to Interest Receivable.

D) Notes Receivable and credit to Cash.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As of December 31,Frappe Company has a balance of $5,000 in accounts receivable.Of this amount,$500 is past due and the remainder is not yet due.Frappe has a credit balance of $45 in the Allowance for Doubtful Accounts.Frappe Company estimates its bad debt losses using the aging of receivables method,with estimated bad debt loss rates equal to 1% of accounts not yet due and 10% of past due accounts.How will the Bad Debt Expense account be included in the required adjusting journal entry at year-end?

A) Debit of $95

B) Credit of $95

C) Debit of $50

D) Credit of $50

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

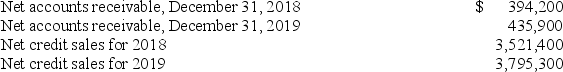

The following information is available:  The receivables turnover ratio for 2019 is closest to:

The receivables turnover ratio for 2019 is closest to:

A) 8.93 times

B) 8.48 times

C) 8.71 times

D) 9.14 times

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company lent $10,000 to an employee who signed a 9%,6-month promissory note.The entry made by the company to record this loan to the employee will include a:

A) debit to Accounts Receivable for $10,000.

B) credit to Sales for $10,000.

C) debit to Notes Receivable for $10,000.

D) credit to Notes Payable for $10,000.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the term and its definition.There are more definitions than terms. -Accounts Receivable

A) The total amount of money loaned through notes that the lender has not yet collected.

B) A system used by companies to allocate their budgets over the different operating expenses.

C) The interest that a company receives during the year divided by the principal of the loan.

D) Another name for a company's total revenue,which is calculated by multiplying the quantity sold by the average price.

E) The denominator of the receivables turnover ratio.

F) The amount of interest a lender receives during a year.

G) The costs of maintaining accounts with customers who have not made recent purchases.

H) A separate record for each accounts receivable customer.

I) Used by the percentage of credit sales method to estimate bad debts.

J) The rate at which a company pays off its liabilities or debts.

K) The numerator of the receivables turnover ratio.

L) The portion of past credit sales that have not yet been collected.

M) An accounting method which involves estimating bad debts.

N) The average level of net sales revenue the firm earns each month.

P) E) and I)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume ABC sells its receivables to another company for immediate cash on a regular basis.How should the factoring fee be reported in the income statement?

A) Selling expense.

B) Non-operating expense.

C) Sales returns.

D) Not at all.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 240

Related Exams