B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a typical U.S. company correctly estimates its WACC at a given point in time and then uses that same cost of capital to evaluate all projects for the next 10 years, then the firm will most likely

A) become riskier over time, but its intrinsic value will be maximized.

B) become less risky over time, and this will maximize its intrinsic value.

C) accept too many low-risk projects and too few high-risk projects.

D) become more risky and also have an increasing WACC. Its intrinsic value will not be maximized.

E) continue as before, because there is no reason to expect its risk position or value to change over time as a result of its use of a single cost of capital.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Suppose you are the president of a small, publicly-traded corporation. Since you believe that your firm's stock price is temporarily depressed, all additional capital funds required during the current year will be raised using debt. In this case, the appropriate marginal cost of capital for use in capital budgeting during the current year is the after-tax cost of debt.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Schalheim Sisters Inc. has always paid out all of its earnings as dividends; hence, the firm has no retained earnings. This same situation is expected to persist in the future. The company uses the CAPM to calculate its cost of equity, and its target capital structure consists of common stock, preferred stock, and debt. Which of the following events would REDUCE its WACC?

A) The market risk premium declines.

B) The flotation costs associated with issuing new common stock increase.

C) The company's beta increases.

D) Expected inflation increases.

E) The flotation costs associated with issuing preferred stock increase.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT? Assume that the firm is a publicly-owned corporation and is seeking to maximize shareholder wealth.

A) If a firm has a beta that is less than 1.0, say 0.9, this would suggest that the expected returns on its assets are negatively correlated with the returns on most other firms’ assets.

B) If a firm’s managers want to maximize the value of their firm’s stock, they should, in theory, concentrate on project risk as measured by the standard deviation of the project’s expected future cash flows.

C) If a firm evaluates all projects using the same cost of capital, and the CAPM is used to help determine that cost, then its risk as measured by beta will probably decline over time.

D) Projects with above-average risk typically have higher than average expected returns. Therefore, to maximize a firm’s intrinsic value, its managers should favor high-beta projects over those with lower betas.

E) Project A has a standard deviation of expected returns of 20%, while Project B’s standard deviation is only 10%. A’s returns are negatively correlated with both the firm’s other assets and the returns on most stocks in the economy, while B’s returns are positively correlated. Therefore, Project A is less risky to a firm and should be evaluated with a lower cost of capital.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The before-tax cost of debt, which is lower than the after-tax cost, is used as the component cost of debt for purposes of developing the firm's WACC.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

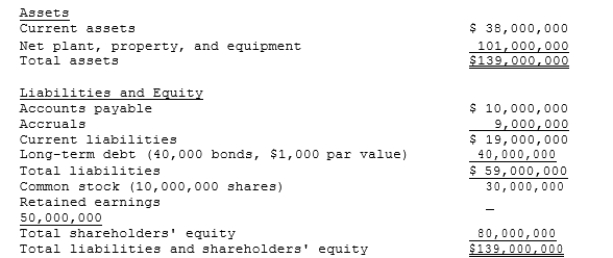

Assume that you have been hired as a consultant by CGT, a major producer of chemicals and plastics, including plastic grocery bags, styrofoam cups, and fertilizers, to estimate the firm's weighted average cost of capital. The balance sheet and some other information are provided below.

The stock is currently selling for $15.25 per share, and its noncallable

$1,000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00. The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. The firm's tax rate is 40%.

-Which of the following is the best estimate for the weight of debt for

Use in calculating the firm's WACC?

The stock is currently selling for $15.25 per share, and its noncallable

$1,000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00. The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. The firm's tax rate is 40%.

-Which of the following is the best estimate for the weight of debt for

Use in calculating the firm's WACC?

A) 18.67%

B) 19.60%

C) 20.58%

D) 21.61%

E) 22.69%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

When estimating the cost of equity by use of the CAPM, three potential problems are (1) whether to use long-term or short-term rates for rRF, (2) whether or not the historical beta is the beta that investors use when evaluating the stock, and (3) how to measure the market risk premium, RPM. These problems leave us unsure of the true value of rs.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Since the costs of internal and external equity are related, an increase in the flotation cost required to sell a new issue of stock will increase the cost of retained earnings.

B) Since its stockholders are not directly responsible for paying a corporation's income taxes, corporations should focus on before-tax cash flows when calculating the WACC.

C) An increase in a firm's tax rate will increase the component cost of debt, provided the YTM on the firm's bonds is not affected by the change in the tax rate.

D) When the WACC is calculated, it should reflect the costs of new common stock, retained earnings, preferred stock, long-term debt, short-term bank loans if the firm normally finances with bank debt, and accounts payable if the firm normally has accounts payable on its balance sheet.

E) If a firm has been suffering accounting losses that are expected to continue into the foreseeable future, and therefore its tax rate is zero, then it is possible for the after-tax cost of preferred stock to be less than the after-tax cost of debt.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Trahan Lumber Company hired you to help estimate its cost of common equity. You obtained the following data: D1 = $1.25; P0 = $27.50; g = 5.00% (constant) ; and F = 6.00%. What is the cost of equity raised by selling new common stock?

A) 9.06%

B) 9.44%

C) 9.84%

D) 10.23%

E) 10.64%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The firm's cost of external equity raised by issuing new stock is the same as the required rate of return on the firm's outstanding common stock.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

S. Bouchard and Company hired you as a consultant to help estimate its cost of common equity. You have obtained the following data: D0 = $0) 85; P0 = $22.00; and g = 6.00% (constant) . The CEO thinks, however, that the stock price is temporarily depressed, and that it will soon rise to $40.00. Based on the DCF approach, by how much would the cost of common from retained earnings change if the stock price changes as the CEO expects?

A) -1.49%

B) -1.66%

C) -1.84%

D) -2.03%

E) -2.23%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The cost of debt is equal to one minus the marginal tax rate multiplied by the average coupon rate on all outstanding debt.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The discounted cash flow method of estimating the cost of equity cannot be used unless the growth rate, g, is expected to be constant forever.

B) If the calculated beta underestimates the firm's true investment risk--i.e., if the forward-looking beta that investors think exists exceeds the historical beta--then the CAPM method based on the historical beta will produce an estimate of rs and thus WACC that is too high.

C) Beta measures market risk, which is, theoretically, the most relevant risk measure for a publicly-owned firm that seeks to maximize its intrinsic value. This is true even if not all of the firm's stockholders are well diversified.

D) An advantage shared by both the DCF and CAPM methods when they are used to estimate the cost of equity is that they are both "objective" as opposed to "subjective," hence little or no judgment is required.

E) The specific risk premium used in the CAPM is the same as the risk premium used in the bond-yield-plus-risk-premium approach.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Norris Enterprises, an all-equity firm, has a beta of 2.0. The chief financial officer is evaluating a project with an expected return of 14%, before any risk adjustment. The risk-free rate is 5%, and the market risk premium is 4%. The project being evaluated is riskier than an average project, in terms of both its beta risk and its total risk. Which of the following statements is CORRECT?

A) The project should definitely be accepted because its expected return (before any risk adjustments) is greater than its required return.

B) The project should definitely be rejected because its expected return (before risk adjustment) is less than its required return.

C) Riskier-than-average projects should have their expected returns increased to reflect their higher risk. Clearly, this would make the project acceptable regardless of the amount of the adjustment.

D) The accept/reject decision depends on the firm's risk-adjustment policy. If Norris' policy is to increase the required return on a riskier-than-average project to 3% over rS, then it should reject the project.

Capital budgeting projects should be evaluated solely on the basis of their total risk. Thus, insufficient information has been provided to make the accept/reject decision.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Daves Inc. recently hired you as a consultant to estimate the company's WACC. You have obtained the following information. (1) The firm's noncallable bonds mature in 20 years, have an 8.00% annual coupon, a par value of $1,000, and a market price of $1,050.00. (2) The company's tax rate is 40%. (3) The risk-free rate is 4.50%, the market risk premium is 5.50%, and the stock's beta is 1.20. (4) The target capital structure consists of 35% debt and the balance is common equity. The firm uses the CAPM to estimate the cost of common stock, and it does not expect to issue any new shares. What is its WACC?

A) 7.16%

B) 7.54%

C) 7.93%

D) 8.35%

E) 8.79%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

If a firm is privately owned, and its stock is not traded in public markets, then we cannot measure its beta for use in the CAPM model, we cannot observe its stock price for use in the DCF model, and we don't know what the risk premium is for use in the bond-yield-plus-risk- premium method. All this makes it especially difficult to estimate the cost of equity for a private company.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You were hired as a consultant to Giambono Company, whose target capital structure is 40% debt, 15% preferred, and 45% common equity. The after-tax cost of debt is 6.00%, the cost of preferred is 7.50%, and the cost of common using retained earnings is 12.75%. The firm will not be issuing any new stock. What is its WACC?

A) 8.98%

B) 9.26%

C) 9.54%

D) 9.83%

E) 10.12%

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that you are a consultant to Broske Inc., and you have been provided with the following data: D1 = $0.67; P0 = $27.50; and g = 8.00% (constant) . What is the cost of common from retained earnings based on the DCF approach?

A) 9.42%

B) 9.91%

C) 10.44%

D) 10.96%

E) 11.51%

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The text identifies three methods for estimating the cost of common stock from retained earnings: the CAPM method, the DCF method, and the bond-yield-plus-risk-premium method. Since we cannot be sure that the estimate obtained with any of these methods is correct, it is often appropriate to use all three methods, then consider all three estimates, and end up using a judgmental estimate when calculating the WACC.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 87

Related Exams